Charles R. Goulding reviews a new ebook that features tech insights and fits into the theme of an unusual year.

Rajeev Bencil Surana, the CEO of Scinnovation in India, has just published his second book in ebook format. Rajeev is a regular reader of Fabbaloo and Scinnovation follows technology developments in 3D printing and other leading technologies.

The book reflects interviews with 20 leading technology followers, including this Fabbaloo writer. His observations are particularly important for the Indian economy as it steps up its own innovation efforts and increasingly is a new supply chain alternative for global business.

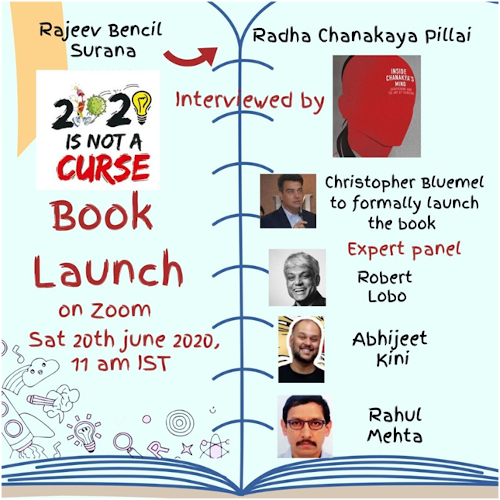

My testimonial was also part of the June 2020 book launch, and is as follows:

“By making the effort to write a positive book about innovation during a pandemic along with a zoom book launch, Rajeev Surana has demonstrated that he practices what he preaches.”

I believe that what this book demonstrates and what it symbolizes is important, especially during this recovery period in history. What it says is when the going gets tough, the tough get innovative in order to solve the problem, not run away from it.

Excerpt

From the section “Technology and Innovation”:

“At such critical times, fast-paced scaling up is needed even more. Businesses were shut down because of the lockdown and have had to move online to ensure survival. “Digitization” of businesses has never made more sense. As we move towards the easing of the lockdown, social distancing will still be prevalent and companies that can adapt to the changing times and adopt technology will be able to thrive.

Be it contact-less doors or robots installed in hospitals, technology and innovation will be at the forefront in the near future. We have already witnessed innovative products and technologies that are serving health needs across the world. For example, snorkelling masks are being altered to work as ventilators, and hockey mask-making companies are now manufacturing visors to facilitate social distancing protocols.”

Efforts in testing and experimenting with new and improved products or processes are eligible for economic benefits.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax for companies with revenue below $50MM, and startup businesses can obtain up to $250,000 per year in cash rebates applied directly toward payroll taxes.

Conclusion

There is no substitute for hard work and the book “2020 Is Not a Curse” reminds us of this. Particularly during these hard times.