Why It Is Important to Get Out of Your Comfort Zone

Charles R. Goulding and Preeti Sulibhavi look to 3D printing for innovation in tough times.

In an April 10th, 2020 Wall Street Journal article, writer John D. Stoll queries why so many normally staid companies were able to so quickly pivot and create new products to fight the coronavirus. He questions whether the absence of normally risk-averse investors or the temporary restraint of conservative financial gatekeepers contributed to this atypical burst of innovation.

The 3D printing industry has been a major contributor to this coronavirus innovation streak with products such as ventilator parts, protective face shields, and nasopharyngeal testing swabs. One of Stoll’s major examples is the Ford Motor Company, where he contrasts Ford’s exceptional performance during this crisis to prior stagnation when Tesla was the industry innovation giant.

It will be interesting to watch the continued innovation levels with the companies that stepped up during the crisis. Hopefully, they have a newfound confidence in their innovation capabilities and can be resolute in hurdling historic innovation constraints.

Necessity is the Key to Ingenuity

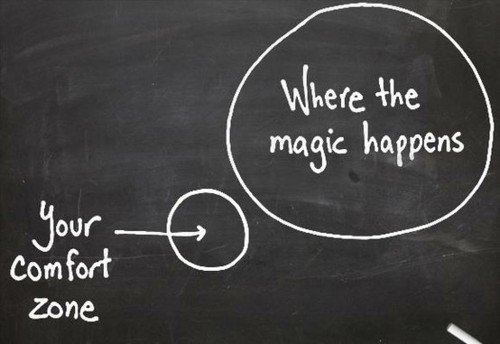

The clichéd “comfort zone” is the likely culprit for lack of innovation for many companies, before this coronavirus situation. Checking budget and cash flow models while analyzing financials normally dictates major decisions at most companies, however, with the advent of the coronavirus pandemic, things changed. The crisis pushed many of us, and certainly the 3D printing industry, out of our comfort zones.

Sometimes all it takes to gain confidence is breaking out from one’s comfort zone. Hopefully, we now have many companies that are now willing to do just that.

Continuous R&D tax credits are available for companies that continually innovate.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax for companies with revenue below $50MM, and startup businesses can obtain up to $250,000 per year in cash rebates applied directly toward payroll taxes.