Charles R. Goulding and Preeti Sulibhavi examine how Carlyle Group’s IPO plans for StandardAero are set to reshape the aviation MRO industry in 2024.

In 2023, Carlyle Group positioned StandardAero, one of the largest independent maintenance, repair, and overhaul (MRO) service providers for aviation, for an IPO. The potential listing of StandardAero follows Carlyle’s acquisition of the firm in 2019 for US$5 billion, and it could reach a valuation of US$10 billion. StandardAero, headquartered in Arizona, reported an impressive US$4.6 billion in sales in 2023, reflecting the strong post-pandemic recovery in the aviation sector. The company’s services focus on engine repair and overhaul, handling everything from commercial and business jets to military aircraft engines.

StandardAero’s MRO Business and Market Position

Founded in 1911 in Canada, StandardAero is one of the oldest MRO companies in existence. StandardAero has grown substantially through acquisitions, including the 2021 purchase of Signature Aviation’s Engine Repair and Overhaul (ERO) business for US$230 million, which expanded its MRO service offerings. StandardAero’s capabilities include working with Pratt & Whitney, Honeywell, and Rolls-Royce engines, among others, solidifying its position in the MRO sector. Compared to competitors like TransDigm, StandardAero is more focused on direct MRO services rather than parts manufacturing and acquisitions of proprietary aerospace technologies, which is TransDigm’s primary model. TransDigm, with around US$5.9 billion in sales in 2023, is known for acquiring businesses with proprietary products used in aerospace and defense. This difference in business models means TransDigm controls many of the high-margin aerospace parts, while StandardAero focuses on the service side, delivering critical repairs and overhauls for various aviation platforms.

Employees and Workforce

As of 2023, StandardAero employed over 6,600 people across its global operations, reflecting its significant scale within the MRO industry. These employees are spread across facilities in North America, Europe, and Asia, contributing to its diverse customer base, including private operators, airlines, and military agencies.

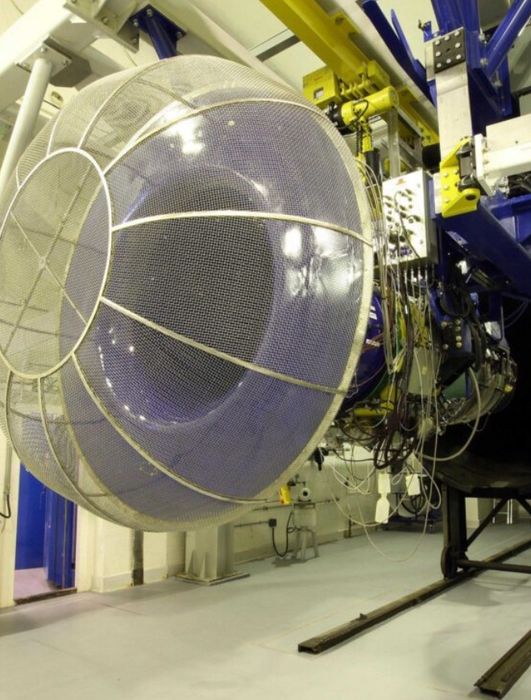

3D Printing in MRO Services

As of 2023, there is limited evidence that StandardAero is integrating 3D printing into its MRO processes on a large scale. However, the potential for 3D printing in MRO services is significant. 3D printing can be advantageous in the aerospace industry for producing hard-to-find or obsolete parts, reducing lead times, and enabling rapid prototyping. For jet engine repair, 3D printing could revolutionize the production of small, complex parts that traditionally require long lead times due to their intricate designs and the need for specialized materials like superalloys. The flexibility and efficiency of 3D printing could also help StandardAero further expand its capabilities in the high-demand aircraft parts market.

Ongoing production delays with both Airbus and Boeing should give a near-term boost to the MRO business.

TransDigm, while not solely focused on MRO services, has explored 3D printing for specialized aerospace components, setting a potential trend for companies like StandardAero to follow. The key advantage lies in reducing downtime by quickly fabricating aerospace replacement parts and lowering costs associated with traditional manufacturing processes.

Environmental and Corporate Sustainability Efforts

StandardAero has made strides toward improving sustainability, aligning with broader industry trends. Their 2024 Corporate Sustainability Report outlines key initiatives, including reducing energy consumption and investing in cleaner technologies across their facilities. This is crucial for MRO firms, which deal with hazardous materials and energy-intensive processes. By modernizing equipment and facilities, such as the ongoing US$12 million investment in its Springfield, Illinois site, StandardAero is improving its environmental footprint while meeting growing demand for MRO business in the aerospace industry.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

IPO and Future Prospects

While no IPO date has been officially announced, industry speculation points to a strong possibility in 2024. The IPO would provide Carlyle with an opportunity to capitalize on the booming demand for MRO services as air travel continues to recover post-pandemic. If StandardAero goes public, the company will likely use the capital to expand its operations, including potential further acquisitions or technological innovations, such as enhancing its 3D printing capabilities for jet engine repair.

In conclusion, StandardAero stands as a leading player in the MRO sector, benefiting from strong market demand and continuous growth. While the firm may not yet be leveraging 3D printing to its fullest potential, the technology offers a clear path for innovation in jet engine repair. The potential IPO, valued at approximately US$10 billion, marks a new chapter for the company as it looks to maintain its competitive edge against other major aerospace players like TransDigm.