![Schneider Electric’s Mankati E180 3D Printer [Source: Mankati ]](https://fabbaloo.com/wp-content/uploads/2020/05/Electrical_img_5eb096db77bf3.jpg)

Charles Goulding & Dylan Comerford of R&D Tax Savers discuss electrical industry usage of 3D printing technologies.

Electrical items and equipment are constantly being used around the globe. Today, most developed countries have some sort of electrical system integrated into their overall infrastructure, to the point that most modern day people will interact with electrical supplies on a day-to-day basis. Electrical materials are used for a variety of different purposes; residential and commercial buildings both require a huge range of electrical services, necessitating power for manufacturing machines, lighting, and a myriad of other purposes. Herm Isenstein, the electrical industry’s leading economist, forecasted a +3.5% electrical industry growth for 2019, indicating that the industry is still growing. The electrical manufacturing industry has also been recently moving forward with newer manufacturing processes. These processes include additive manufacturing.

Large-Scale Electrical Equipment Manufacturing

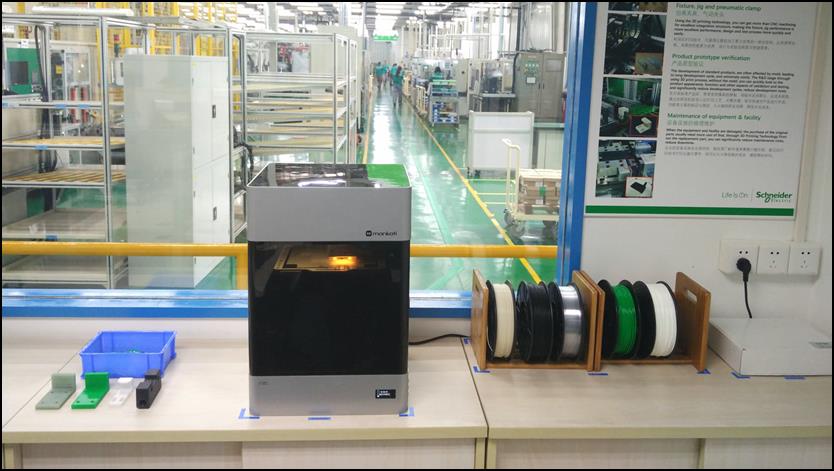

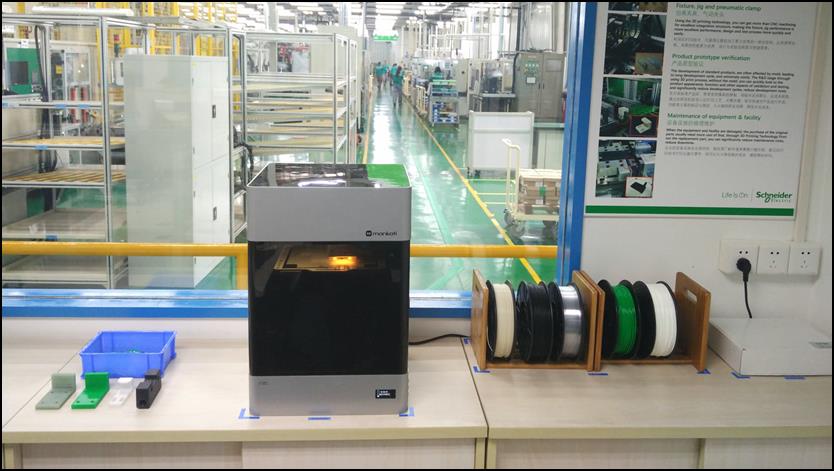

Schneider Electric is one of the worldwide leaders in power management. Recently, they have shown interest in additive manufacturing as a means of overall systemic improvement. In 2018 Schneider Electric, along with French 3D printing development platform Platinum 3D, partnered with Prodways Technologies in an effort to increase the effective output of commercial electric components. Prodways Technologies specializes in industrial and professional 3D printing, with one of their hallmarks being their patented MOVINGLight technology. MOVINGLight is a photopolymerization process used for producing prototypes as well as high-resolution functional parts. It creates these parts at very high speeds by polymerizing the photosensitive resins with moving Digital Light Processing (DLP) UV rays. Schneider is working with Prodways Technologies to use their MOVINGLight technology for the purpose of creating 3D molds for some of their electrical components.

As Frederick Choupin, manager of Schneider Electric’s internal model shop OpenLab, explains, “With 3D printing and agile project management, we’re in a position to overcome the traditional obstacles of long established processes and market an innovative product 60% faster.” Schneider Electric has been continually working to improve the efficiency of their production line and 3D printing has proven to be an effective tactic for this purpose.

Along with Schneider Electric, other major electrical companies have been investing in 3D printing. The global 3D Printing Plastics market research report for the forecast period 2017-2022 indicated that General Electric and Siemens AG were both major players in the 3D printing plastics market. While the 3D printing plastics market is not often considered in the electrical industry, General Electric and Siemens are both large manufacturers of circuit breakers, service panels, and power outlets, among other electrical items. Items such as these are composed of a myriad of components, almost all of which have the potential to be 3D printed, in some capacity, with today’s technology. Siemens in particular has an incredibly large additive manufacturing research facility. Just recently they have invested in four Guyson systems to assist in their handling and finishing processes. Their current manufacturing facility contains 15 additive manufacturing systems, and these could potentially be used for hardware such as electric panel boxes.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include U.S. employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, U.S. contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and for the first time, pre-profitable and pre-revenue startup businesses can obtain up to $250,000 per year in payroll taxes and cash rebates.

Conclusion

The electrical industry has been moving forward with the development of new technologies. Additive manufacturing has been an enormous help with these new developments, providing a cost effective way to design and test new products. These iteratively designed products can also qualify for a Research & Development tax credit due to their unique design process. Furthermore, the implementation of 3D printing into various large-scale manufacturing processes is a huge development that is promising for the future of additive manufacturing.

The first simulated 3D print has been produced using Adrian Bowyer’s radical new Electric 3D Printing concept, which could produce objects in mere seconds.