![Cartier: Jewelry Traditions Past and Present [Source: TrueFacet ]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb08c22c3ae5.jpg)

Charles Goulding and Preeti Sulibhavi look at the possibilities available to major jewelry providers in 3D printing.

The jewelry industry has been one of the fastest-growing 3D printing sectors, and there are lessons to be learned from recent jewelry industry news involving Tiffany and Cartier.

In 2019, Louis Vuitton Moet Hennessy (LVMH) Group purchased Tiffany for $16.2 billion.

During 2019, Francesca Cartier-Brickell, a direct descendant of the legendary Cartiers, published her book “The Cartiers.” With the Tiffany acquisition by LVMH Group and Cartier’s ownership by Swiss-based Richemont, both of these leading Jewelers are now owned by very large multi-brand luxury goods companies.

Tiffany & Co.

In 2019 alone, Tiffany & Co. reported sales of $4.5 billion. This is a strong indicator that demand for fine jewelry has certainly not diminished.

Richemont/Cartier

Richemont/Cartier experienced high sales and growth in 2019. For 2019, Richemont’s gross sales amounted to almost US$14B. Richemont owns several of the leading global luxury brands, including Van Cleef, Arpels, IWC Schaffhausen and of course, Cartier.

The new Cartier history book exceeds 500 pages and provides excellent business knowledge for jewelers as well as for other businesses. The Cartier’s instinctively knew how to use royalty and other well-known celebrities as product influencers.

The Cartier’s also leveraged other luxury brands for location, facilities, marketing and sales. They were also early to arrive on the global business scene, expanding from their home country in France to the UK, then U.S.A, Russia and Asia. This expansion was for both new product categories, sourcing and market sectors.

Lessons for the 3D Jewelry Industry

The Cartier’s had no desire to be copycats. They wanted to be known for unique products that came to be known as the Cartier style. They experimented with new products including new settings, new gems, and new materials. Even more relevant for today’s 3D printing industry, the Cartiers worked with new metal materials, such as platinum.

Examples of the Cartier Style through different time periods are presented below.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied to payroll taxes.

Conclusion

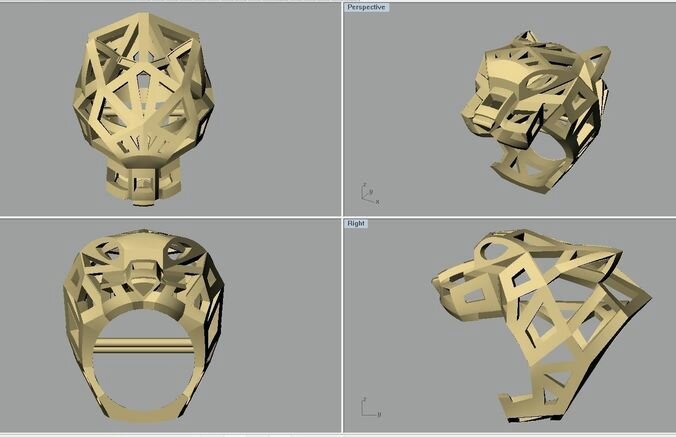

![Cartier - Panther Ring - 3D Print Model [Source: CGTrader ]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb08c2338db2.jpg)

Today, large companies are often not the leaders in innovation. Jewelers who optimize ongoing 3D printing product and material developments may be able to create their own jewelry style, just as the Cartiers did generations ago.