Charles R. Goulding and Preeti Sulibhavi investigate how major private equity firms like BlackRock, KKR, and Carlyle can leverage 3D printing technology to enhance supply chains, cut costs, and improve product innovation.

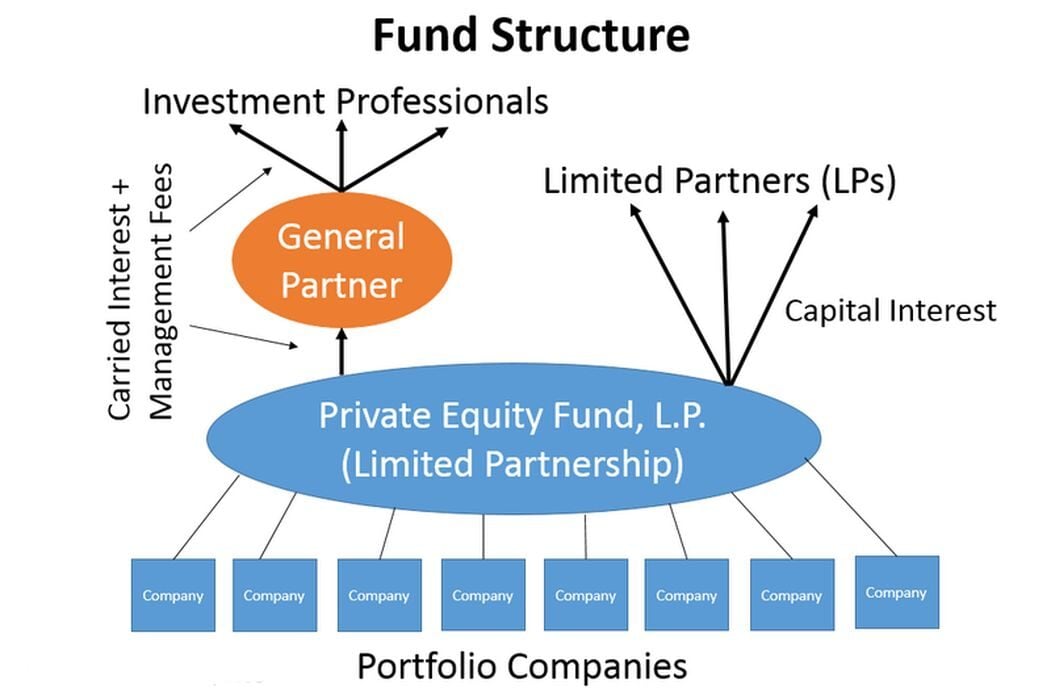

The American business landscape is now dominated by very large private equity (PE) firms. The number of public companies is steadily declining while the number of companies owned by PE is largely growing.

Some of the largest PEfirms include Blackstone, BlackRock, Carlyle, Apollo, KKR, and Clayton Dubilier and Rice (CDR). These firms are heavily involved in sectors such as Life Sciences/Healthcare, Industrial, Defense/Aerospace, and Infrastructure—industries where 3D printing has rapidly gained traction.

While PE firms boast supply chain expertise, it’s questionable whether their leadership has fully embraced the significant advancements in 3D printing technology. 3D printing is no longer limited to prototyping; it has evolved into a core production tool for major players like Baker Hughes and GE, particularly in supply chain management. Despite this, 3D printing is rarely cited by PE firms as a key strategy in their supply chain operations.

The Growing Role of 3D Printing in Dental and Orthopedic Industries

3D printing has rapidly advanced in healthcare sectors such as dental and orthopedics. Companies backed by major PE firms are already integrating 3D printing into their manufacturing processes. Here are three significant examples illustrating this trend:

Henry Schein (Backed by KKR) – Custom Dental Solutions

Henry Schein, a leading provider of healthcare solutions to dental practitioners, has integrated 3D printing extensively into its product offerings. One standout innovation is SprintRay’s Pro S 3D Printer, a device capable of printing high-precision dental models, aligners, and surgical guides. Henry Schein has distributed this technology to dental offices, allowing practices to produce same-day dental restorations, reducing costs and improving patient outcomes.

The SprintRay Pro S printer utilizes biocompatible resins tailored for dental applications, allowing for crowns, dentures, and surgical guides to be produced on-site in hours. This adoption is transforming dental supply chains by eliminating the need for third-party milling centers and lowering production costs.

BlackRock Purchases Panama Canal Ports

The Hong Kong-based conglomerate that operates ports near the Panama Canal has agreed to sell shares of its units that operate the ports to a consortium including BlackRock Inc. This deal was struck after President Trump alleged Chinese interference with the operations of the critical shipping lane.

