Once again we take a look at the valuations of the major 3D printing companies over the past week.

Publicly traded companies are required to post their financial reports, as well as appear on stock markets. From there we can calculate the total value of their company by multiplying the current stock price by the number of outstanding shares. This number is the market capitalization, and represents the current valuation of the company.

It’s a great number of compare companies, as the market capitalization can be leveraged to provide more capabilities for the company. Shares could, for example, be used as collateral for a loan. That and similar maneuvers could generate cash with which the company might undertake new projects.

In other words, “market cap”, as it is known, is quite important.

You might think it’s not important to monitor these companies each week, as their value is realized only when stocks are sold. However, events happen to companies occasionally that cause their value to rise and fall, and this weekly post is where we track such things.

Note that our list here does not include all major 3D print companies. Not all 3D print companies are publicly traded, and thus we cannot officially know their true size, such as EOS. Others, like HP or Siemens, have very large 3D printing divisions, but are part a much larger enterprises and we cannot know the true size of their 3D printing activities.

Let’s take a look at the 3D printing companies on this week’s list.

3D Printing Leaderboard

| RANK | COMPANY | CAP | CHG |

| 1 | 3D Systems | 2294 | +167 |

| 2 | Xometry | 1898 | -218 |

| 3 | Stratasys | 1544 | +109 |

| 4 | Protolabs | 1369 | +49 |

| 5 | Desktop Metal | 1197 | +31 |

| 6 | Materialise | 1170 | +77 |

| 7 | Velo3D | 1156 | +90 |

| 8 | FATHOM | 1135 | -156 |

| 9 | Nano Dimension | 926 | +87 |

| 10 | Markforged | 881 | +82 |

| 11 | SLM Solutions | 363 | +32 |

| 12 | Shapeways | 147 | -6 |

| 13 | Massivit | 99 | +6 |

| 14 | MeaTech 3D | 85 | +4 |

| 15 | voxeljet | 46 | +11 |

| 16 | Freemelt | 43 | -4 |

| 17 | Sigma Labs | 24 | +2 |

| 18 | Sygnis | 12 | 0 |

| 19 | Aurora Labs | 11 | -2 |

| 20 | AML3D | 9 | 0 |

| 21 | Tinkerine | 2 | 0 |

| TOTAL | 14410 | +360 |

This week saw a much more stable collection of companies than last week’s chaos. However, while most companies recovered slightly, some still suffered rather large drops in value, and a few managed to strike gold with big boosts.

Second place Xometry suffered a significant near eleven percent loss in value this week. It was not quite enough for them to lose their position on our leaderboard, which has at times had them in first place. For now, they remain in second behind 3D Systems.

The reason for their drop might have something to do with the announcement they have raised US$250M in convertible notes. Basically, they’ve leveraged their high stock price to gain some cash from investors in a fancy type of loan that eventually will turn into shares.

This is quite a normal thing for companies with high-priced shares to do: get more value while you can. However, it seems the market didn’t think so well of the move.

On the other hand, Xometry’s stock price has been gradually floating downward for quite some time, so this week’s drop could be part of a continuing pattern.

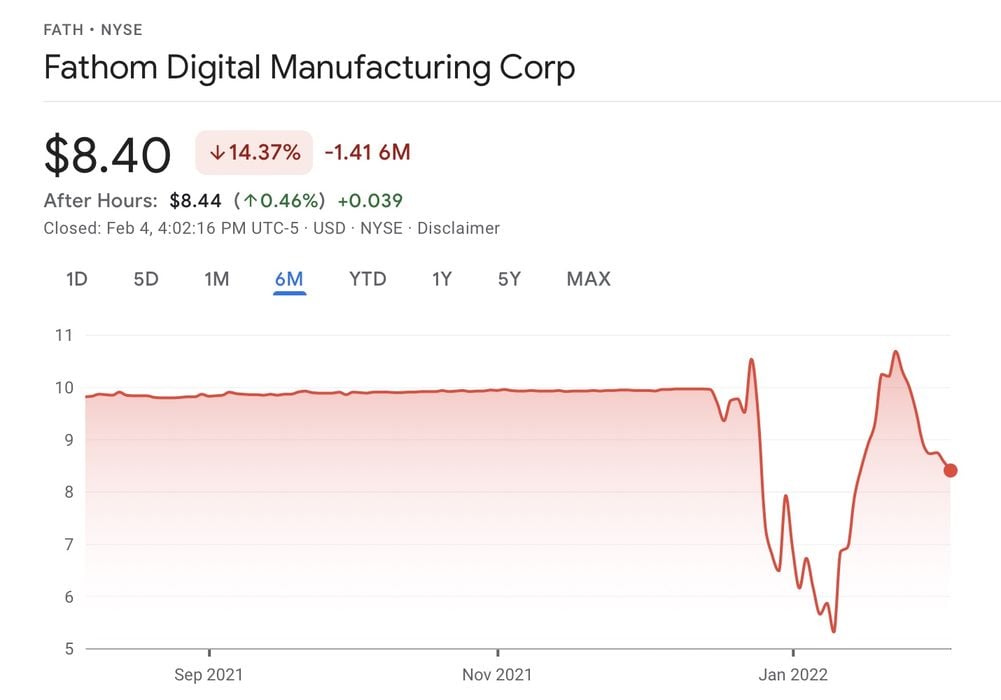

Newcomer FATHOM also dropped significantly, with a twelve percent decrease in value, leaving them three ranks lower. There’s no specific company announcement that triggered this. Instead it is simply the market trying to find a stable level for this relatively new and still unknown company. Here you can see the swings in the company’s value over recent weeks. Note that the flat period was prior to the company performing the SPAC maneuver to get on the market.

voxeljet is the winner of the week with a gain of over 30% in value. While this may sound huge, it’s actually not for two reasons. First, the company’s value is rather small on our leaderboard, so relatively small absolute value changes can create big percentage shifts. Secondly, much of the gain is a recovery from a stiff loss the prior week.

Aurora Labs suffered a 13% loss in value, but big shifts like that are not unexpected for smaller-cap companies such as this one. However, it may be that investors had a look at the company’s most recent filings, where it’s clearly stated they have not made significant revenue and continue to spend on R&D for their revolutionary metal 3D printing system. While that might appear negative, that’s what companies must do when starting up with a new approach: spend for a while and later reap the rewards. It may be that the filing spooked some investors, causing a slight dip.

Upcoming Changes

We are still awaiting the appearance on the market of one more 3D print company: Fast Radius, a digital manufacturing cloud service.

Another company set to appear in early 2022 is Essentium, who announced plans to use a SPAC-merger to launch on NASDAQ.

Another company to watch for is post processing specialist DyeMansion, which this week secured €15M (US$17M) in new investment. When I see numbers like this, I expect they eventually will make an appearance on the stock market.

Others In The Industry

While we’ve been following the public companies, don’t forget there are a number of private companies that don’t appear on any stock exchange. These privately-held companies likely have significant value, it’s just that we can’t know exactly what it is at any moment. The suspected bigger companies include EOS, Carbon, Formlabs and SLM Solutions.

Perhaps someday some of them will appear on our major players list.

Related Companies

Finally, there are a number of companies that are deeply engaged in the 3D print industry, but that activity is only a small slice of their operations. Thus it’s not fair to place them on the lists above because we don’t really know where their true 3D print activities lie.