![[Image: Stratasys]](https://fabbaloo.com/wp-content/uploads/2020/05/OrionDockingHatchPEKKcoverphoto_40171_img_5eb0a52334b97.jpg)

It’s an interesting time for 3D printing as the technology moves toward production.

In part one of our interview, Scott Sevcik, Stratasys’ Vice President of Manufacturing, shared a look into the company’s history in developing FDM 3D printing and developments toward production through close work with key customers. Collaborating with users such as Airbus and Team Penske to develop production-quality thermoplastic 3D printing has led Stratasys to create a growing portfolio of proven solutions for the market. What does that market look like, though — and how can it compete with metals?

When someone discusses additive manufacturing and its place for end-use parts, most minds leap immediately to metals. Metal 3D printing has been seeing fast-paced and increasingly validated usage in production environments. These technologies are rightfully grabbing a lot of attention right now, with an increase of market introductions showing significant strength. But look around; chances are you see more plastic products in your immediate environment than metal. Plastic is also a production material group, and we can’t forget that.

“Timing-wise, it’s very interesting for us right now. As there has become so much interest and hype around metals additive, that is much more production-oriented in nature, a lot of people have dismissed plastic for production even though they’re surrounded by plastic every day,” Sevcik said.

“People have realized there’s still a lot of maturation to happen in metals additive manufacturing. And here’s this highly repeatable plastics process that has qualification data published publicly and has standards being reviewed. Metals have helped many in the industry recognize tremendous value in securing not only metals for production but also, quietly in the background, thermoplastic additive has matured very greatly in terms of repeatability and in quality control necessary for production applications.”

The two primary areas adoption for production use at the moment, he continued, are in aftermarket and original equipment manufacturer (OEM) applications. Each of these has different requirements and highlights different capabilities where 3D printing can serve as a best-fit solution.

The aftermarket offers a bit more obvious a fit for 3D printing, Sevcik noted, as we can discuss spare parts or MRO (maintenance, repair, and operations) applications. Airbus saw one of its earliest applications in a seat component for an older aircraft, for example, as 3D printing offered the ability to make low volumes of the out-of-manufacture replacement part rather than create new tooling. Stocking a digital inventory, rather than a physical one, enables users to cut down on the time, money, and space required to store parts that may or may not be required at some point in an indeterminate future.

“The ability to stock inventory digitally and only print what you need, when and where you need it, can have a cost benefit we don’t normally consider ideal with additive. It’s not just some topology optimized thing; it’s just a normal part, and that can have major applications,” he said.

Many of the examples he noted in our conversation, including with Airbus, Etihad, and Singapore Airlines, are benefitting from their ability to produce their own spare parts. Aerospace is by no means the only industry to see such benefit, of course. Continuing to talk transportation, Sevcik highlighted the work Siemens Mobility is doing as an example in spare parts production.

![[Image: Stratasys]](https://fabbaloo.com/wp-content/uploads/2020/05/Siemens_mobility3_img_5eb0a523b4142.jpg)

Rather than produce 15 external panels for the front of trams — the only economical quantity for traditional production — now Siemens Mobility can create a single panel when needed without leaving 14 sitting on a shelf.

“What they have now done is print that part on a Fortus 900 in an appropriate transportation-certified material. It’s better economics and more streamlined production for them,” he said.

Of course, he continued, the real high interest area, longer-term, is on original equipment.

