Charles R. Goulding and Preeti Sulibhavi consider how KKR’s employee equity ownership model is reshaping mergers and acquisitions, with a special focus on its impact on the rapidly evolving 3D printing industry.

The employee equity ownership acquisition model is gaining considerable attention in recent years, thanks to its ability to align the interests of all parties involved in mergers and acquisitions (M&A). One of the companies leading this innovative model is KKR, a global investment firm known for its distinctive approach to acquisitions. Not only does KKR focus on maximizing value for its investors, but it also increasingly offers equity to all employees, a practice that has been transformative for various industries, particularly those relying on highly skilled technical workers.

This model has profound implications for the 3D printing industry, a sector that is experiencing rapid growth and consolidation. The 3D printing industry’s reliance on skilled workers—designers, engineers, and production specialists—creates fertile ground for the adoption of employee equity ownership. In this article, we will explore the potential for the 3D printing industry to benefit from employee equity ownership, using KKR’s acquisition strategy as a model. We will also examine a recent example of how 3D printing is being used in the pump industry, a sector in which companies like Circor have been leading the charge.

The KKR Acquisition Model: A Game Changer

KKR’s approach to acquisitions has been transformative, particularly in how it integrates employee ownership into its deals. A prime example is KKR’s $1 billion sale of GeoStabilization International (GSI), a firm specializing in infrastructure repair. What caught headlines wasn’t just the size of the deal but the fact that US$75 million of the sale proceeds went directly to employees, with payouts ranging from US$10,000 to US$325,000 each. This method of giving employees an equity stake in the company incentivizes them to contribute more actively to the company’s growth and success. It also fosters loyalty and can be a key driver in retaining skilled labor, a particularly important aspect in industries where talent is critical, like 3D printing.

Other private equity firms such as Apollo Global Management, TPG, and Silver Lake Partners have started to consider similar employee ownership structures. The model has proven to be a win-win, providing financial benefits to employees while also fostering a stronger alignment between labor and capital interests. For example, Leonard Green, the purchaser of GSI, is also structuring the deal with an employee ownership model. This model can be especially useful in industries like 3D printing, where skilled technical employees play a crucial role in driving innovation and maintaining competitiveness.

Circor and the Employee Ownership Model

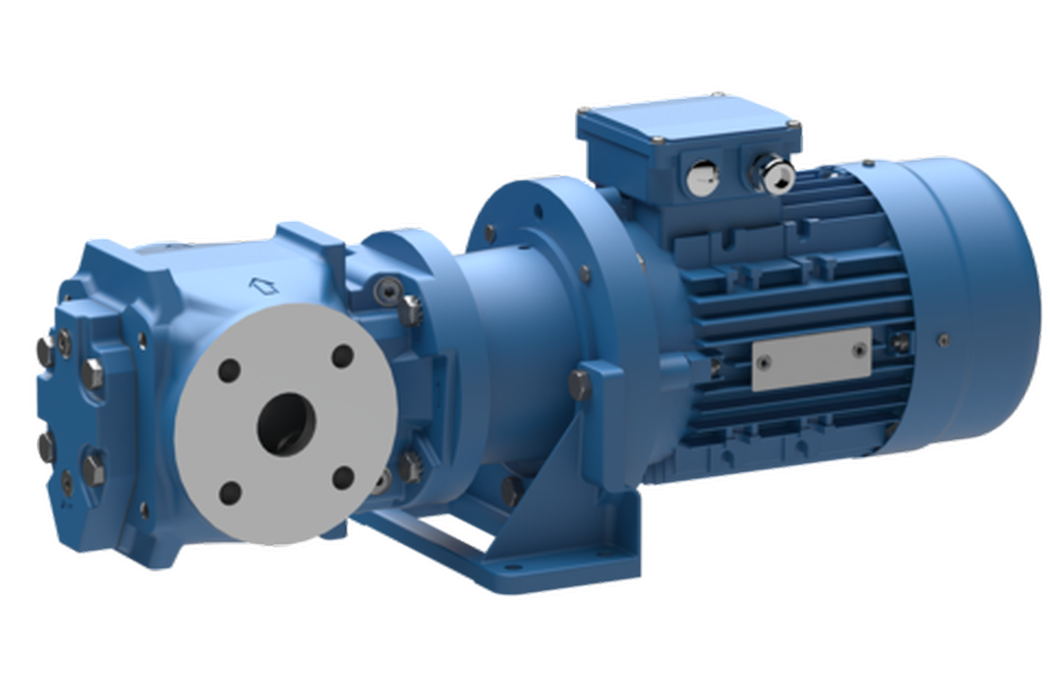

KKR’s acquisition of Circor, a leading designer and manufacturer of highly customized fluid control solutions such as pumps, demonstrates the power of this employee equity model. Acquired for US$1.6 billion in late 2023, Circor had the option to sell to a higher bidder but chose to stay with KKR, presumably due to the benefits of the employee equity model. This decision illustrates the growing importance of employee satisfaction and engagement in determining the long-term success of industrial acquisitions.

Circor’s business involves the design and manufacture of pumps, which are essential for industries like oil and gas, aerospace, and defense. Interestingly, pumps are increasingly being produced using 3D printing technology, which allows for greater customization and faster production times. The potential for integrating employee ownership models in companies like Circor is vast, especially given the specialized nature of the workforce required for 3D printing operations. By offering employees equity stakes, companies can ensure they retain the highly skilled workers essential to maintaining a competitive edge in an industry where innovation is key.

