Charles R. Goulding and Preeti Sulibhavi analyze Thermo Fisher’s US$3.5-$4 billion acquisition of Solventum’s filtration business, exploring its impact on the industry, competitors, and innovation in 3D printing technology.

Thermo Fisher Scientific Inc. has announced plans to acquire Solventum’s filtration business in a deal expected to be valued between US$3.5 billion and US$4 billion. This acquisition will reshape the filtration market and drive changes across related industries. The move also comes amid pressure on Solventum to streamline its operations further by separating additional business units.

Company Profiles and Financials

Thermo Fisher Scientific is headquartered in Waltham, Massachusetts, and specializes in life sciences tools and services. As of 2024, Thermo Fisher employed over 125,000 people worldwide. The company generated approximately US$40 billion in revenue that year, driven by its diverse product portfolio in research, diagnostics, and industrial markets.

Solventum is based in St. Paul, Minnesota, and was spun off from 3M in 2023 to focus on healthcare solutions. Solventum employed roughly 22,000 people in 2024 and posted annual sales exceeding US$8 billion. The company provides products in wound care, dental solutions, filtration systems, and software tools for medical environments.

Details of the Deal

The proposed US$3.5-$4 billion acquisition involves Thermo Fisher taking over Solventum’s filtration business, a key provider of industrial and healthcare filtration systems. These products are crucial for pharmaceutical manufacturing, laboratory research, and water treatment.

The acquisition aligns with Thermo Fisher’s strategy to expand its portfolio in laboratory and industrial solutions. The filtration segment’s integration is expected to enhance Thermo Fisher’s capabilities in fluid management and contamination control, critical areas in biopharmaceutical and cleanroom environments.

Impact on the Industry

Thermo Fisher’s acquisition is poised to intensify competition in the filtration market. Companies like Pall Corporation (owned by Danaher) and Sartorius, major players in bioprocess filtration, may need to adjust pricing strategies or develop new products to remain competitive. Additionally, Thermo Fisher’s enhanced filtration capabilities could drive innovation in drug manufacturing and scientific research, increasing demand for precision equipment.

The deal also signals continued consolidation in the healthcare tools and services industry, where large firms are expanding through targeted acquisitions to diversify their portfolios. This trend could drive smaller niche providers to seek partnerships or mergers to remain viable.

Activist Pressure on Solventum

On February 27, 2025, The Wall Street Journal reported that activist investors are pressuring Solventum to divest additional business segments. Investors argue that Solventum’s dental products and software businesses are non-core assets that dilute the company’s focus on healthcare solutions. Specifically, Activist investor Nelson Peltz of Trian Fund Management believes that separating these units could unlock shareholder value and better position Solventum to concentrate on its core healthcare products.

The dental business includes products like orthodontic brackets, cement, and impression materials, while the software division offers medical imaging and data management tools. The dental industry is a major market for 3D printing technology, and we have written numerous articles on the industry compatibility, such as “Exploring Formlabs’ Cutting-Edge Resins for Dental and Healthcare Applications.”

3D Printing in Divested Industries

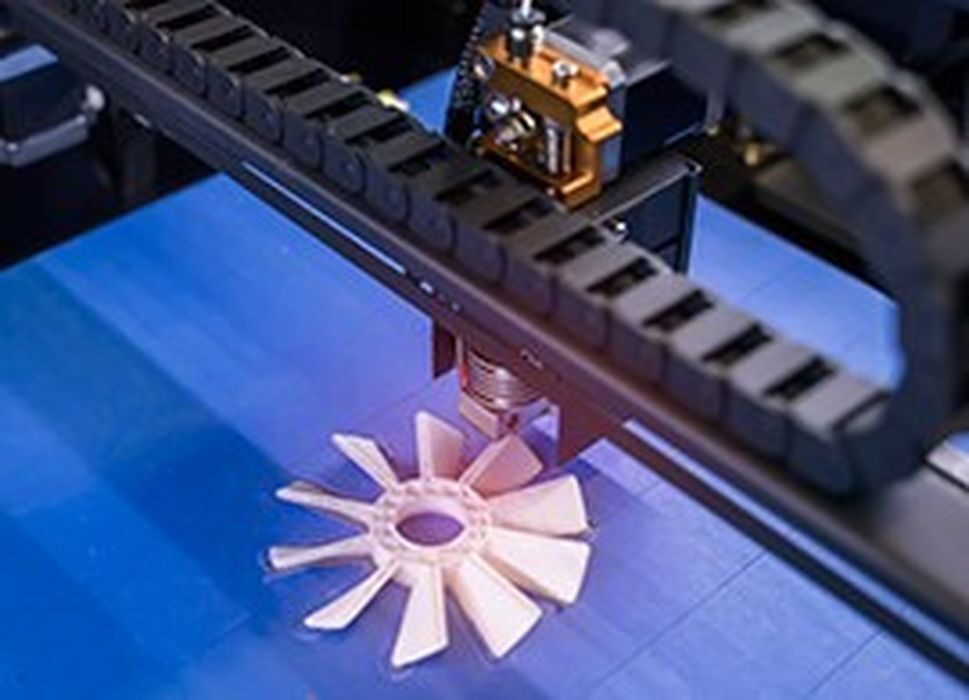

Both Thermo Fisher and Solventum’s divested businesses utilize 3D printing technology to improve product design and manufacturing. Here are five recent examples of 3D printing applications in these sectors:

- Thermo Fisher’s Custom Filtration Devices Thermo Fisher has adopted 3D printing to create custom filtration systems tailored to pharmaceutical clients. These systems feature precisely engineered flow channels and porous membranes that enhance particle capture and reduce clogging in bioprocessing environments. The company’s additive manufacturing techniques allow rapid prototyping, ensuring faster development of filtration devices with improved performance.

- Lab Consumables with Complex Geometries Thermo Fisher employs 3D printing to produce specialized lab consumables such as chromatography columns and customized pipette tips. These products require intricate internal structures that are difficult to achieve with traditional manufacturing methods. By leveraging 3D printing, Thermo Fisher enhances product consistency and optimizes fluid flow control.

- 3D Printed Dental Implants from Solventum’s Dental Business Solventum’s dental division uses 3D printing to manufacture dental implants and crowns. The technology enables personalized designs that match individual patients’ oral structures, improving comfort and integration. This method also reduces production time and material waste compared to conventional manufacturing.

- 3D Printed Surgical Guides Solventum’s software division offers surgical planning tools that incorporate 3D printed guides for complex dental and orthopedic procedures. These guides help surgeons achieve precise implant positioning and improve procedural outcomes, especially in reconstructive surgeries.

- Customized Respiratory Filtration Systems Thermo Fisher recently developed custom respiratory filtration devices using 3D printing. These devices combine intricate airflow patterns with specialized filter materials designed for hospital environments, improving infection control in critical care settings.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes are typically eligible expenses toward the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software can also be an eligible R&D expense. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Thermo Fisher’s acquisition of Solventum’s filtration business marks a significant shift in the industry landscape, enhancing Thermo Fisher’s portfolio while adding pressure on competitors. Meanwhile, activist investor demands for Solventum to further divest assets highlight the growing focus on strategic specialization in healthcare markets. Both Thermo Fisher and Solventum’s business segments increasingly rely on 3D printing technology to develop innovative solutions that improve product performance and accelerate development timelines. The integration of these advanced manufacturing techniques will likely continue shaping product innovation in the filtration, dental, and healthcare software industries.