Charles R. Goulding and Preeti Sulibhavi spotlight GE’s final spinout, Vernova, and highlight the transformative impact of 3D printing technology on various industries involved.

In a move to streamline its operations and unlock shareholder value, General Electric (GE) is nearing the completion of its final major spinout, Vernova. This latest divesture follows a series of strategic moves by the industrial conglomerate to reshape its portfolio and focus on core businesses.

Post spinout, the remaining GE parent will be renamed GE Aerospace, which is also the owner of GE’s 3D printing business segment. As covered on Fabbaloo recently, GE Aerospace has announced a significant investment in its manufacturing facilities, with an emphasis on additive manufacturing (AM). The company plans to invest nearly US$450 million in new machines, inspection equipment, building upgrades, new test cells and safety enhancements at 22 facilities across 14 states. U.S.-based suppliers will receive another US$100M, as will some of GE Aerospace’s international sites in North America, Europe and India.

As the company prepares to launch Vernova, the spotlight is also shining on the growing role of 3D printing across various industries, including those served by Vernova and its peers.

Some of the partial comparisons to the GE Vernova spinoff are Schneider, Siemens Energy, and Mitsubishi Heavy Industries. These companies are at the forefront of embracing 3D printing technology, which offers numerous advantages, such as reduced lead times, increased design flexibility, and cost savings.

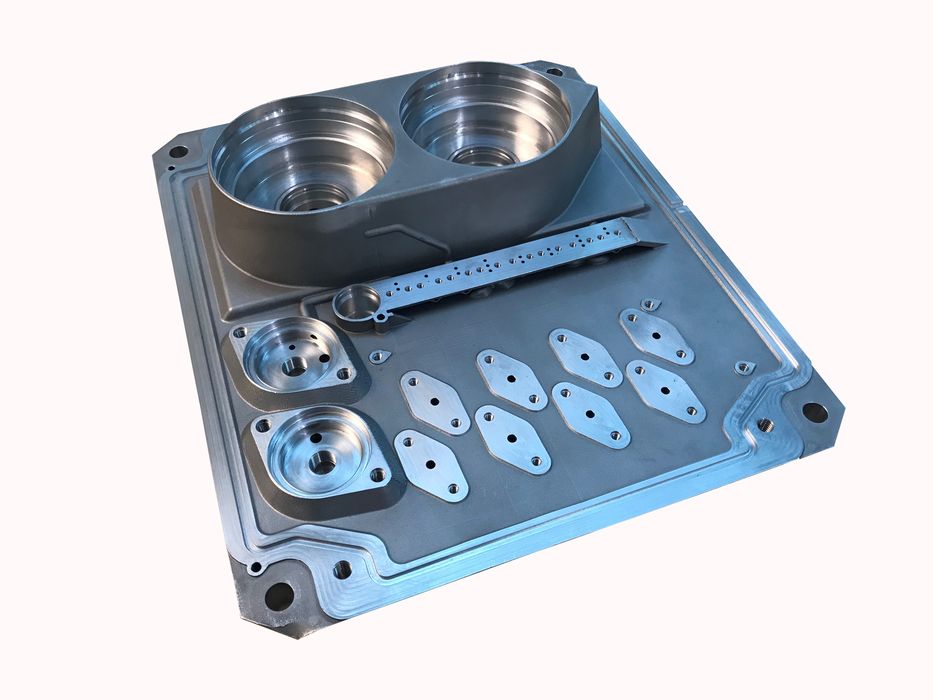

For instance, Schneider has recently utilized 3D printing to produce custom-designed heat exchangers for its industrial customers. By leveraging additive manufacturing, the company can create intricate geometries that improve heat transfer efficiency while reducing material waste and lead times.

