Charles R. Goulding reads into INEOS’ story as it relates to a new book and to 3D printing.

Three men in the UK have worked together for decades and have now become the exclusive owners of INEOS, one of the largest chemical companies in the world with $83 billion in sales. Their names and main responsibilities are:

- Jim Ratcliffe, CEO

- Andy Currie, Director

- John Reece, Finance Director

INEO is Latin for new beginning, coming from Eos, the Greek goddess of the dawn, while Neo meant new and innovative. The INEOS Group is a global manufacturer of petrochemicals, specialty chemicals, and oil products. Its 183 sites span 26 countries and 34 businesses. Pre-acquisition, Innovene was BP’s olefins, derivatives, and refining subsidiary. But after 2005 it became part of the INEOS Group as a complementary fit for the petrochemicals industry.

In 2017, INEOS purchased the fossil fuel assets of DONG, a Danish oil and gas company, which left the seller exclusively a seller of wind turbines and the subject of our recent article.

In 2019 the global engineering company, Renishaw, supported the INEOS Team UK in winning the America’s Cup. Renishaw was the official additive manufacturing (AM) partner primarily because of its expertise in precision measurement and position encoding and the only UK manufacturer of metal additive manufacturing machines.

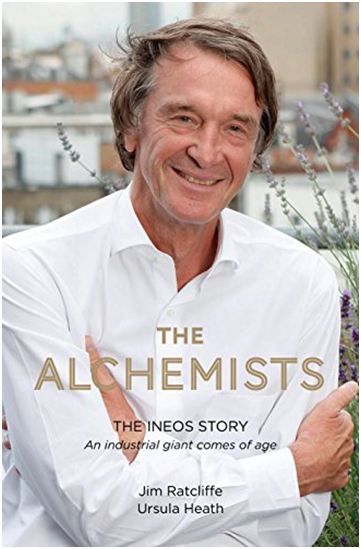

The company’s interesting history is now memorialized in the new 2020 book titled “The Alchemists.”

They have acquired numerous chemical companies including business segments from BP and BASF, Shell, and Fluor. INEOS makes worker safety and accident protection a top company priority. INEOS makes products the world uses every day including the plastic materials for LEGOs. INEOS Styrolution is the global leader in Styrene Monomer, Polystyrene, ABS, and Styrenic specialties. In fact, with the help of INEOS Styrolution, Lego is now integrating botanical elements in its kits from polyethylene derived from sugarcane. INEOS is one of the sponsors of the Mercedes Formula One race car, which will give senior management continuous exposure to leading 3D printing technologies.

Activities related to chemical engineering and 3D printing can be eligible for research and development tax benefits.

The Research and Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

“The Alchemists” is well-written and engages the reader from the beginning. Which path 3D printing will take in this global chemical revolution remains to be seen.