Charles R. Goulding discusses the rising use of robots in hotels, and how 3D printing might help in their creation.

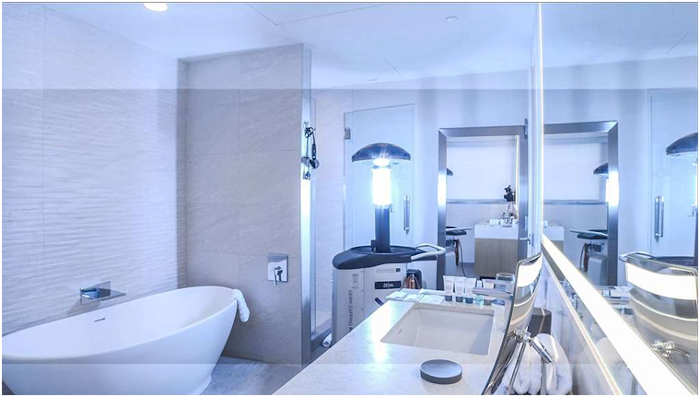

Having had involvement in robot technology and 3D printing for over 30 years, I am particularly pleased to see the convergence of both technologies in important new products like the Relay hotel service robot. At hotels, the Relay robot typically brings up to 700 service items per month to guest rooms. This robot delivery process frees up hotel housekeeping staff and enables more time for deeper cleaning. In fact, the hotel industry has currently integrated virus-killing robots to thoroughly clean guest rooms utilizing UV light technology. The germ-killing robots can clean guest rooms, common spaces (e.g., lobby area), restaurants, cafés, and conference rooms daily.

The Savioke Relay programmable robot story is interesting because the founder of Savioke has a long-standing 3D printing history and patiently waited while 3D printing technology evolved so he could access the capability he needed to accomplish this tremendous feat. While the robots are ready to assist hotel guests, people may need to get accustomed to a programmable robot cleaning up after them and providing their room service instead of a person. Right now, in the San Francisco Bay area, Relay is bringing robotics to hospitality as well as other industries. These enhanced cleaning measures have also been utilized in over 500 hospitals globally (including our own Mayo Clinic).

The Wall Street Journal had an August 12, 2020 article on the Relay robot which also covered new products described by Micah Green, the founder of Maidbot vacuuming robots. Green said that Maidbot is preparing to roll out new wet cleaning and disinfecting machines/robots, to further assist housekeepers. The purpose of these robots is to both clean and disinfect, particularly now that the pandemic has forced many to seek more innovative ways of accomplishing both tasks.

R&D tax incentives are available for cleaning or service robot-related 3D printing developments and improvements.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Taking a Byte Out of History

Change has always been difficult. But often, it has led to positive societal advancement. Only time will tell if service robots can widely replace humans in accomplishing cleaning and other related tasks, not only in the hotel industry but in healthcare and travel as well. One thing is certain, robots are beginning to take a “byte” out of history.