Charles R. Goulding and Preeti Sulibhavi consider how Boeing’s suppliers, facing industry disruptions and potential strikes, are turning to submarines, defense, HVAC, and 3D printing to diversify and reduce dependency on the aerospace giant.

As industry disruptions continue to affect aerospace giant, Boeing, suppliers tied to their production lines are feeling the pressure. Morgan Stanley stated that two of Boeing’s Suppliers that would be adversely impacted by a long strike are, specialty materials company, Hexcel, and aviation partnership, Howmet Aerospace. Following this year’s International Tool Show in Chicago, two long-time time tier suppliers of Boeing approached us to explore alternatives. With Boeing’s ongoing challenges compounded by the potential for a prolonged strike, many of its suppliers are searching for ways to diversify their portfolios and reduce their dependence on the aerospace leader.

This article explores several potential alternatives for these suppliers, including opportunities in submarine production, the defense sector, and HVAC systems, with an added emphasis on the role that 3D printing could play in facilitating diversification and growth in each of these industries.

Challenges Facing Boeing and Tier Suppliers

Boeing, one of the largest aerospace manufacturers in the world, has encountered numerous hurdles over the past several years, ranging from production delays to safety concerns. The recent talks of a long-term strike only exacerbate the situation, putting a strain on Boeing’s supply chain. Tier suppliers—those that provide parts and services to Boeing—have been particularly vulnerable, as they often lack alternative contracts to fall back on.

For many suppliers, diversifying their customer base and entering new industries is no longer just an option—it’s a necessity. Given the uncertainty in Boeing’s production schedules and the broader challenges in the aerospace sector, these companies are now seeking opportunities in industries with more stability and growth potential. Below, we explore a few of these potential avenues.

1. Electric Boat Submarine Opportunities

One promising alternative for Boeing suppliers is to enter the submarine manufacturing sector, particularly with General Dynamics Electric Boat. Electric Boat, a major contractor for the U.S. Navy, has a robust order book and is deeply involved in producing submarines for military use. In many cases, the components required in submarine manufacturing—such as specialized materials, high-precision parts, and advanced assembly techniques—overlap with those needed in aerospace.

For example, 3D printing, which is already used in aerospace for producing lightweight, complex geometries, is also being integrated into submarine production. Electric Boat has begun using 3D printing to produce parts for nuclear submarines, reducing lead times and costs. For Tier suppliers with existing expertise in 3D printing for aerospace applications, this could provide a seamless transition into a new but familiar market.

Furthermore, Electric Boat’s reliance on advanced technology and high-quality production standards make it an ideal candidate for suppliers experienced in aerospace, which is similarly stringent in its requirements. With defense spending continuing to rise, particularly in naval defense, the submarine sector is a lucrative avenue worth exploring for Tier suppliers looking to pivot away from Boeing.

2. Defense Contractor Opportunities

As global conflicts persist, particularly in Ukraine and the Middle East, the defense industry remains strong, with increasing demand for military equipment and supplies. The United States alone recently approved a US$52 billion defense budget increase to support military aid and technological advancement for its allies. This provides ample opportunities for new entrants into the defense supply chain, but there are risks.

Suppliers must proceed cautiously when entering this highly regulated and competitive market. Defense contracts often come with strict compliance requirements and long sales cycles. However, for those willing to navigate these complexities, the rewards can be substantial.

In addition to traditional manufacturing methods, 3D printing is increasingly being adopted by defense contractors to produce everything from small replacement parts to complex weapons systems. Additive manufacturing allows for the rapid prototyping and production of customized parts, which is particularly advantageous in the defense industry, where the ability to quickly adapt to evolving needs is critical. For Boeing suppliers already equipped with 3D printing capabilities, this technology can be leveraged to meet the unique demands of the defense sector.

Moreover, 3D printing can help reduce supply chain vulnerabilities in defense contracts, as parts can be produced on-demand and closer to the point of use, thereby reducing reliance on long lead times and distant suppliers.

3. HVAC Industry and the Inflation Reduction Act

Another sector with significant growth potential is HVAC (Heating, Ventilation, and Air Conditioning), particularly in light of recent legislative changes. The Inflation Reduction Act, effective January 1, 2023, has introduced a wide range of incentives for energy-efficient building technologies, including HVAC systems. Section 179D of the Act offers building energy tax incentives, while state and local governments, as well as non-profits, can now receive substantial direct-pay cash payments for qualifying alternative energy measures.

This legislation has resulted in a surge of interest in geothermal systems, Combined Heat and Power (CHP), and Thermal Storage technologies, creating opportunities for suppliers to enter this space. While this sector may seem unrelated to aerospace at first glance, there are overlapping technologies—such as precision manufacturing and advanced materials—that can facilitate a smooth transition.

