Charles R. Goulding and Preeti Sulibhavi cover how a protracted approval process led Carlyle Group to abandon its bid for a stake in Thyssenkrupp Marine Systems, potentially leaving a golden opportunity on the table for German defense innovation.

Carlyle Group, a major investment firm based in Washington D.C., recently withdrew from acquiring a significant stake in Thyssenkrupp Marine Systems (TKMS), a leading German submarine manufacturer. This decision followed an eighteen-month delay by the German government in approving the terms of the acquisition, particularly regarding a mandatory ten-year holding period that Carlyle viewed as unusually long. Typically, private equity firms operate on a shorter three- to five-year timeframe to ensure flexibility and optimize returns. Meanwhile, as Carlyle contemplates selling its aerospace maintenance and repair company StandardAero, the strategic move for Thyssenkrupp seems increasingly complex, especially in a rapidly expanding defense industry.

The growing demand for submarines in today’s geopolitical landscape is underscored by a significant backlog at TKMS, including a €3.5 billion order, largely fueled by heightened defense spending among nations aiming to bolster naval capabilities. With the submarine market booming, Rheinmetall, a major German defense contractor, has also expressed interest in acquiring TKMS. A timelier government decision may have positioned the German submarine industry advantageously for strategic partnerships, especially with stakeholders like Rheinmetall that are well-suited to a longer-term defense focus.

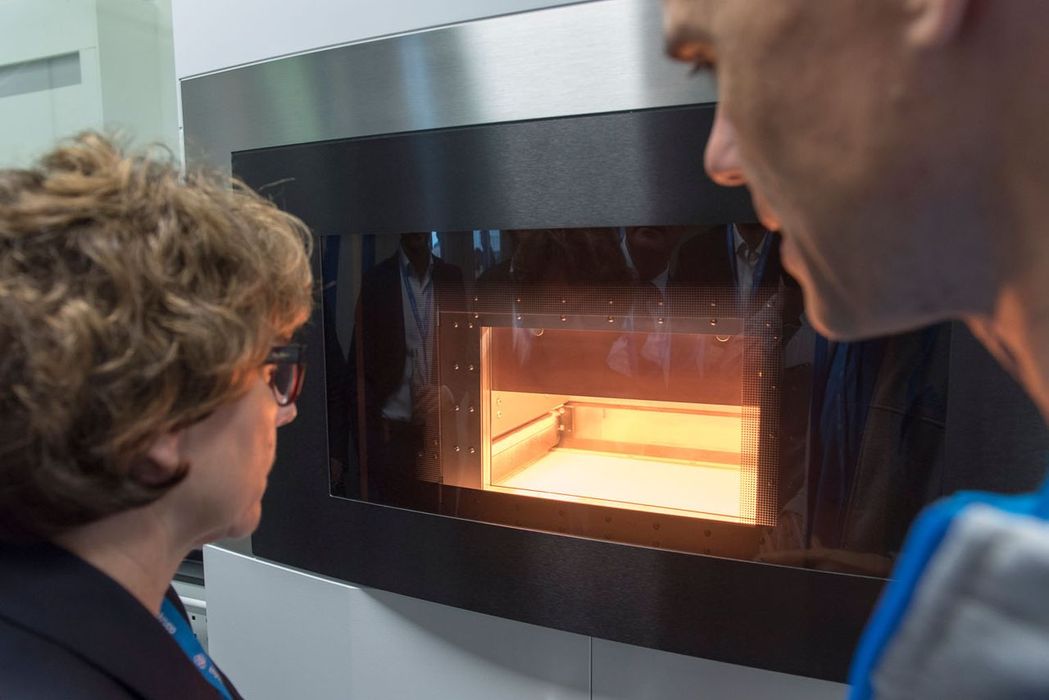

Thyssenkrupp has been investing in 3D printing technology. In fact, Andreas Stapelmann, Head of Thysenkrupp’s TechCenter for AM, has been on record saying, “We can use our printers to produce components that can be used on an industrial scale. This is because printed metal components that are equivalent to their conventionally produced counterparts cannot be produced with home printers. And we’ve got the option of using different materials approved by industrial customers. So, we can print both – prototypical visual objects as well as functional components that can carry loads, for example, because our team has proven their suitability through appropriate simulations. In addition, 3D printers for private users have a lower reproducible quality with regard to geometric accuracy and surface quality. This severely restricts industrial usability.”

In terms of industry advances, 3D printing has emerged as a transformative force in submarine production, notably in the manufacturing of critical components, which expedites timelines and reduces dependency on traditional supply chains. For instance, General Dynamics Electric Boat and Huntington Ingalls Industries’ Newport News Shipbuilding are pioneering 3D printed parts in Virginia-Class submarines.

Fairbanks Morse Defense (which acquired AMMCON Corp), the Navy components manufacturer, and General Dynamics successfully fabricated and integrated a 3D printed copper-nickel, 70-pound valve assembly. This is the first 3D printed assembly to be installed on a US submarine and will provide the Navy with a product that meets or exceeds the quality produced through traditional sand-casting in about two-thirds less time.

The valve body is produced by Lincoln Electric: through 3D printing, and it demonstrates both cost-effectiveness and reliability for naval applications. This additive manufacturing capability could expand further, paving the way for faster builds and more resilient production systems for submarines.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

With defense contractors embracing 3D printing innovations and governments carefully balancing intervention in industry transactions, a timely decision-making process becomes crucial. Prolonged indecision, as shown in Carlyle’s exit from the TKMS deal, can hinder market potential, delay innovation, and stall strategic growth within vital sectors like submarine manufacturing.