Charles R. Goulding and Preeti Sulibhavi discuss how Novo Holdings is channeling the massive success of weight loss drug Wegovy into strategic investments in 3D bioprinting.

Novo Holdings, the investment arm of the Novo Nordisk Foundation, has built up a substantial war chest thanks to the runaway success of weight loss drug Wegovy. This positions the firm to make major investments in emerging biotechnologies like 3D bioprinting.

The foundation’s 28% stake in pharmaceutical giant Novo Nordisk generated immense dividends in 2022 as demand for Wegovy skyrocketed. The injectable weight loss medication became an overnight blockbuster, with Novo Nordisk booking record sales last year. This led the company’s market capitalization to swell to an astonishing US$500 billion.

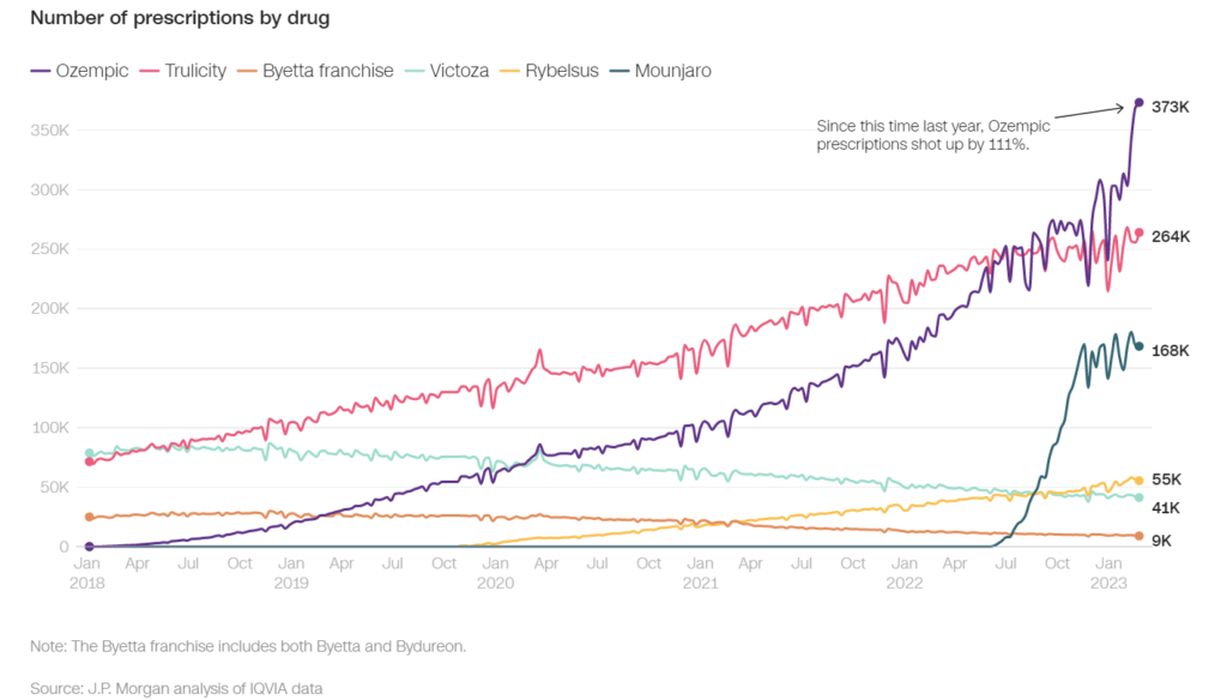

Analysts predict the obesity and diabetes treatment market will reach US$100 billion by 2030, driven by Wegovy and sister drug Ozempic. With Novo Holdings now flush with cash, its CEO Kasim Kutay revealed the firm will invest up to US$7 billion annually in life sciences companies by the end of the decade. A key area of interest is 3D bioprinting – using 3D printers to manufacture living tissues and organs. This emerging technology promises to revolutionize medicine by solving the organ shortage crisis.

In 2023, Novo Holdings acquired Canadian bioprinting company Aspect Biosystems for US$2.6 billion. Aspect has developed innovative 3D bioprinting platforms that enable the development of complex engineered living tissues.

For example, Aspect’s RX1 bioprinter uses proprietary tissue-engineering inks to print constructs like cardiac patches and skin that mimic native tissue structure and function. These printed tissues have great potential for use in drug screening and eventually as implants for regenerative medicine.

The Aspect acquisition provides Novo Holdings a foothold in 3D bioprinting, an area analysts see as a hot growth market in the coming years. Grand View Research estimates the global 3D bioprinting market will reach US$4.6 billion by 2030.

Other recent examples demonstrate the promise of 3D printing human tissue. Last year, Prellis Biologics announced the development of the first viable 3D printed human cornea (part of the human eye). This breakthrough could help address the shortage of transplantable corneas worldwide.

Researchers have also shown 3D bioprinting can create bone, cartilage, heart tissue, and even miniature kidneys. If the technology matures as expected, tailored organ substitutes could be printed on demand for patients in the future.

Novo Holdings’ Kutay confirmed the firm is looking to make larger bioprinting investments given the immense market potential. “We’ve got an ever-growing investment portfolio that’s generating very attractive returns,” he told the Financial Times. “We have more money than ever to invest.”

With Aspect Biosystems already in its portfolio, Novo Holdings is tipped to acquire other leading bioprinting firms with proven technology platforms. Potential targets include Cellink, a pioneer in commercial bioprinting valued at nearly US$1.5 billion.

Other innovative players like Allevi, RegenHU and Poietis seem ripe for investment or potential acquisition as well. By snapping up best-in-class bioprinting companies, Novo Holdings can position itself as a dominant player in the 3D tissue engineering space.

In the coming years, these Novo Holdings subsidiaries may help transform 3D bioprinting from an experimental niche into a mainstream MedTech field. Just as Wegovy disrupted the obesity drug market, 3D printed organs could revolutionize transplant medicine and regenerative healthcare.

Novo Holdings certainly has the capital required to make major bets on the future of bioprinting. If it continues to put its windfall profits to work via strategic acquisitions, Novo Holdings may quickly become synonymous with 3D printed human tissue. Its deep pockets and long investment horizon make the firm an ideal backer of emerging biotechnologies.

The Research & Development Tax Credit

The now permanent Research & Development Tax Credit (R&D) Tax Credit is available for companies developing new or improved products, processes and/ or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits

Conclusion

The coming decade will reveal whether 3D bioprinting can fulfill its therapeutic promise. But with generous funding from Novo Holdings’ soaring diabetes drug profits, companies like Aspect Biosystems now have ample runway to refine 3D tissue engineering and help bring printed organs from the lab to the clinic.