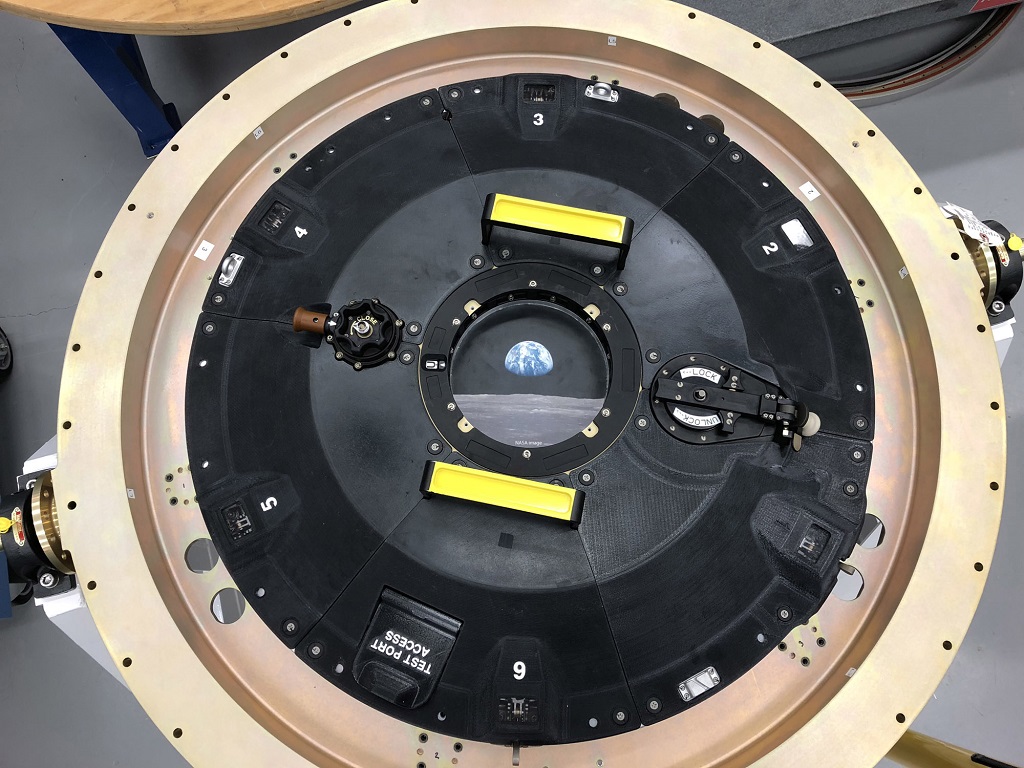

In creating original parts at volume, 3D printing has a ways to go yet before it can truly compete with traditional injection molding and subtractive technologies. Serial production parts must meet or exceed quality needs at a lower cost. Many of the most-touted benefits of 3D printing (e.g., lightweighting, topology optimization, parts consolidation) can indeed see costs come down across the board (e.g., materials, labor, time) — but this is still work in progress. Low-volume manufacturing needs are more immediately addressable, such as parts used for Airbus’ A350 and for the Orion space vehicle with Lockheed Martin.

“We’ve seen others that we can’t share publicly, but where producing a part at low volume becomes much more cost effective with 3D printing today. We’re actively exploring with customers in automotive and other industries,” Sevcik said. “Sometimes it’s 3D printing in concert with other trends in industry, like more personalization and more configuration.”

We closed out our conversation with a few questions.

I asked where he sees such trends in usage going in the short term.

“Since we introduced higher repeatability, we’re seeing extension from major OEMs into their supply chains, from Tier 1 down into Tier 2 and Tier 3. There’s a quick way to support their end customers with additive. One of the things we’re seeing change very quickly is that it’s no longer just the deep-pocket OEMs,” he said.

Why does Stratasys see itself as a leader in this evolution toward production? Why is this the company to drive manufacturing forward?

“We have a unique place within the industry from a standpoint of FDM. It’s a technology we originated, and we have continued to mature and improve, continue to expand materials, and drive repeatability. A lot of that is because of our customers,” he said.

“We know we have a reputation for a good industrial product and for supporting industrial customers. Because we have built that reputation and that position with our customers, we need to build on that and advance on that. We’re looking toward standards. We’re confident in our capabilities and quality, and we believe we’re in a position to grow adoption overall and not be a detriment to ourselves.

We believe we need to act like a leader as we look at advancing this technology, and continuing to do the things we need to show that FDM can be a mature manufacturing technology. ULTEM 9085 on a Fortus 900 has demonstrated a level of performance and maturity in that environment.

There continues to be a reaction to having these deep customer partnerships, and we listen to our customers and make sure they’re seeing responsiveness in the industry. The question over the last several years has been: is the technology mature enough? Like in metals, we see many maturing, but very few reaching that level of repeatability in performance that we’re reaching with FDM. We’re achieving what’s possible, and driving multiple technologies toward manufacturing readiness so our customers can have the variety they need and the tools in their toolbox so they can continue to take full advantage of additive.”

Speaking of metals… how is Stratasys looking toward metal 3D printing?

While Stratasys is developing its own metal 3D printing technology, it’s not yet fully ready for market introduction. We saw some more parts (and heard the name “Layered Powder Metallurgy”) at IMTS, but at the moment the company’s public offerings in terms of metal come from Stratasys Direct Manufacturing.

“One key piece we believe about metal is: not all customers need that metal in-house,” Sevcik said, and that’s where Stratasys Direct Manufacturing comes in to offer services. “We have seen strong results from customers in being a good partner with existing technologies.

Because we have both that experience with that and engagement with the metals market, and our experience with FDM, we’re recognizing the gaps in current metal 3D printing. We believe there’s room for additional metal manufacturing technologies to fill those gaps. We’ll continue to advance that and share more and more over time. We’re seeking to advance metals technologies in addition to what’s on the marketplace already.”

Advances in FDM are enabling consistent, reliable, repeatable 3D printing of engineering-grade materials — and Stratasys is looking to leverage three decades of experience, as the originator of that technology, to drive forward as an overall leader in the next phase of additive manufacturing: manufacturing.

Via Stratasys

A blog post reveals much of what happens behind the scenes at 3D print service Shapeways.