A big milestone has been achieved in the pending Desktop Metal / Nano Dimension takeover.

You may recall that some weeks ago Nano Dimension announced a deal to fully acquire Desktop Metal in a cash transaction. This happened after months of attempts by Nano Dimension to acquire Stratasys. Eventually Nano Dimension gave up on Stratays and turned to Desktop Metal.

This was quite ironic, as Desktop Metal had a prior deal to merge with Stratasys, but it was shot down by Stratasys shareholders. In a way it was inevitable that the two parties would come together.

The deal was targeted to close later this year, but there were some barriers to overcome.

One of them was the HSR waiting period. This is a requirement of the US Hart-Scott-Rodino Act of 1976, where corporate mergers must undergo a review before they can proceed. This is the stage where the US government can potentially intervene if they feel that there are antitrust concerns.

Normally this review takes around 30 days, during which the authorities might ask for a “second request” for information. It seems there was no second request here, and the waiting period has expired.

This means that the parties are free to continue with the transaction, as the government has apparently determined there are no antitrust concerns.

What does this mean? Two things.

First, the deal is almost certain to be concluded later this year. Desktop Metal will become part of Nano Dimension, making that company substantially bigger.

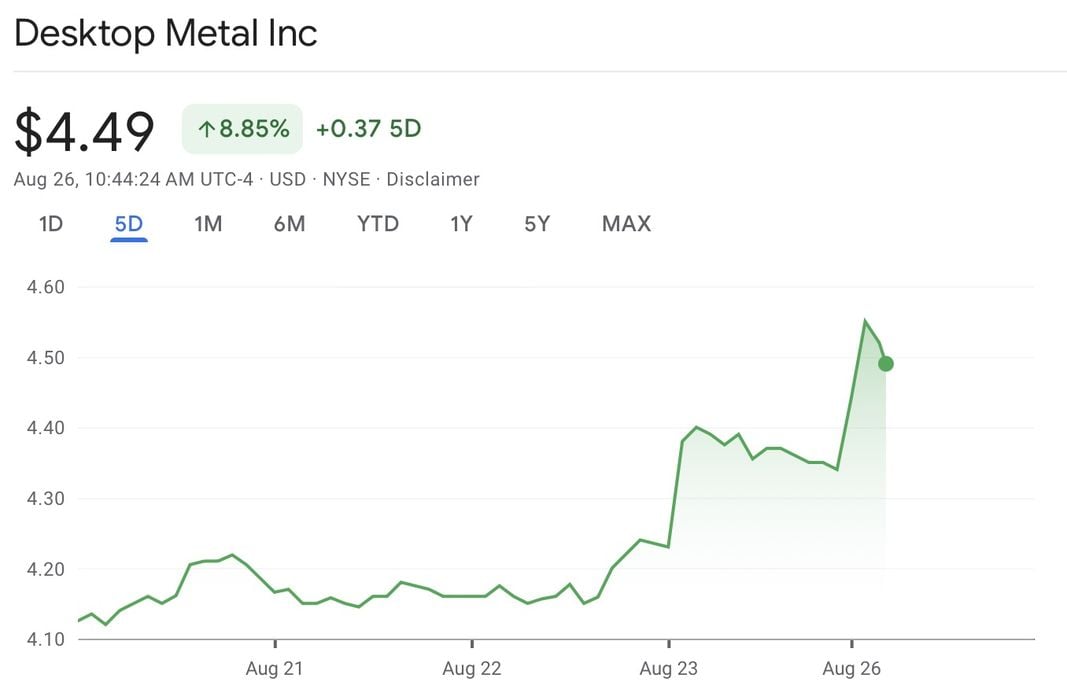

Second, Desktop Metal shareholders are happy, as the expiry has driven up the company’s share price. At top you can see a notable jump in the value.

This is important because the proposed deal has a variable price point. Nano Dimension’s statement at the time was this:

“Nano Dimension Ltd. and Desktop Metal, Inc. today jointly announced that they have entered into a definitive agreement under which Nano Dimension will acquire all outstanding shares of Desktop Metal in an all-cash transaction for $5.50 per share, subject to possible downward adjustments to $4.07 per share, as described below.”

In other words, the higher the current price of Desktop Metal shares, the higher price Nano Dimension will pay for them, topping out at US$5.50 each.

This sounds like good news for those involved in the deal, and effectively seals the fate of Desktop Metal.