![3D Systems’ financial results made something happen [Source: Google]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb09bafa6bb7.jpg)

It’s that time of year when many companies release their year-end financial results, and 3D Systems’ were quite interesting.

The 3D printing giant, one of the very few that is publicly traded on the stock markets, is obligated to release their financials periodically. By examining the results we can gain some insight into the company, and by extension, the entire business world of 3D printing.

There were a number of big positives in their announcement, such as an increase in overall revenue for the full year 2018 of US$688M as compared to US$646M in 2017. That’s a reasonable increase of six percent.

The company still reports a loss on their per share earnings, however in 2018 the loss was considerably less than in 2017, dropping from US$0.59 per share to US$0.18 per share. That’s good news, although still a loss.

The really positive statistic was their printer sales. They say:

“For the full year 2018, revenue increased six percent to $687.7 million compared to $646.1 million in 2017, driven by 25 percent printer revenue growth on a 76 percent increase in printer unit sales, one percent growth in materials, five percent growth in software, two percent growth in on demand manufacturing and 20 percent growth in healthcare solutions.”

Wait, that’s getting close to doubling their 3D printer sales. That’s significant. However, the printer revenue increased by only 25%, suggesting that the printers they are selling are generally have a lower price per unit. While that’s not so good, it is consistent with the highly competitive market of 3D printing, where hundreds of vendors now vie for buyer dollars.

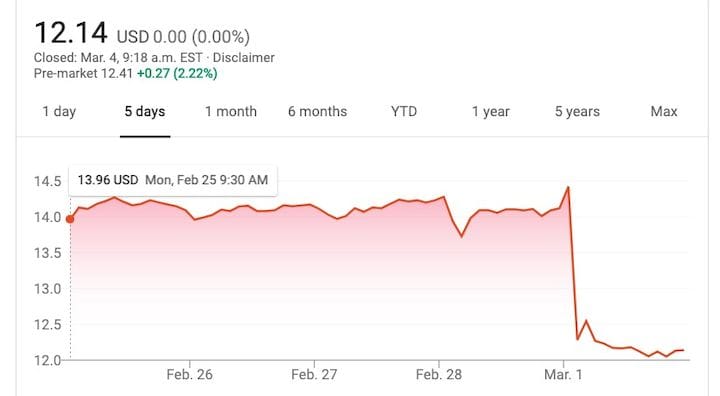

These statistics seem reasonable, or even positive, depending on how you look at it. However, a glance at the image at top shows the market’s reaction to the release. It seems that 3D Systems’ stock price dropped suddenly from US$14.42 on Friday to US$12.28, close to 15%.

What could the markets have seen in these stats to deliver such a blow to the stock price? One other stat was that their GAAP gross profit margin dropped from 48.2% in 2017Q4 to 45.7% in 2018Q4. They’re making less money on each sale. Perhaps that was the item that spooked investors.

I’m not sure this is warranted, because there is something else at play here. Each 3D Systems device sold uses proprietary materials that must be purchased from 3D Systems or their resellers. Thus, each machine sold is effectively guaranteeing a multi-year revenue stream of materials as the device is used.

And 3D Systems is selling more systems than before.

So what if they make less per machine, as long as they sell plenty of them and make copious revenue from them after the fact?

I think they realize this, as their EVP/CFO John McMullen said:

“With multiple 2018 product launches now behind us, we are shifting our investment focus to materials innovations and software growth opportunities. We are very focused on reducing our cost structure and driving cash generation during 2019.”

So they are now focusing on materials, which makes sense.

It also means it’s highly unlikely we will see new equipment from 3D Systems for a while.

Via 3D Systems

A blog post reveals much of what happens behind the scenes at 3D print service Shapeways.