The Potential for Employee Ownership in 3D Printing

The 3D printing industry is marked by its reliance on technical expertise, whether in the design phase, production, or post-processing of parts. As the industry continues to consolidate, with larger firms acquiring smaller, more specialized companies, employee equity ownership could become a critical factor in successful mergers and acquisitions.

One of the key benefits of this model is its ability to attract and retain top talent. Skilled workers in the 3D printing industry, such as engineers, product designers, and material scientists, often seek more than just a paycheck. They are driven by the opportunity to innovate and solve complex problems. By offering these employees an ownership stake in the company, 3DP firms can create an environment where employees are financially invested in the company’s success. This could be especially valuable in an industry where turnover is high, and companies are constantly looking for ways to retain top-tier talent.

Furthermore, as 3D printing technology continues to evolve, the need for experienced workers who can manage the intricacies of production and innovation becomes increasingly important. Employee ownership can serve as a strong incentive for these workers to stay with their companies long-term, ensuring continuity and stability as new technologies are developed and integrated into existing processes.

3D Printing in the Pump Industry: Recent Examples

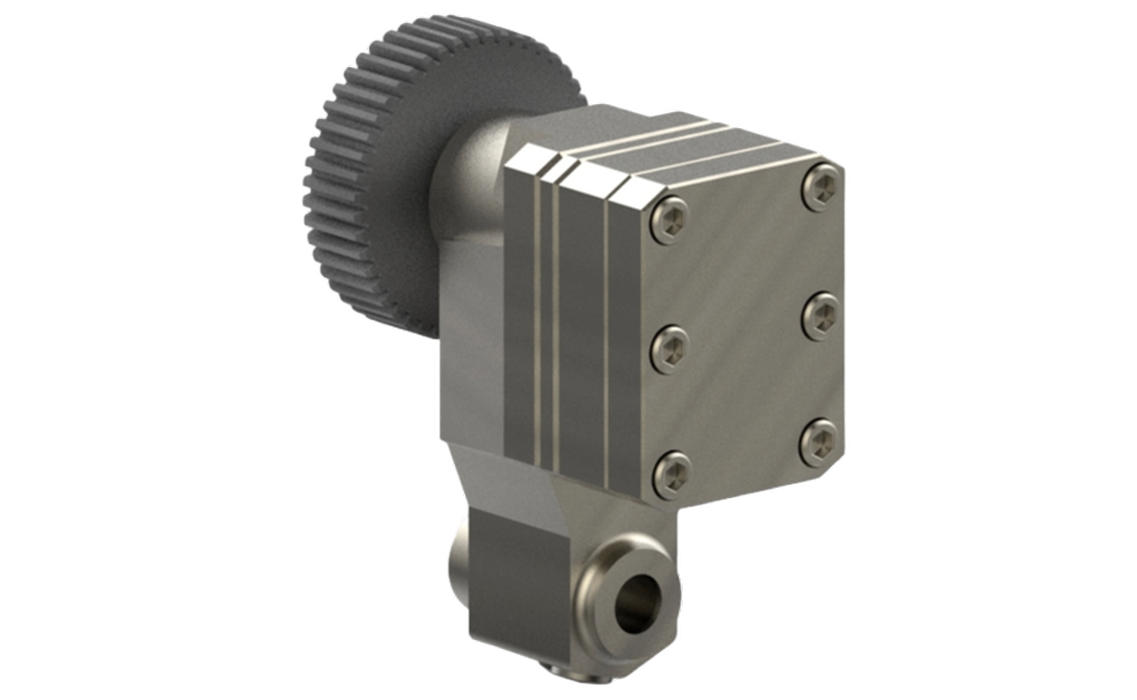

The pump industry, where Circor operates, is an excellent example of how 3D printing is revolutionizing manufacturing. Pumps are vital components in various industries, including aerospace, chemical processing, and oil and gas. They often need to be highly customized to meet specific requirements, making them ideal candidates for 3D printing. Circor recently used 3D printing to create a customized pump component.

Circor has been leveraging 3D printing to produce highly customized pump components. In 2023, the company successfully integrated additive manufacturing into its production process for certain types of specialized pumps used in aerospace and defense. This allowed Circor to reduce production times and increase the precision of its products. By using 3D printing, the company was able to prototype and iterate designs faster, ensuring that its products met the stringent requirements of its clients.

This example illustrates the significant potential for 3D printing in the pump industry. As companies like Circor continue to integrate this technology into their manufacturing processes, the role of 3D printing is likely to expand, offering new opportunities for customization, efficiency, and innovation.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion: A New Frontier for Employee Ownership and 3D Printing

As the 3D printing industry continues to grow and evolve, the employee equity ownership model has the potential to play a transformative role. By aligning the interests of employees and employers, this model can help 3D printing companies attract and retain the highly skilled workers they need to stay competitive. In an industry where innovation and technical expertise are critical, offering employees an ownership stake can be a powerful tool for fostering loyalty and driving long-term success.

Furthermore, the integration of 3D printing in industries like pump manufacturing is a clear indication of the technology’s potential. Companies that embrace both 3D printing and employee equity ownership are well-positioned to thrive in the coming years, as they leverage the best of both worlds: cutting-edge technology and a motivated, invested workforce. The future of 3DP is bright, and employee ownership could be the key to unlocking its full potential.