Charles R. Goulding and Peter Favata consider how 3D printing helps to individualize and make some unique footwear market-ready.

Crocs, Inc. is an American company based in Niwot, Colorado that offers comfortable leisure footwear and is known for innovation. In 2020 Crocs sales have surged partly due to people staying at home in response to COVID-19. The company saw a 14% increase in March 2020 when compared to 2019 sales numbers.

Crocs has done what some had thought impossible by making their shoes stylish and cool by creating collaborations with some of the most influential businesses, musicians, and artists in the world today, including but not limited to KFC, Balenciaga, Post Malone, and Takashi Murakami. Influencer demand sometimes creates a market imbalance, which not only causes shoes to sell out within hours but also creates a secondary market where the $50 shoe will sell as high as $600 depending on the model.

Crocs’ collaboration with Post Malone [Source: footwearnews.com]

3D Printing Opportunities

Crocs has been utilizing 3D printing for some time. Partnered with Italian 3D printing company 3ntr, they have been utilizing 3D printing during the prototype phase of the manufacturing process. This allows them to receive highly accurate feedback on the performance of the shoe and increase the rate of production while keeping costs low.

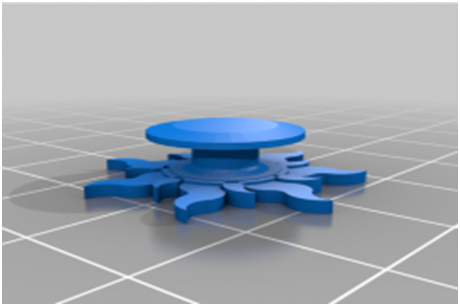

Jibbitz are another avenue where Crocs can leverage their 3D printing resources to aid manufacturing. Jibbitz are small accent pieces that are attached through the holes of the Crocs that add the unique ability for the wearer to customize post-purchase. They are made out of a hard rubber or plastic material similar to materials that are commonly used in 3D printing. This would allow the customer to create any one-off design they desire.

The footwear category is one of 3D printing’s most successful categories. Some commentators are forecasting $9 billion in 3D printing retail sales in the footwear market by the year 2030. We recently covered the popular Nike’s Performance Zoom Vaporfly product that illustrates this potential. That article can be viewed here.

Manufactures and designers utilizing 3D printing in the shoe ware industry may be eligible for R&D Tax Credits.

The Research & Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Conclusion

In recent months, Crocs has seen a huge boost in popularity and, in turn, sales. The company has already integrated 3D printing technology into its design and development process with opportunities for more usage still. 3D printing has proven to be beneficial in the prototyping phase and can ultimately improve the production process. Additive manufacturing and other techniques or technologies that lead to process improvements are just some of the eligible activities that support the R&D Tax Credit.