![Autodesk's Stock Price Takes A Hit [Source: Seeking Alpha]](https://fabbaloo.com/wp-content/uploads/2020/05/autodesk-stock_img_5eb096c140a61.png)

Autodesk’s stock dropped 10% after their first quarter results were made public.

The company reported missing their targets for the first quarter. Publicly traded companies frequently issue forecasts for their future performance, and these targets are taken into account by traders. Should the actual results vary notably from the forecast, the stock price will suddenly shift to account for the change in profitability, as the stock price had already been assuming the targets would have been met.

In this case, Autodesk’s revenues were lower than expected, causing the slight investor panic.

A report on Seeking Alpha summarizes the news:

-

Shares of Autodesk crumbled nearly 10% in after-hours trading after reporting a miss on Q1 revenues and EPS.

-

Billings and ARR growth remained strong at 40% and 33% y/y respectively, though the latter decelerated one point from last quarter.

-

Autodesk’s growth in FY20 is heavily subject to risk in the slowing construction sector, which has become a greater portion of revenues since the acquisition of PlanGrid.

-

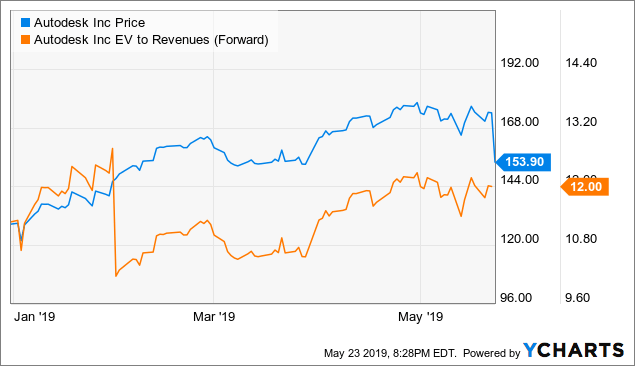

Autodesk’s double-digit forward revenue valuation continues to weigh on the stock’s capacity to rally further.

The report, written by Gary Alexander and brashly entitled “Autodesk: Ditch This High-Flying Stock”, attempts to persuade readers to abandon Autodesk stock as they feel it may encounter some rough roads ahead.

Alexander’s reasoning seems sound, as he suggests the CAD tool company may experience reduced demand due to an anticipated slowdown in construction. The idea is that fewer designers will be required, and thus lowered demand for Autodesk CAD tools, or at least suspended subscriptions.

Similarly, Alexander suggests that the ongoing battle between the USA and China may cause a similar drop in CAD need in China, where a substantial portion of Autodesk’s revenue is sourced. If this is the case, then there may be further pressure on Autodesk’s revenues. Alexander explains:

“Autodesk’s disappointing guidance ranges isn’t just a reflection of management’s conservatism, but bona fide macro risks in the global economy. As a software vendor that derives a good portion of its revenues from infrastructure and construction companies, it wouldn’t be surprising to see Autodesk’s billings pull back. Note also that Autodesk has a fairly aggressive billings growth target of 50-53% y/y this year (the nominal range is $4.05-$4.15 billion), which the company may be hard-pressed to meet.”

The company has been working to switch their users from one-time-charge products to their more profitable subscription services, and by and large they’ve been successful in doing so up to now. However, Seeking Alpha explains an issue:

“What is disappointing, however, is the rate of deceleration in Autodesk’s ARR growth – which, for a company whose narrative focuses almost entirely on subscriptions now, is a huge blow. Total ARR grew 33% y/y to $2.83 billion, as shown in the chart below.

This represents one point of deceleration from 34% y/y growth in Q4. However, when we account for the fact that organic ARR growth was only 29%, the story becomes much worse. Autodesk completed its purchase of PlanGrid in December, and expects the acquisition to contribute three points of ARR growth in FY20. It contributed four in Q1 – so on a net basis, organic ARR slowed down by five points this quarter.”

Nevertheless, Autodesk is a very large company and its entirely possible they can find a way through these challenges. Shifts in statistics of this type are just the sort of thing investors focus on to try to gain insight into what may happen. But often the true results end up quite differently.

Via Seeking Alpha