Several publicly traded companies have undergone significant valuation losses over the past year, and one of them is Velo3D.

The company emerged from stealth mode around 2017 with a very interesting technology for metal 3D printing. Their secret sauce is a combination of precision tuning and an unusual powder recoater that in many situations eliminates the need for support structures.

That technology makes it possible to use the company’s equipment in a more economical fashion, as post processing of metal supports can be tedious and expensive, for both equipment and labor. It’s quite unique in the industry.

Because of these benefits, several leading companies have acquired significant quantities of Velo3D gear over the past few years.

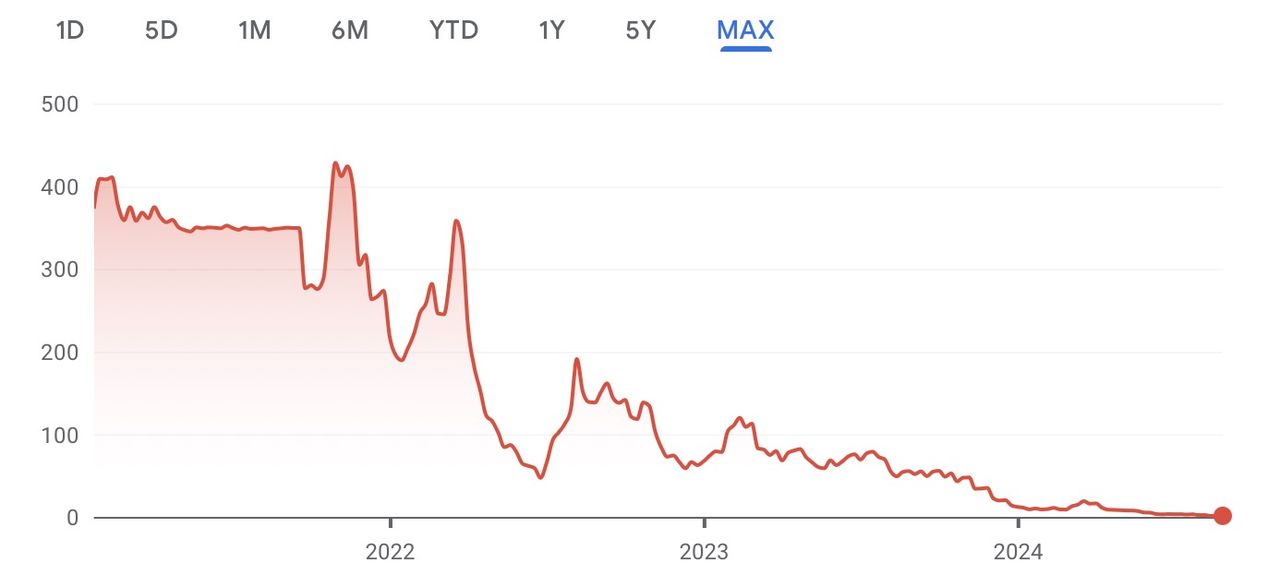

Velo3D is a publicly traded company, and we have tracked their valuation on our weekly leaderboard for several years now. Among all the companies we track, Velo3D has always been the one with the most valuation volatility. Its value has gone up and down quite dramatically, without formal explanation. This is a different pattern than we normally see with the other 3D print companies tracked.

The company launched into public trading in fall of 2021, with an initial valuation of US$1.65B. Unlike most new entries, Velo3D’s value rose afterwards, even hitting a huge US$2.2B in late 2021. At that point they were number three on the leaderboard.

Then the company’s valuation began a slow downward trend. As you can see in the stock chart above there were plenty of major ups and downs, but in the end the valuation seems to be converging towards the bottom. From their entry on the leaderboard at US$1.65B, the company’s valuation last week was only US$10M, a loss of 99.4%. That’s dangerously close to 100%.

This valuation slide is not unique to Velo3D: there were several companies that entered the market around that time and suffered similar downward trends. Some others:

- Markforged: US$1950M -> 53M

- Shapeways: US$426M -> 1M, now defunct

- Fast Radius: US$36M -> 18M, now defunct

- FATHOM: US$1100M -> 35M, acquired by Core Industrial

Velo3D’s most recent financial report had some mixed results, but perhaps the most notable factor was a massive drop in revenue in the quarter from US$25M to only US$10M. While the company stemmed losses through expense cutting, the lack of revenue seems to have affected investor sentiment.

Valuations today are largely based on expectations of future growth. If a company has shrinking revenue, then the valuation will correspondingly fall.

The question is, “where is this going?”

There are several possible outcomes.

One is that Velo3D somehow turns things around and makes a sudden batch of sales. With their reduced expenses it might be possible to lower the quarterly losses, but they are significant.

Another is that the Velo3D gives up and sells their assets. This is the route that Shapeways chose when they hit bottom.

A far more likely scenario is that another player in the industry swoops in and acquires Velo3D and their still powerful metal 3D print technology. After all, it wouldn’t cost that much: the entire company is now valued at only US$10M.

Of the public companies that might consider a takeover, the one that first comes to mind is Nano Dimension, which certainly has the cash to do this acquisition. Nano Dimension has been on an acquisition spree lately, acquiring Admatec, Desktop Metal and others. They don’t have a metal technology like Velo3D’s in their portfolio, so this might make sense for them. HP is also a possibility.

The other public 3D print manufacturers are less likely to get involved because they already have metal technology or probably can’t justify the cash expense to do an acquisition.

The major private companies without metal technology, including Carbon, Formlabs and others seem unlikely to acquire Velo3D as their businesses are focused elsewhere or they already have metal print technology, like EOS.

There is one more tantalizing possibility: one of their customers might acquire them. It’s rumored that the company has a very large, well-known aerospace customer that uses more than two dozen machines. In order to avoid re-doing all their printed metal parts on other equipment, this company might instead purchase Velo3D outright in order to keep the tech alive. After all, it would cost only US$10M, and that might be less than the cost of re-certifying their parts on new platforms and materials.

One way or another, Velo3D will probably have to change in the next while.

Via Velo3D