Charles R. Goulding spoke with Formlabs’ Guillaume Bailliard.

On June 20th, 2023, I had the privilege of meeting with Guillaume Bailliard, the President of Formlabs’ healthcare and dental business segment.

Formlabs has 800+ employees with 50 plus PhD scientists. The company is headquartered in Somerville, Mass near Boston, and benefits from the Boston area 3D printing ecosystem including leading universities, talent and supply chains.

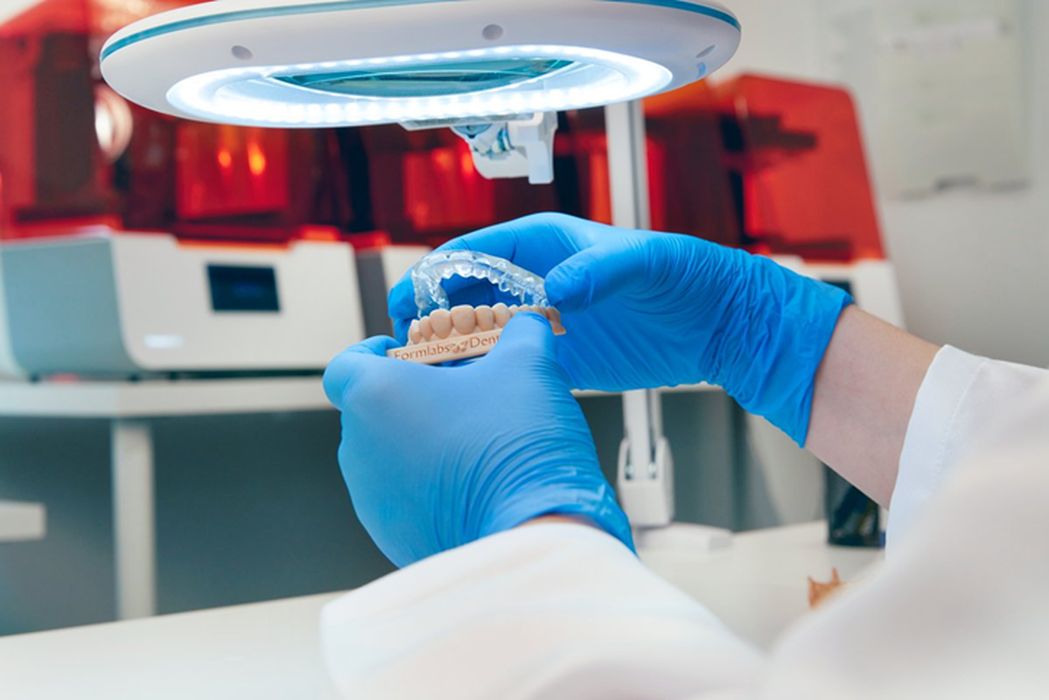

Formlabs published an excellent webinar describing their new BioMed Durable Resin, which impressed me greatly. Formlabs also launched a new material, Dental LT Comfort Resin, for occlusal splints and night guards. Their extensive materials expertise results in a value-added resin library.

Although Formlabs’ 3D printer capability is essential, the resin achievements provide a compelling, comprehensive offering for dental and surgical procedures. The BioMed Durable Resin is a clear biocompatible resin that can withstand impact, rough processing, and pressure.

3D printed medical devices using Formlabs’ Impact-resistant durable, resin [Source: Formlabs]

Guillaume has an impressive healthcare background that mixes long term GE Healthcare medical expertise with startup experience. To me, his background is ideal for a company of Formlabs’ size which he characterized as positioned to scale up and grow.

BioMed Durable Resin includes single use instruments which optimize surgical processes. Complimentary samples are available from their website. Formlabs is focused on accumulating clinical data which provides clinical evidence for efficacy and eventual medical code reimbursement.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

This writer is impressed with Formlabs’ product offerings, management and business model. The combination of recognized 3D printing hardware, extensive materials library and clinical data is exciting.