Charles Goulding and Preeti Sulibhavi consider how two prominent automotive firms, Ferrari and Ford, are using 3D printing.

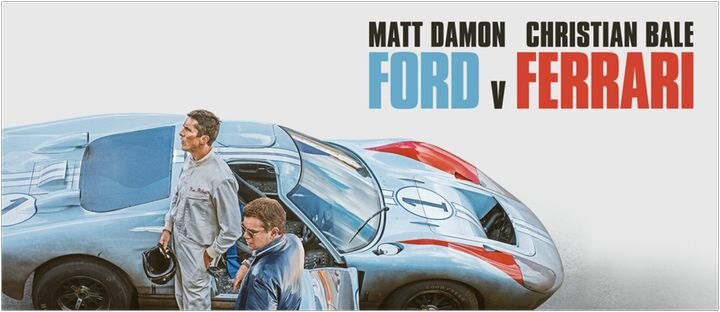

The Hollywood Movie

In the hit movie “Ford vs. Ferrari,” Matt Damon plays Caroll Shelby, the master high-performance car builder, and Christian Bale plays Ken Miles, the acclaimed racecar driver and mechanical expert.

Caitriona Balfe (of Highlander fame) plays Ken Miles’ wife. Since Caroll Shelby was married seven times, the movie producers adroitly never address his marital status.

The movie, which takes place in the 1960s, portends future automotive 3D printing since the competition is a relentless quest for overall vehicle weight reduction and new high performance quality components. We described Ferrari’s later 3D printing accomplishments in our Formula One article, as well as Ford’s extensive 3D printing initiatives in our previous article.

Demonstrating the perpetual business cycle, Ford’s underlying car business was suffering at the time, not unlike its current business predicament. The movie uses the LeMans racing competition to illustrate the challenge innovators face with corporate bureaucrats, while accurately presenting some fascinating business history involving the global auto industry’s historic financial figures.

The famous auto giants in the movie include Henry Ford II, Enzo Ferrari, Giovanni Angelli (the Fiat CEO), and socialite-turned-Ford executive (and later of Chrysler fame), Lee Iacocca. We have to wait for Elon Musk’s response. We have had to wait from the time period of this movie until now, this Elon Musk era, to see this kind of excitement in the auto industry.

The ongoing innovation related to 3D printing is eligible for R&D tax credits.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Since 2016, the R&D credit can be used to offset Alternative Minimum Tax (AMT) or companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in cash rebates that can be applied directly to payroll taxes.

Automotive 3D Printing

Ford is currently utilizing 3D Printing and is changing the way engineers develop and test cars. Ford has demonstrated that prototyping parts is much faster, more flexible and cost-effective.

More specifically Ford is utilizing 3D sand printing (along with fused deposition modeling, FDM, and selective laser sintering, SLS). Ford is even utilizing 3D printing to build hand tools, jigs & fixtures to assist inventing and developing new parts.

Ferrari has revealed that it is using metal additive manufacturing systems from Renishaw for more efficient part production. For many years, Ferrari was the only racing team to build both the body and the engine of its cars. What has transformed the process for Ferrari, and now others such as Mercedes Benz is the utilization of AM for more challenging metal engine components. This is revving up the engine for Ferrari’s continued racing success.