Adaptive3D has secured a major investment.

The Dallas-based company produces a very useful 3D printing elastomer resin that can be used to produce amazing flexible objects.

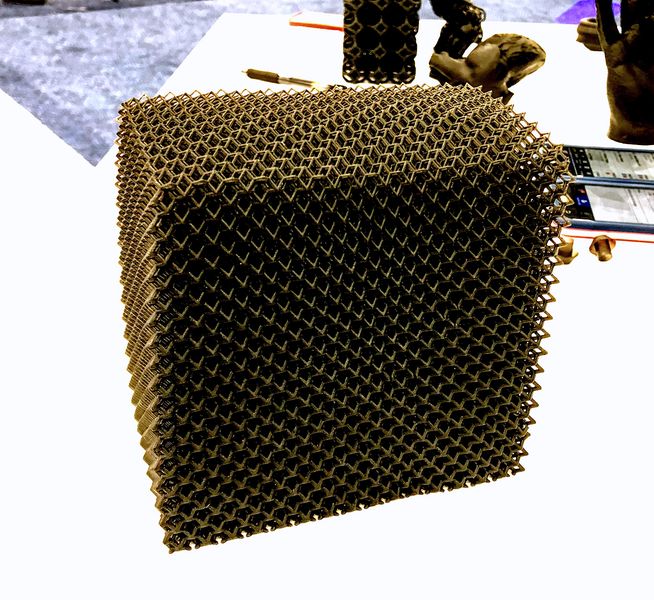

In fact, one of my favorite 3D printed objects — and I’ve seen A LOT of 3D printed objects — is one made from Adaptive3D’s flexible resin: this curious sparse block:

What made it amazing for me is that the thickness of the structures gradually thins as you get to the top. This made the object incredibly “feel-able” as it was soft on the top and more rigid at the bottom. Everyone nearby could not keep their hands off this squishy model.

Now we learn that there has been a significant investment in the company, a Series B round. “Series B” typically means a larger investment that’s received later on in a startup’s growth phase. Unfortunately, the press material does not specify the amount, but we can surmise it represents at least several million dollars.

They don’t say specifically what the funding will be used for — other than “Adaptive3D furthers its mission of providing materials to enable 21st century manufacturing” — but my guess would be to increase the scope and scale of their sales, as the product seems to work very well. It’s just a matter of getting into more 3D printers.

What is quite curious about this announcement is that the investment round was made by a syndicate of parties led by Arkema Group.

Arkema, if you’re not aware, is one of the leading chemical companies in France, and one that has been active in the 3D print space for some time. They’re quite large, having over 20,000 staff, 136 production plants and no fewer than 13 research centers.

Arkema has previously partnered with Farsoon and even Carbon. Now we can add Adaptive3D to their list.

This is a company that can easily develop whatever type of material they might want.

But in spite of that ability, they have led an investment into Adaptive3D, a startup company that might be viewed as a competitor. Why could they be doing so? It may be that they feel Adaptive3D’s product is sufficiently good that it is easier for them to buy a slice of the company rather than developing their own competing product.

Arkema says in their announcement of the investment:

“Through its Sartomer’s activity and its pioneering N3xtDimension range of advanced UV curable liquid resins, Arkema and Adaptive3D have already succeeded in many technical and commercial developments. With this announcement, the companies aim to partner across the end points of an additive manufacturing ecosystem, from new material development, scaled specialty resin manufacturing, to functional end-use parts, to deliver market leading materials solutions at scale. Arkema, specializing in many other material technologies like photoinitiators and thio-based materials, can further enhance Adaptive3D product offerings through custom solutions.

With this investment in Adaptive3D, Arkema takes a new milestone that will create exciting opportunities for new applications in footwear, medical, automotive and electronic appliances, among others. With materials developed to best meet market needs, both consumers and producers stand to benefit from the specialty and sustainable high-performance solutions developed by Arkema and Adaptive3D.”

This feeling was apparently felt by other members of the Series B syndicate, which include “West Pharmaceutical Services, Clear Fir Partners, and current investors including Applied Ventures and the founding family of Texas Instruments.”

These companies seem to have great confidence in Adaptive3D’s products and prospects.

For Adaptive3D, this is obviously very good news. They will now be flush with cash that they can use for a variety of purposes, and seem to have obtained an important partner of sorts in the industry. This could lead to many doors being opened for Adaptive3D’s products in the long run.

Via Adaptive3D and Arkema