Charles R. Goulding and Joseph Castine examine the rise of both prices and interest in copper as the material continues to see more use in 3D printing.

Throughout history, copper has been a diversified metal with use in coins, guns, and electronics. In today’s market, the global demand for copper has caused the price to double over the last 12 months up to a record price of $10,762 per metric ton in May 2021. The impetus for the increase in demand for copper is the increase in demand for electronics, electric vehicles (EVs), and increased use of renewable energy sources which all require significant amounts of copper.

In regards to electric vehicles, demand for copper is so high because in order to decarbonize the world through the use of electric vehicles and other clean energy sources, Jeff Currie head of commodities research at Goldman Sachs says, “the only possible way we can do it is through copper. There’s really nothing else that conducts electricity as well.” Additionally, the global container ship demand in the first five months of 2021 is nearly double at 208 than that of 2019 and 2020 combined, which represents a significant need for new electronic wiring and componentry.

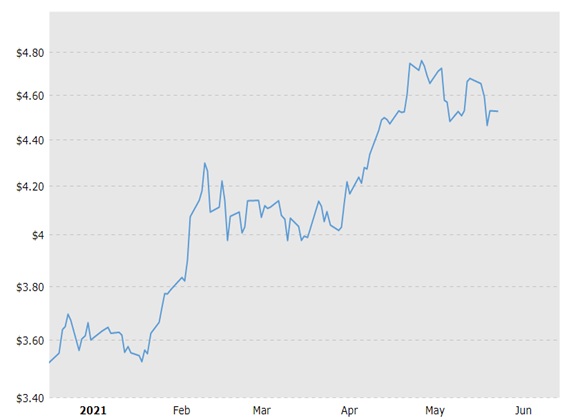

YTD Copper Price Performance Per Pound (USD) [Source: macrotrends]

With the global uptrends in the price of copper, several companies have begun to look into alternative sources. One of these obscure sources of copper mining is part-owned by members of the Pritzker and Walton families. This new mining business is receiving some large investments from BHP Group and Freeport-McMoRan Inc., two of the world’s largest mining companies. Jetti Resources LLC is a mining company that has been garnering significant support in recent times. Their copper mining process includes the extraction of copper out of mine waste from other mines. Their current owners include DNS Capital the family office of Gigi Pritzker a movie producer who is one of the heirs to the Hyatt hotel chain along with Ben Walton whose family founded Walmart Inc.

This company begins its process where its competitors end their process. Typically mining companies abandon the earth they have stripped once the ore is perceived to be of low grade. Jetti believes that this so-called low-grade copper ore could be beneficial in easing the looming shortage of copper ores. Jetti’s chief executive Mike Outwin has said that while traditional mines can take 10 years to develop, this new method can produce copper more quickly because it is working on sites that have already produced copper. Jetti has estimates that suggest there are around 234 million metric tons of contained copper, which could be processed from now until 2050, which could be valued at $2.4 trillion at current market value. The idea of recycling old mines to obtain new ore is not a new concept, the gold industry has been doing it for a significant amount of time. With copper demand predicted to jump 40% in the next decade, and with the so-called green sector demand predicted to jump by 900% according to Goldman Sachs, the result could be supply shortages of 8.2 million metric tons. This green sector demand is so high as there is anywhere from 60-84 kg of copper per electric vehicle which is five times that required for a traditional gas car.

3D Printing Copper

Other expanded ventures into copper additive manufacturing will also place a further strain on the copper supply over the next decade as additive manufacturing with metals becomes more mainstream.

With the recent developments in binder jet printing with metals and companies like Australia-based SPEE3D developing systems to 3D print copper, it is likely that copper 3D printing will move towards mainstream applications in the future. Some applications include the 3D printing of copper coils which has been adopted by a German electric motor company, Additive Drives GmbH. The benefits of this methodology include reduced time for prototype production which can greatly increase the speed of production cycles.

Companies engaging in advancements with 3D printing technology may be eligible for Research and Development Tax Credits.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software. Eligible costs include U.S.-based employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, contract research expenses, and certain costs associated with developing a patent. As of 2016, eligible startup businesses can use the R&D Tax Credit against $250,000 per year in payroll taxes.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Ultimately, as copper demand continues to increase the supply lines will continue to experience strain, resulting in further surges in copper pricing. This new mining technique is capable of recovering copper ore from previously mined stockpiles, which represents a projected 234 million metric ton supply. As mines become harder to come on line this new copper venture could prove crucial for the future of the copper market.

*Author’s Note: at the time this article was pending publication, the price of copper took a dip. It does not change the fact that the demand for copper is overall increasing.