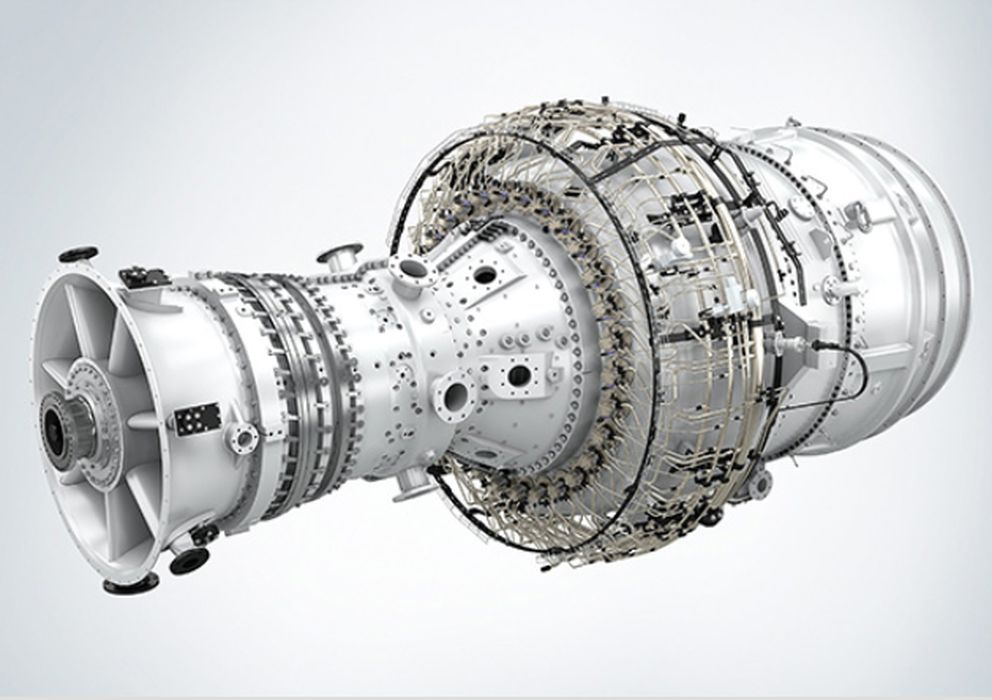

Similarly, Siemens Energy has leveraged 3D printing to manufacture intricate components for its gas turbines. In 2022, the company announced the successful testing of a 3D printed burner for its SGT-800 industrial gas turbine. This innovative approach not only reduced manufacturing costs but also improved the component’s performance and durability.

Mitsubishi Heavy Industries has also embraced 3D printing in the aerospace sector. In 2021, the company unveiled a 3D printed combustor for its Mitsubishi Regional Jet (MRJ) aircraft. This pioneering effort showcased the potential of additive manufacturing to produce complex geometries that would be challenging or impossible to achieve with traditional manufacturing methods.

GE’s recent spinoffs include GE Healthcare, a leader in medical imaging and diagnostics, and Wabtec, a prominent player in the railroad equipment industry. Both companies have also explored the integration of 3D printing into their operations.

GE Healthcare has leveraged 3D printing to produce customized medical devices and prosthetics, enabling personalized solutions for patients. Additionally, the company has utilized additive manufacturing for prototyping and testing, accelerating the development of new products.

Wabtec, on the other hand, has employed 3D printing to manufacture spare parts and components for its rail equipment. This approach has helped streamline supply chains, reduce inventory costs, and improve equipment availability by enabling on-demand production of essential components.

The GE Aerospace business, often referred to as the crown jewel of the company, boasts a massive installed base and a thriving aftermarket business. With over 40,000 existing GE engines in commercial aircraft and 26,000 in military applications, the potential for leveraging 3D printing in maintenance, repair, and overhaul (MRO) operations is significant.

One company that has successfully capitalized on the aftermarket business is TransDigm. Known for its financial acumen, TransDigm has demonstrated the value of a well-managed aftermarket strategy. As 3D printing technology continues to advance, it presents new opportunities for companies like GE Aerospace to streamline MRO processes, reduce lead times, and improve parts availability.

As GE completes the final major spinout of Vernova, the company and its peers are embracing the transformative potential of 3D printing across various industries. From custom-designed heat exchangers and aerospace components to medical devices and rail equipment, additive manufacturing is enabling greater design flexibility, cost savings, and supply chain efficiencies.

The Research & Development Tax Credit

The now permanent Research & Development Tax Credit (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits

Conclusion

Over the last five years, GE’s continuous spinoff process has been extremely successful, unlocking value for shareholders and enabling each separate company to focus on its core strengths and growth opportunities. As these newly independent entities navigate their respective markets, the expanded applications of 3D printing will undoubtedly play a crucial role in driving innovation, efficiency, and competitive advantage.