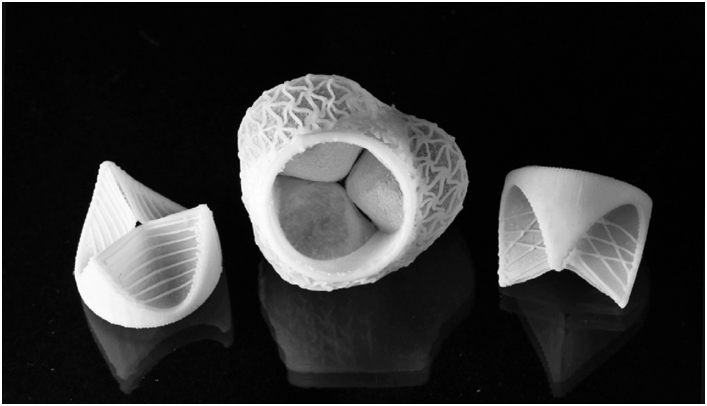

3D Printed Knee Replacement [Source: Sculpteo]

Charles R. Goulding considers increasing lifespans increasing medical 3D printing demand.

In their new book The Future is Faster than You Think, authors Peter H. Diamandis and Steven Kotler (D&K) devote a chapter to the potential for increased human longevity.

D&K identify 9 factors controlling longevity that can be classified as DNA/cell-related or environmental. It is generally recognized that one of the environmental factors, namely better nutrition, is already improving longevity.

The theory of longevity escape velocity holds that science will eventually be able to increase longevity by one year, every year. Experts vary on a prediction of when this will occur but the range is within 12 to 30 years. There is a prediction by some longevity experts that by 2050, living to age 120 will be a common occurrence.

Living a longer life will result in more worn body parts that will need to be replaced, and replaced more than once. Some of the more common body parts already being replaced by custom 3D printed parts include:

- Teeth

- Knee Joints

- Skin

- Audio Assistive Aids

- Heart Valves

Medtronic’s recent acquisition of Medicrea, a pioneer in spinal surgery applications through AI, illustrates how companies are positioning for opportunities in the orthopedic area.

Companies that are embracing 3D printing technology to develop medical implants and devices may be eligible for R&D tax credits.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

With Age Comes 3D Printing…

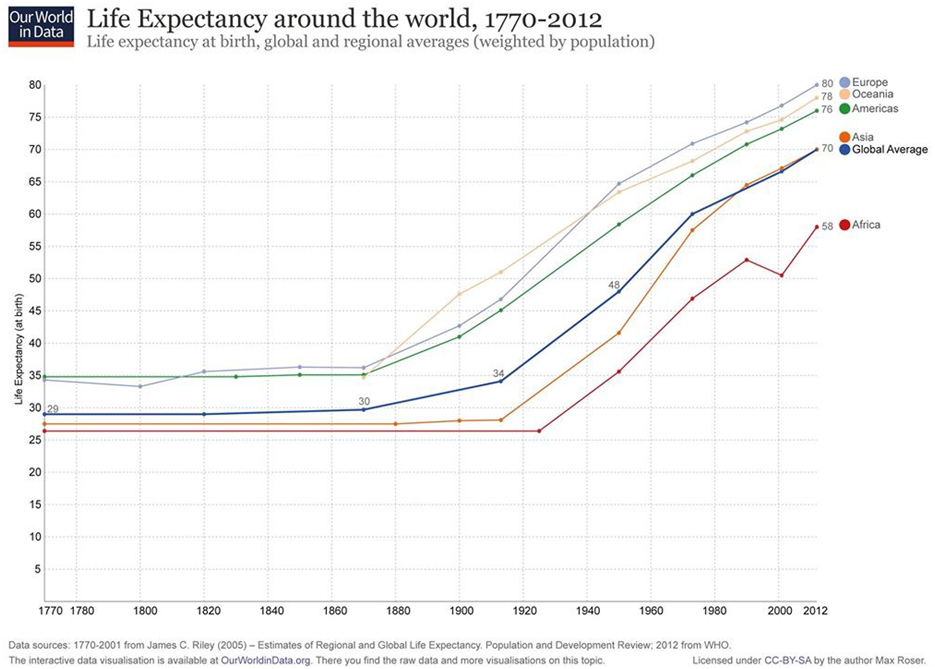

Life expectancy as increased dramatically since the industrial revolution [Source: Medium]

It is clear that human longevity dramatically increased after the industrial revolution (see above chart). Human longevity is dependent on several variables: where in the world and at what time in history a person was born, as well as genetic/familial history. Although most of us would like to live longer, one important question looms: what will the quality of extended life be? 3D printing can help improve that quality of life.