Charles R. Goulding discusses 3D printing in helping all four legs leap.

One of the long time mysteries in sports was whether all four legs of a racing horse leave the ground simultaneously. This question was finally answered when the four levitated horse legs were captured in photos by Edward Muybridge in 1878.

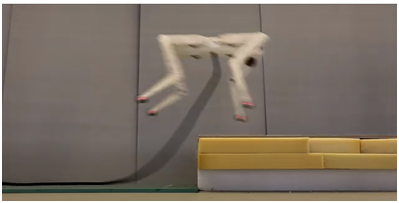

Recently an open source robot approved by Boston Dynamics, known as Solo 8, was presented levitating in the press release photos.

The Solo 8 robot is the result of research collaboration by the NYU Tandon School of Engineering and the Max Planck Institute for Intelligent Systems (MPIS) in Germany. Because it utilizes 3D printed plastic components, Solo 8 is not only inexpensive and easy to assemble but also enables startups and research facilities to obtain a proven model. Perhaps most importantly, Solo 8 can be enhanced and modified, enabling more advanced research and development.

We recently wrote about the underlying traditional Boston Dynamic Spot being transformed into a UVC disinfection robot in the fight against the spread of the coronavirus. We frequently write about robot and 3D printing applications because we view them as complementary manufacturing technologies. Robots can be made more efficiently with 3D components and lower-cost open source access will generate a wide range of uses.

The integration of both robots and 3D printing will undoubtedly result in significant process improvements. Activities related to robot and 3D printing applications are eligible for economic tax benefits such as the Research & Development Tax Credit, which is described below.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax for companies with revenue below $50MM, and startup businesses can obtain up to $250,000 per year in cash rebates applied directly toward payroll taxes.

The Finish Line

Projects like Solo 8 can accelerate the growth of the robot industry. The 3D printing industry has the opportunity to aid in and benefit from this growth by enhancing both the robot technology itself as well as the industries the technology assists. All of this while obtaining economic benefits to fuel further innovation.