Charles R. Goulding and Preeti Sulibhavi consider the idea that Siemens is a tech company.

A September 15, 2020 Wall Street Journal article, titled “Siemens Halfheartedly Becomes a Tech Company,” questions whether Siemens is actually a tech company. Based on our knowledge of the company and, particularly it’s work with digitalization and 3D printing, we respectfully disagree with that author’s premise.

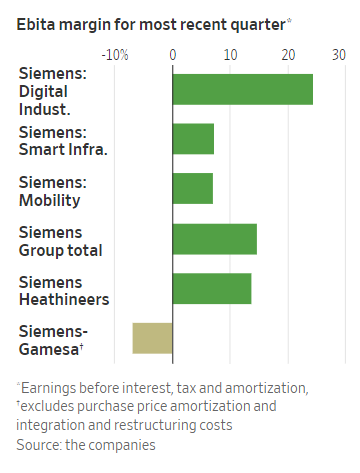

The WSJ article describes Siemens 5 major business segments and presents the graph below:

The WSJ author acknowledges that the Digital Industries division and the Smart Infrastructure businesses are in fact tech businesses. We concur and move onto the other 3 business segments:

Mobility/Rail Business

Using this business segment the author begins to challenge the Siemens technology characterization. Based on efforts we see with rail predictive analytics, machine learning and advanced signaling we feel this is incontrovertibly a technology-based business.

Siemens Healthineers

We recently covered Siemens Healthineers’ technology expansion with the purchase of $16.4 billion acquisition of Varian Medical Technologies in a Fabbaloo article. The first two paragraphs of that article explain why Healthineers is undoubtedly a tech company:

“Siemens Healthineers, the 2018 medical spinoff from Siemens, announced on August 1, 2020 the acquisition of Varian Medical Technologies Inc. of Palo Alto, California for an astounding $16.4 billion. The deal will be financed with debt and equity and will close in the first half of 2021.

Both companies have deep X-ray and scanning technology expertise and have already been closely working together in what is called the Envision Partnership. The combination creates an X-ray imaging powerhouse with a holistic treatment approach to cancer and other diseases beginning with planning, all the way to post-operative care. Both companies have 3D printed assets that can be integrated and enhanced.”

Siemens-Gamesa

Today’s offshore wind turbine business is all about technology.

Research and Development Tax Credits are available for the eligible US-based, 3D printing activities that Siemens business segments engage in.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Recognizing 3D Printing Technology

The 3D printing community recognizes Siemens as a major 3D printing player. The WSJ author concluded that at the end of the day Siemens is “still a conglomerate.” In our view, and upon closer inspection, it is a conglomerate – a technology conglomerate, to be accurate.