Charles R. Goulding and Preeti Sulibhavi illustrate how Ferguson is rapidly expanding beyond its plumbing roots, leveraging strategic acquisitions and cutting-edge 3D printing technology to revolutionize the North American HVAC market.

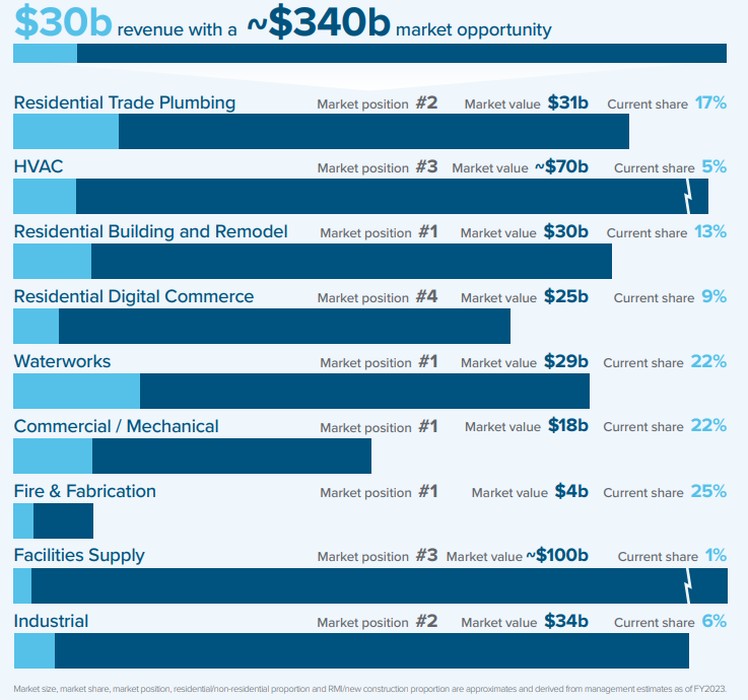

Ferguson, a leading supplier of residential plumbing products, is making significant strides to diversify and strengthen its foothold in the North American HVAC market. The company, headquartered in Newport News, Virginia, recorded nearly US$30 billion in sales in 2023, underscoring its position as a major player in the construction and home improvement industries. While traditionally known for its plumbing supplies, Ferguson has recognized the vast opportunities in adjacent sectors like HVAC (Heating, Ventilation, and Air Conditioning) and the burgeoning field of 3D printing.

This strategic expansion is not just a logical progression but also a forward-thinking move that could reshape the landscape of these industries. With the acquisition of multiple companies and the integration of new technologies, Ferguson is positioning itself to lead in areas where it sees untapped potential. This article delves into Ferguson’s recent acquisitions, its move into the HVAC industry, and its pioneering efforts in 3D printing, along with examples of how these technologies are being applied in real-world scenarios.

Ferguson’s Foray into the HVAC Industry

A Logical Extension of Existing Capabilities

The HVAC industry is a natural extension of Ferguson’s existing capabilities in plumbing and fire suppression systems. Buildings are complex structures that require seamless integration of various systems to function efficiently. Plumbing, HVAC, and fire suppression systems are interconnected and often share physical spaces within a building. Engineers use Building Information Modeling (BIM) systems to design these systems in a way that avoids conflicts and ensures optimal functionality.

Given Ferguson’s extensive experience in plumbing and fire suppression, expanding into HVAC allows the company to offer a more comprehensive solution to builders, engineers, and contractors. By providing all three essential systems, Ferguson can streamline the procurement process for its customers, reduce installation errors, and enhance overall project efficiency.

Strategic Acquisitions in HVAC

Ferguson has been aggressive in its pursuit of HVAC market share. By the end of 2023 fiscal year (which ended July 31, 2024), the company had completed ten acquisitions, many of which were focused on expanding its presence in the HVAC sector. These acquisitions are not just about increasing market share but also about acquiring expertise, technology, and new customer bases.

The chart below illustrates how Ferguson has about 17 percent market share of the US$31 billion residential plumbing industry, and only 5 percent of the US$70 billion value for the HVAC market.