In a March 4, 2025 press release, CK Hutchison Holding indicated that it would sell all shares in Hutchison Port Holdings and all shares in Hutchison Port Group Holdings, in a deal valued at US$22.8 billion. The two units hold 80% of the Hutchison Ports group that operates 43 ports in 23 countries, including two of the four major ports that exist along the Panama Canal. The deal will give the BlackRock consortium control over these ports in Mexico, the Netherlands, Egypt, Australia, Pakistan and elsewhere.

The consortium, comprised of BlackRock, Global Infrastructure Partners (GIP), and Terminal Investment Limited will acquire 90% interests in Panama Ports Company, which owns and operates the ports of Balboa and Cristobal in Panama. Since the purchase of the ports along the Panama Canal, BlackRock has purchased the other two members in the consortium, GIP and Terminal Investment Limited, which gives it a substantial amount of resources to manage. The control that BlackRock has over the ports now has left it well-positioned in light of the recent tariffs on foreign imports. The deal could not have come at a better time for BlackRock.

We have covered ports, cranes, marinas and other related topics on Fabbaloo before. The 3D printing industry should not overlook this opportunity to be a part of this history-making investment.

Carlyle and Acrotec: a 3D Printing Investment

Some of the PE firms do have subsidiaries that utilize 3D printing, which their other investment holdings can learn from. Carlyle has a large medical device and medtech portfolio, which is an area where 3D printing is a mainstream technology now. Carlyle owns Acrotec, a company that specializes in medtech. Acrotec is actively seeking to acquire new companies for their medtech division, particularly smaller companies with 3D printing expertise.

We have also covered Carlyle’s recent spin out of StandardAero which also utilizes 3D Printing.

Apollo and ADT Home Security

Another firm looking to acquire firms with high-tech expertise, is Apollo Global Management, a cornerstone of PE management. Apollo is gaining momentum in the offshore energy space and we have previously covered offshore drilling as well as the offshore wind turbines in Denmark, both utilizing 3D printing technology. We see this as an opportunity for Apollo to leverage 3D printing technology.

Apollo owns ADT, the large security and home technology company. Additionally, we had previously written an article about the “secretive” ADT Engineering Lab and whether it was engaged in 3D printing activities, and if not, that it should be.

After the publishing of that article we discovered that the lab is actively engaged in the 3D printing of prototypes of ADT’s future product lines. The lab conducts extensive testing on these models to determine whether they can withstand extreme weather conditions and other factors that may cause damage to the security devices.

Clayton, Dubilier & Rice (CD&R)

Taking an operational approach to PE investment, CD&R owns businesses that span a wide range of industries including healthcare, consumer brands, industrial services, among a host of others. One of the companies listed in CD&R’s portfolio is the Kalle Group. Based in Germany, the Kalle Group produces industrially produced casings for meat, poultry and other protein products. The Kalle Group is heavily invested in innovation as their research and development is fundamental to their brand.

For example, their R&D center in Vista, California has their R&D teams developing new products and processes for innovating their casings. The Kalle Group has created value-added casings that offers their customers added benefits such as smoke, color, flavor or spice transfer onto the filling thereby eliminating a number of production steps. This then provides their customers with substantial time and cost savings. As a result of their R&D, they have developed products such as NaloProSpice, NaloFerm, and Nalo Clean Label.

Tipper Tie, Inc. (now JBT Corporation) is another major company in the industry that manufactures casings. Tipper Tie uses 3D printing to produce some of its ties, which are the clips that seal off meat casings.

The Intersection of PE Firms and Healthcare 3D Printing Growth

PE firms like KKR, BlackRock, and Carlyle have invested heavily in healthcare, yet many of their portfolio companies have yet to fully explore the potential efficiencies and cost savings that 3D printing offers. As companies like Henry Schein and Materialise demonstrate, additive manufacturing is rapidly improving supply chain agility, reducing overhead, and enhancing product customization.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes are typically eligible expenses toward the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software can also be an eligible R&D expense. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Private equity firms are increasingly emphasizing digitization and AI, both of which align with emerging 3D printing trends. As PE firms pursue growth in sectors like healthcare, industrial manufacturing, and infrastructure, understanding 3D printing’s impact will be key to unlocking additional value within their portfolios. By recognizing the technology’s role in streamlining production, reducing costs, and enhancing product quality, PE firms can better position themselves to capitalize on the rapidly expanding 3D printing landscape.