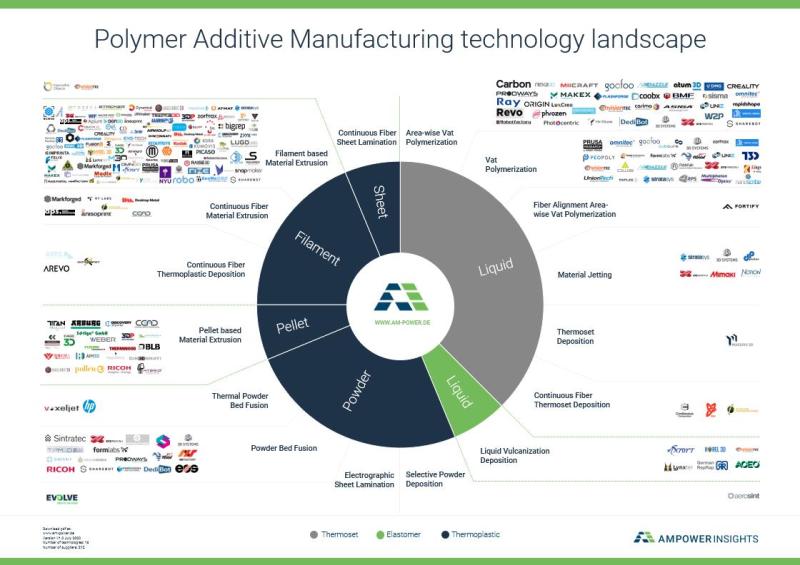

A new chart published by AMPOWER shows a comprehensive view of the polymer 3D printing landscape.

AMPOWER is a Hamburg-based additive manufacturing consultancy, providing training, quality control, design aspects and more. One of their co-founders and current managing partners, Matthias Schmidt-Lehr, recently published the new chart on LinkedIn.

I’ve seen this type chart before, and they are quite elusive, as they attempt to capture the current state of affairs in the industry. As we all know, that’s a moving target: not only do new companies emerge and others fade away on a regular basis, but wholly new additive processes can suddenly appear. While some may say additive manufacturing is maturing, it really is still in a long exploratory period where we are still sorting out what the optimal processes and equipment might be.

It’s very difficult to track all of the companies in the space, as there are now literally hundreds operating worldwide. While some are large and well-known, others are regional and may have zero visibility in other areas. Evidently Schmidt-Lehr called upon his contacts to help fill in the gaps and the result is quite impressive.

The chart covers 16 different additive processes, and assigns companies to each. The processes include:

- Electrographic sheet lamination

- Powder bed fusion

- Thermal bed powder fusion

- Pellet based material extrusion

- Continuous fiber thermoplastic extrusion

- Continuous fiber material extrusion

- Filament based material extrusion

- Continuous fiber sheet lamination

- Area-wise vat polymerization

- Vat polymerization

- Fiber alignment area-wise vat polymerization

- Material jetting

- Thermoset deposition

- Continuous fiber thermoset deposition

- Liquid vulcanization deposition

- Selective powder deposition

You may not be familiar with all of these, but rest assured they are indeed different, usually in ways that are relevant to those selecting a technology.

While there are a couple of very crowded categories, such as “Filament based extrusion” with around 100 entries, there are others that have very few entrants.

For example, Aerosint is the sole company providing selective powder deposition. This, in a way, shows the progress of 3D printing tech: the earlier processes have multiple providers, while the newly-invented technologies have only a few. That will likely be the case until patents expire, as happened in and around 2009 for the original 3D printing technology patents.

What’s most impressive about the chart is that it covers ONLY polymer processes. There is no mention of metal additive processes, which surely will make up a future chart. It won’t be quite as busy as the polymer chart, but will no doubt be just as interesting given the growing use of metal additive processes in industry.

More charts could be produced even after polymer and metal versions: there are several devices that can perform paste extrusions, typically for food or ceramic applications. These don’t fit into the polymer chart for obvious reasons, but with multiple groups now using 3D printing for production of meat alternative products, it might be of interest.

Another possible chart could be bioprinting, which again is another growing application area. It’s often forgotten by mainstream 3D printing folks as it’s really in another domain. Yet the processes involved are truly 3D printing.

As for me, I’m going to be zooming in on the fine details in the polymer chart to see which companies I have not heard from. We deal with plenty of additive companies at Fabbaloo, but my goodness, this chart has around 200 entries!