The recent Bosch – Johnson Controls product line acquisition illustrates how a German company that traditionally operates in large part within the auto industry is recognizing opportunities in the US HVAC industry.

Additionally, 3D printing is playing an increasingly important role in the HVAC industry. Custom, highly efficient HVAC components, such as heat exchangers, can be designed and produced more quickly and cost-effectively using additive manufacturing techniques. Tier suppliers that have experience with 3D printing for Boeing can easily transfer those skills to the HVAC sector, where customization and energy efficiency are key drivers of innovation.

4. Acquisitions and Market Consolidation

In addition to exploring new industries, Tier suppliers may also want to consider acquiring other companies or product lines that complement their existing capabilities. The 3D printing industry, for example, is currently undergoing a wave of consolidation, as several companies face bankruptcy or financial instability. For the right buyer, this presents an opportunity to acquire valuable intellectual property, equipment, and talent at a discount.

Acquiring a 3D printing company or a related product line could give Tier suppliers a competitive edge in both their existing and new markets. For instance, a supplier that specializes in aerospace parts could acquire a 3D printing company focused on automotive or healthcare, thereby diversifying its product offerings and reducing dependence on any one sector. However, it’s crucial to approach such acquisitions strategically—due diligence is essential to ensure that the acquisition aligns with the company’s overall goals and strengths.

In 2024, experts predict that bankruptcies in the 3D printing industry will continue to rise, providing even more opportunities for savvy investors. However, not all companies will be worth the investment, so it’s important for suppliers to thoroughly assess the long-term viability of any potential acquisition targets.

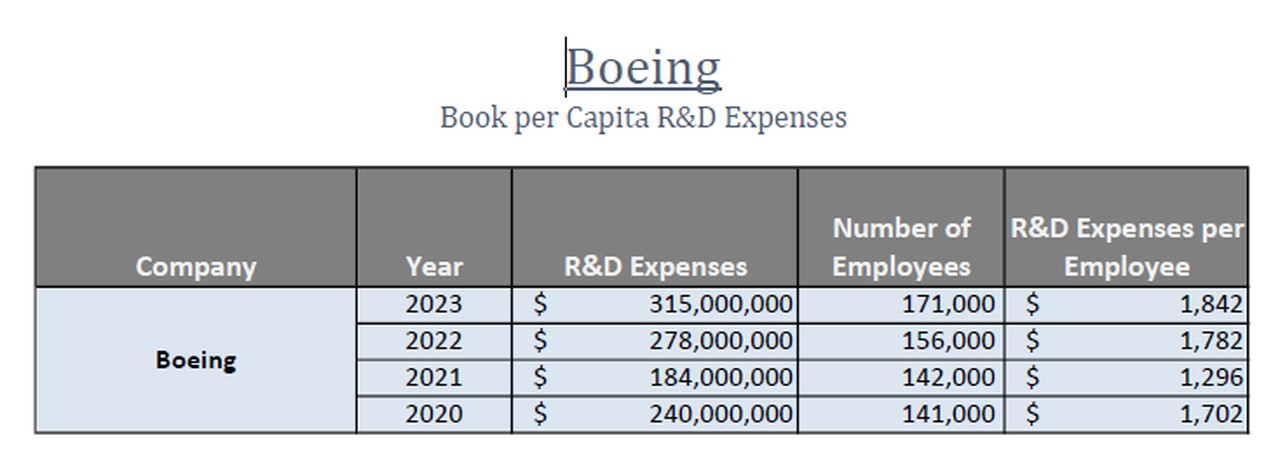

Below is a slide that presents the research and development expenses at Boeing over the past four years.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion: Finding the Right Path Forward

The challenges faced by Boeing and its Tier suppliers are significant, but they also present opportunities for growth and diversification. By exploring alternatives such as Electric Boat’s submarine production, the defense industry, and the HVAC sector, suppliers can reduce their reliance on aerospace and tap into new revenue streams.

3D printing serves as a common thread throughout these opportunities, offering suppliers a versatile and innovative technology that can be adapted to various industries. Whether producing parts for submarines, military equipment, or energy-efficient HVAC systems, additive manufacturing enables suppliers to remain agile, competitive, and ready to meet the evolving demands of the modern marketplace.

Finally, strategic acquisitions—particularly in the 3D printing sector—can further enhance a supplier’s ability to diversify and thrive. However, these decisions should be made carefully, ensuring that any new ventures align with the company’s expertise and long-term objectives.

In today’s uncertain economic environment, agility and innovation are key to survival. Boeing’s Tier suppliers have the expertise and capabilities to pivot to new markets successfully, provided they are willing to embrace change and leverage new technologies like 3D printing to their advantage.