[Source: Pikrepo]![[Source: Pikrepo ]](https://fabbaloo.com/wp-content/uploads/2020/05/3D-Printer_img_5eb06530df32e.jpg)

Charles Goulding of R&D Tax Savers takes a look at pandemic production.

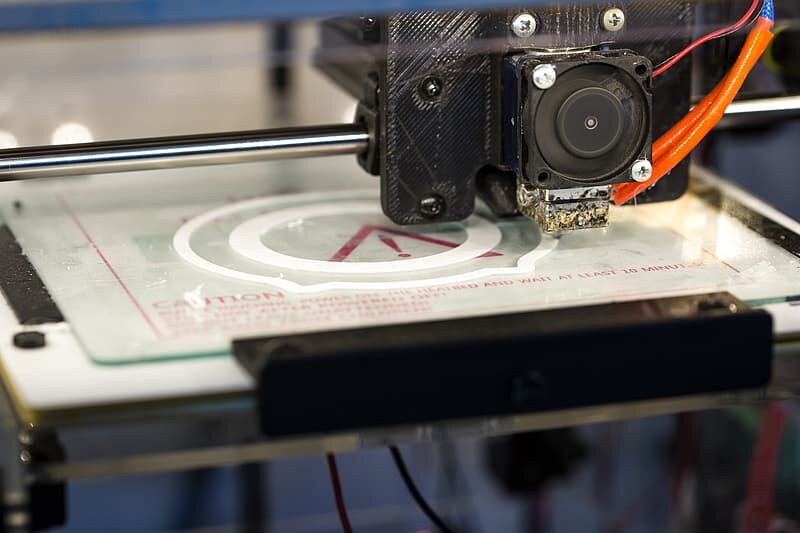

The novel coronavirus crisis has brought out the best in the 3D printing industry, which has stepped up to make critical products including protective masks, ventilator parts and lab equipment.

3D printing service centers are similar to traditional machine shops and contract manufacturers in that they typically produce as directed by the customer. To produce as directed by the customer, the job shop receives design drawings and specifications. With smaller, less sophisticated customers, the drawings can be crude, incomplete or even inaccurate. The job shop typically takes what it gets and then converts the data into shop drawings and as built drawings when the project is completed. The end design is usually a superior design because of the job shops expertise and practical knowledge.

With the coronavirus pandemic, 3D printing companies are doing the fundamental product design work and creating products they aren’t accustomed to, often with materials, product standards, and regulatory compliance they are not familiar with. The deep expertise of some 3D printing firms is actually resulting in better products. Besides doing a great service for all of us, these 3D printing companies are gaining valuable technical knowledge. Many of our job shop and 3D printing service center clients actually desire to have some portion of production products for business stability so that they don’t have to rely entirely on receiving new customer designs for orders.

Activities associated with first-time design of new and improved products, as well as working with new materials, are eligible for R&D tax credits.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Helping others is of the highest calling. More often than not, you get back even more than the satisfaction of making a difference.