Charles R. Goulding and Preeti Sulibhavi look at 3D printing as related to Autodesk’s acquisitions in construction software.

In our opinion, the 3D printing industry is going to benefit from vast improvements in construction management software (CMS). Up until a few years ago the construction industry lagged behind other industries in effectively utilizing software. Autodesk, Inc.’s recent purchase of two leading CMS companies for over $1 billion is a signal that construction management software has arrived. In November of 2018, Autodesk announced the purchase of PlanGrid, Inc., a sophisticated construction management software company, for $875 million. This was followed only a month later by Autodesk purchasing BuildingConnected for $275 million. Once these systems are integrated into the existing Autodesk offerings, the possibilities can grow to be limitless. Software developers and construction designers can use R&D tax credits to further develop this software and apply it to projects. Likewise, Autodesk can maximize R&D tax incentives to support future developments.

Autodesk’s Existing Powerful Construction Related Software Offerings

Autodesk already has robust offerings in the construction-related software industry, including Revit and Building Integrated Management (BIM). With Autodesk’s expanded construction software offerings, the new possibilities are virtually endless. For example, assume BIM identifies what is called a “conflict” because piping for fire sprinklers and mechanical systems can’t be configured in current design iterations. The solution may a 3D printed pipe design created in another Autodesk module.

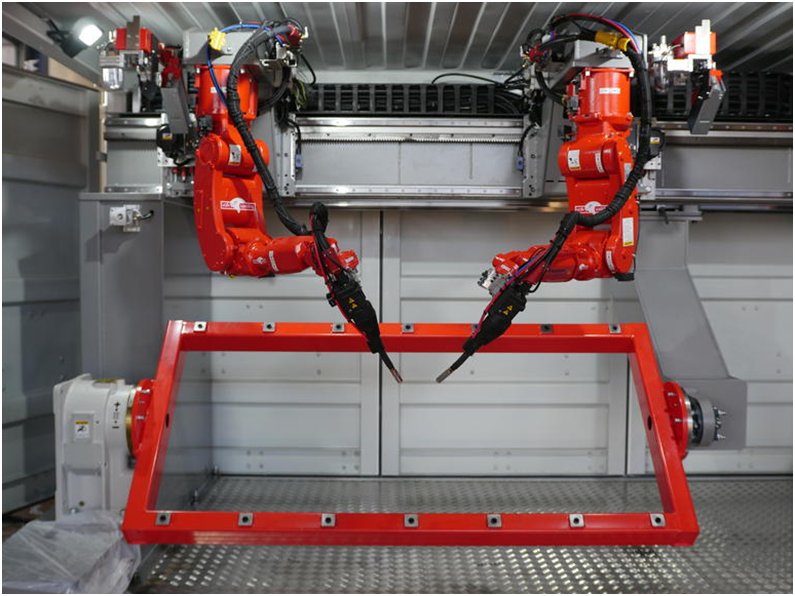

Autodesk’s 3D printed construction robot software is rooted in the belief that robot and printing systems, capable of printing large, usable metal components, can be packaged up in a shipping container and sent from job site to job site. This allows buildings to be constructed quickly, parts to be produced more accurately, and it fills the existing construction labor shortage in the market.

There are numerous other construction management software offerings, which include:

-

CoConstruct LLC is a mobile as well as web-based construction project management product designed for the specific needs of builders.

-

eBuild, Inc.’s ERP offers a web-based system that includes layout planning, remote project management, and budget control features. eBuild does not appear to provide information about integration options with QuickBooks and ADO-compatible database (Excel, SQL, MS Access).

-

Aconex, Inc. allows all parties to use the same system that is consistent, connected and creates a workflow process. It includes bids and tenders as well as quality and safety modules.

-

AccuLynx, Inc., primarily used by roofing contractors, allows for all aspects of the sales pipeline to be centralized and organized.

-

Newforma, Inc. prides itself on eliminating coordination errors and mitigating risk. The single view into construction projects allows for architects, engineers and contractors, as well as owners, to organize their data in real-time.

-

Viewpoint, Inc. provides construction specific collaborative tools for construction accounting, project management and workflow optimization. This tool is known for organizing office, team and field together, rather than a one-point software.

-

Textura Corporation or Textura, Inc. is actually powered by Oracle. Textura is more of a cloud-based payment management system.

-

BuilderTREND Solutions, Inc. is a cloud-based CMS – primarily for homebuilders and remodelers.

Aside from the advent of 3D printed robots, Autodesk, with the help of Formlabs, has been utilizing 3D printing to bring various construction designs to life in other ways. Using the most advanced desktop 3D printers, Formlabs allows clients to import Autodesk STL or OBJ formatted files and print with user-friendly print setup software (i.e., “PreForm”). Designers and CAD users can effectively visualize models in the physical world using stereolithography (SLA). This service is provided with the belief that physical models actually help users understand their designs in a more tactile way. CMS should improve with time, with respect to both quality and pricing.

3D Printing and CMS: A Design within the Constructs of the Future

The construction software competitors described above are now confronting Autodesk’s greatly expanded product line offering. To remain competitive, our view is that they will need to improve their capabilities, perhaps including 3D printing interfaces or perhaps themselves merging with companies that have enhanced functionality including 3D printing integration. Internet access on job sites was limited in the past, but with the advent of smart phones and tablets, widespread use of this software has become more accessible, feasible and reliable. The construction industry is embracing this fast-growing software technology, while 3D printing is now pervading the construction sector. Construction companies can utilize this software and 3D printing, while benefitting from R&D tax credit incentives that can help fuel future innovation.

The Research & Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

-

Must be technological in nature

-

Must be a component of the taxpayer’s business

-

Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

-

Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.