Charles Goulding and Ryan Donley examine the makeup of several leading companies in 3D printing when it comes to their R&D expenditures.

It is important to analyze the level of the R&D occurring at the leading 3D printer manufacturers to help understand just how quickly the industry is growing and why more companies are committing to the potential future of 3D printing. Compared to the prior year, several companies have significantly boosted their expenditure towards R&D Expenses throughout 2019.

In the year 2020, we expect all of the 3D printing companies will have a specific incremental boost in R&D for new COVID-19 related applications including, PPE, medical equipment, and pharmaceuticals.

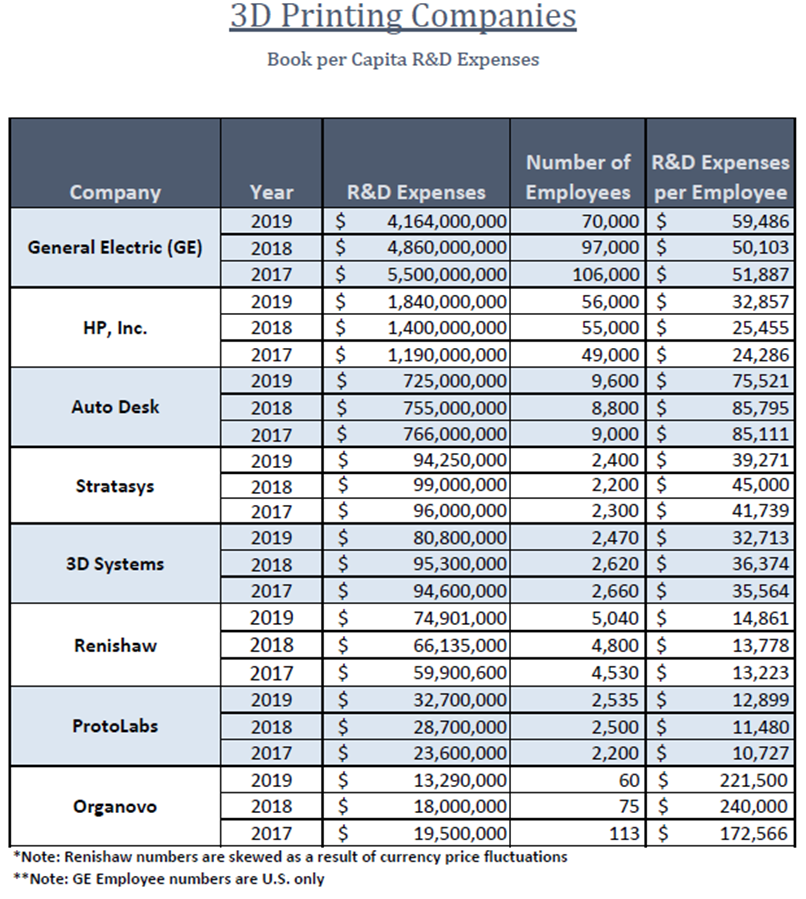

A table providing the last three years per capita R&D for eight companies’ public reporting purposes is presented above.

Some conclusions from the five-company data for the pure-play 3D printers — Stratasys, 3D Systems, Renishaw, Protolabs, and Organovo — are as follows:

- This is an industry with a large commitment to R&D with three-year average spending of $179 million for all five pure 3D printing companies

- The pure 3D printer manufacturers are engineering/design-intensive since the average company per capita annual R&D spend is $79,500, this excludes GE and HP

- A significant percent change (-44.2%) occurred compared to 2018 due to Organovo’s financials and Renishaw currency fluctuations (€ to USD)

- Organovo is an organ printing company, that again topped the R&D Expense Per Capita table due to their small employee numbers and millions spent on R&D Expenditures

- GE and HP Inc. are not 3D printing-specific, though they have committed large portions of R&D spending on 3D printing as the companies have a combined 15% market share in 3D printing (HP 6%, GE, 9%) and continue to grow their capabilities in this realm. Their large numbers skew the overall data results.

This table only reflects the R&D investment of large commercial 3D printer manufacturers. Other 3D printing or R&D investors include:

- Foreign, U.S. federal and local government

- Universities

- Software developers

- Material suppliers

- Designers and end-users

- Numerous privately-held 3D printer manufacturers, many of which have large R&D budgets, including Desktop Metal, Markforged, and Carbon