![[Image: Royal DSM]](https://fabbaloo.com/wp-content/uploads/2020/05/DSM5_img_5eb09a054de88.png)

Charles Goulding and Ryan Donley of R&D Tax Savers present an overview of DSM’s recent involvement in the 3D printing industry.

On March 21, 2019, we had the privilege of attending the New Jersey Manufacturing Extension Partnership (MEP) State of the State manufacturing event at the Veterans Memorial in Trenton, New Jersey. The venue is a large ballroom and the event drew an overflowing crowd comprised of New Jersey manufacturers and government officials. The keynote-manufacturing speaker was Hugh Welsh, the President of Royal DSM’s (DSM) North America business sector headquartered in New Jersey. DSM is a large publicly traded Netherlands-based industrial company with multiple business sectors including health, nutrition, pharmaceuticals, and organic chemistry.

Mr. Welsh is an excellent speaker that could engage the audience with a positive but forthright message. He began his presentation by asking how many people had heard of DSM? Only four or so people raised their hands. He gave the history of the company, which evidenced continuous innovation since this was originally a European coal miner created in 1902. The company has become a global powerhouse by combining organic growth with a large number of acquisitions. Current organic growth initiatives include a potential expansion of the company’s U.S. enzyme facilities.

Royal DSM Background

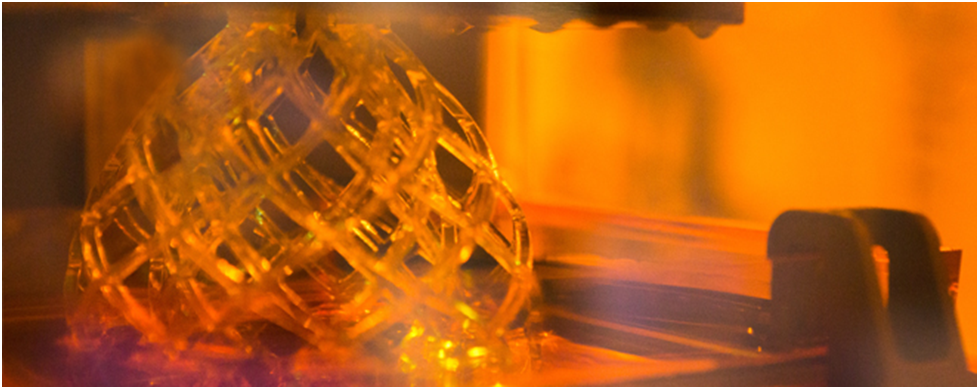

Royal DSM is a unique purpose-led global science-based company. DSM strives to deliver innovative business solutions for human nutrition, animal nutrition, personal care, medical devices, and green products/applications. These business solutions are fronted by DSM’s leading innovation in additive manufacturing that was ushered in over 25 years ago by DSM’s Somos team. Since the company undertook additive manufacturing solutions, they have continuously innovated materials for 3D printing with the purpose of unlocking the full potential of additive manufacturing.

DSM’s 3D Printing Initiatives

Hugh Welsh made point of describing DSM’s commitment to 3D printing polymer materials, which began 25 years ago. DSM has multiple initiatives to accelerate the introduction of its materials into the 3D market such as the launch of a trial program in partnership with Juggerbot 3D in Youngstown, Ohio, a joint investment with Adaptive 3D in Dallas Texas, and a partnership with Fortify based in Boston, Massachusetts.

Juggerbot 3D

Juggerbot 3D is an additive manufacturing machine builder specializing in 3D printing. Recently, DSM and Juggerbot 3D agreed to a trial program partnership to evaluate engineering-grade materials in an industrial-grade filament printer. According to Jill Cohen, the Global Marketing & Sales Director of Additive Manufacturing at DSM, “The two issues reported most frequently are the cost of equipment, and/or limited investment budget, and the lack of in-house expertise on various 3D printing technologies.” The expertise from both companies combined together will assist in overcoming these challenges and will serve companies active in transportation, consumer appliances, and medical prosthetic devices and sockets.

Adaptive3D

Adaptive3D is a premium additive manufacturing polymer resin supplier that collaborates with global leaders to deliver functional end solutions. Royal DSM and Adaptive 3D recently agreed on Series A investments co-led by DSM Venturing and Applied Ventures. This funding will allow Adaptive 3D to deliver materials-centric solutions to global companies in consumer, healthcare, industrial, transportation, and oil and gas sectors. According to Hugo da Silva, the VP of Additive Manufacturing at DSM, “At DSM we believe that the age of additive manufacturing for industrial applications is, in fact, the age of materials. Adaptive3D’s engineered photoresins enable new design paradigms in end applications. Working together with Applied Materials allows us to think globally about big problems at scale and offer big ecosystem solutions.” The funding provided by Royal DSM is going to provide a significant boost to the capabilities of Adaptive 3D as they look to optimize their additive manufactured materials in high-volume. With continued fundamental technical research, Adaptive 3D will disrupt today’s materials market.

Fortify

Royal DSM and Fortify entered a partnership that brings together Fortify’s Digital Composite Manufacturing platform and fiber processing expertise with DSM’s application knowledge in 3D printing resin and formulation development. Together, the companies will develop high-performance composite materials to be distributed through Fortify hardware. Thoughts on the partnership came from Hugo da Silva, VP of Additive Manufacturing at DSM, “At DSM Additive Manufacturing, we believe that collaborating with industry partners is key to advance the industry. Partnering with Fortify allows us to develop high-performance composite materials for DLP technology, making the technology viable for functional parts in demanding applications.” The partnership allows the full potential of additive manufacturing to be explored as both companies draw upon experience in 3D printing technologies, performance materials, and deep application expertise to help change the way products are designed and manufactured.

Do You Now Know Royal DSM?

After Hugh Welsh’s recent speech about DSM’s multiple new ventures, a lot more people are going to know DSM.

*Additive manufacturing products and processes may be eligible for the R&D Tax Credit, which is briefly described below.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.