Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

You might think it’s not important to monitor these companies each week, as their value is realized only when stocks are sold. However, events happen to companies occasionally that cause their value to rise and fall, and this weekly post is where we track such things.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s take a look at the 3D printing companies on this week’s list.

3D Printing Leaderboard

| RANK | COMPANY | CAP | CHG |

| 1 | Protolabs | 816 | +32 |

| 2 | Xometry | 727 | -22 |

| 3 | Stratasys | 631 | +27 |

| 4 | Nano Dimension | 573 | -29 |

| 5 | 3D Systems | 550 | +80 |

| 6 | Materialise | 300 | +5 |

| 7 | Desktop Metal | 162 | -23 |

| 8 | Markforged | 88 | +3 |

| 9 | Titomic | 61 | -1 |

| 10 | Velo3D | 42 | -2 |

| 11 | Massivit | 24 | -2 |

| 12 | Aurora Labs | 19 | +5 |

| 13 | AML3D | 18 | +2 |

| 14 | Steakholder Foods | 11 | -1 |

| 15 | Freemelt | 8 | -0 |

| 16 | Shapeways | 7 | +0 |

| 17 | Sygnis | 4 | -0 |

| TOTAL | 4,040 | +75 |

This week saw healthy rises, with our leaderboard jumping almost two percent in value. That’s a good change from previous weeks of doom, and beat the markets overall gains.

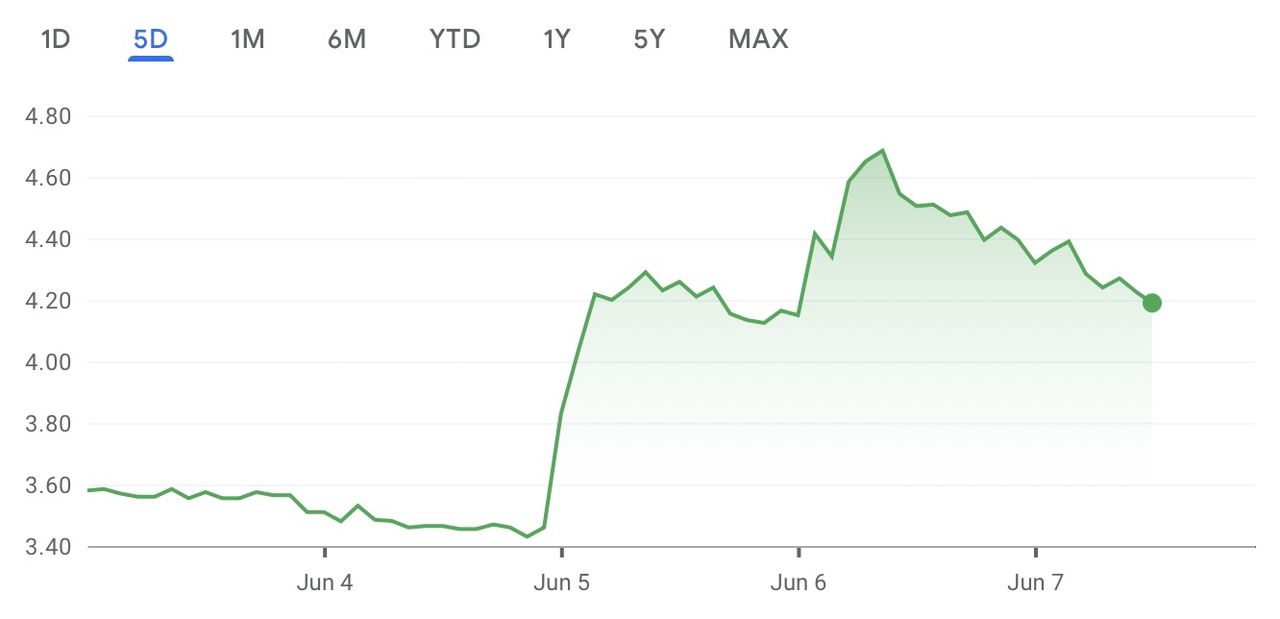

3D Systems leapt upwards a huge 17% this week. You can see in the chart above how dramatic this shift truly was. But what happened on June 4th to cause this effect?

That day 3D Systems released information on their dental growth strategy. The company has provided products and services to the dental industry for many years, but their announcement described new hardware, materials, regulatory approvals and a comprehensive dental market strategy.

The dental market has always been profitable for many 3D printer manufacturers, and several have been focusing on that industry over the years. Now it seems that 3D Systems is putting the pedal to the floor on dental. The key part of the announcement was the reveal of a massive near-quarter billion US$ deal to produce dental aligners. That guaranteed revenue clearly added to 3D Systems’ valuation this week.

Stratasys also rose, but not as much, “only” 4.5%. This was certainly due to a bounce back after last week’s financial report that could be described as flat or slightly negative. The company did announce a new “OpenAM” program for their Fortus series, but that should not have major effect on the company’s valuation.

Nano Dimension dipped almost 5% this week, no doubt as a result of their financial results released on June 3. Those showed higher margins, but lower revenue, with a focus on management of cash burn rates. Evidently investors didn’t see this quite so positively, and caused the dip in valuation. But, like Stratasys, they might bounce back next week.

AML3D grew a huge 15% this week. The company has been on a tear as industry seems to be discovering the company’s powerful metal 3D printing technology over the past few months.

Another Australian metal 3D printer company, Aurora Labs, also boosted its value this week to the tune of 33%. The company has been growing in value this week as they seem to be setting up for final development of their large-scale metal technology.

Finally, let’s talk about Desktop Metal. The company’s valuation fell over twelve percent this week, and a lot of that dip was due to the announcement on Friday of a reverse stock split.

In this procedure, stocks will be collapsed 10-1 on June 10th, and by implication raise the price of each individual stock by 10X. Except that’s not how it usually works. Investors are fickle and they evidently decided to downgrade the valuation prior to this move. The move was likely triggered by a shrinking stock price, as exchanges require minimum values.

Upcoming Changes

BigRep announced plans to go public via the SPAC approach, so we will soon see them appear on the leaderboard.

One company I’ve started to watch is ICON, the Texas-based construction 3D printer manufacturer. This privately-held company has been raising a significant amount of investment to the tune of almost half a billion dollars. At that level it is likely they will be discussing a transition to public markets at some point, which would certainly place them at or near the top of our leaderboard.

Another company that would seem logical to go public is VulcanForms, a manufacturing service using an advanced metal 3D printing process. They are currently privately valued at over US$1B, and going public could cause that to go even higher.

If you are aware of any other publicly-traded 3D print companies that should be on our leaderboard, please let us know!

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t know exactly what it is at any moment. The suspected bigger companies include EOS, Carbon and Formlabs.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.