Recognizing the growing importance of smart technologies in the HVAC industry, Ferguson has also made a significant acquisition of Gerster Equipment Co. In 2024, the company acquired the New York-based distributor of Trane and Mitsubishi HVAC brands to advance its dual-trade strategy by syncing HVAC and plumbing in the greater New York region. This acquisition allows Ferguson to facilitate the dual-trade contractor to conduct business with Ferguson.

One of the notable acquisitions in the HVAC space was the purchase of Grove Supply, Inc., a leading plumbing and HVAC distributor that serves the residential trade, builder and remodel markets. Grove Supply has 17 locations across Pennsylvania and New Jersey, and six of the locations include showrooms that operate as GSI Bath Showplace. This acquisition expands Ferguson’s plumbing and HVAC presence in Metro Philadelphia and will allow us to better serve local dual-trade professionals. This acquisition not only expanded Ferguson’s product offerings but also gave the company access to a well-established customer base and a strong network of distribution centers across North America.

Another significant acquisition was Yorkwest Plumbing Supply, Inc., a leading distributor of plumbing, municipal, hydronics, institutional, HVAC, and industrial products in the greater Toronto area. Each of Yorkwest’s four locations includes a kitchen and bath showroom branded as Atlantis Bath Centre. Yorkwest’s business operations will be integrated into Ferguson’s subsidiary in Canada, Wolseley Canada.

By integrating these companies into its operations, Ferguson has positioned itself as a one-stop shop for HVAC, plumbing, and fire suppression needs. This comprehensive approach is expected to resonate well with contractors and builders who prefer dealing with a single supplier for all their building system requirements.

In addition to its focus on HVAC, Ferguson has also made strategic moves in the waterworks industry. In 2024, the company acquired California-based, United Water Works, Inc., a leading distributor of piping and water, storm, and sewer products serving the Orange County and greater Los Angeles areas. This acquisition expands United Water Works’ product offering to include erosion control and stormwater management products and strengthens Ferguson’s Waterworks presence in Southern California. This acquisition significantly expanded Ferguson’s presence in the waterworks sector, allowing it to offer a broader range of products and services to municipal and commercial customers.

United Waterworks’ expertise in waterworks complements Ferguson’s existing capabilities in plumbing and fire suppression. The acquisition also aligns with Ferguson’s strategy of becoming a comprehensive supplier of building systems, offering everything from plumbing and HVAC to waterworks and fire protection under one roof.

Embracing 3D Printing Technology

The Untapped Potential in Plumbing and HVAC

While 3D printing has been making waves in various industries, the plumbing and HVAC sectors have been slower to adopt this technology. However, this is beginning to change, and Ferguson is at the forefront of this transformation. The company recognizes the potential of 3D printing to revolutionize the way components are manufactured and installed in buildings.

3D printing allows for the creation of complex components with high precision, reducing waste and shortening production times. In the context of plumbing and HVAC, 3D printing can be used to produce custom parts that are tailored to specific building designs, ensuring a perfect fit and reducing the need for modifications on-site.

Ferguson has already started exploring and implementing 3D printing in various aspects of its operations. One of the most promising applications is in the production of custom pipe fittings. Traditionally, pipe fittings come in standard sizes and shapes, which can sometimes require adjustments on-site to fit the unique layout of a building. With 3D printing, Ferguson can create custom fittings that match the exact specifications of a project, reducing installation time and minimizing the risk of leaks or other issues.

Another area where Ferguson is leveraging 3D printing is in the production of HVAC duct components. HVAC systems often require ducts to be installed in tight or oddly-shaped spaces. By using 3D printing, Ferguson can produce ducts with complex geometries that would be difficult or impossible to manufacture using traditional methods. This not only improves the efficiency of the HVAC system but also reduces the amount of material needed, leading to cost savings and environmental benefits.

In addition to these examples, Ferguson is also exploring the use of 3D printing for custom valve components. Valves are critical components in both plumbing and HVAC systems, and having the ability to produce custom valves on-demand can significantly reduce lead times and improve system performance. For example, Ferguson could use 3D printing to produce valves with specific flow characteristics tailored to a particular building’s needs, enhancing the overall efficiency of the system.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

Ferguson’s strategic expansion into the HVAC industry and its embrace of 3D printing technology are clear indicators of the company’s forward-thinking approach. By acquiring leading companies in HVAC, waterworks, and smart building technologies, Ferguson is positioning itself as a comprehensive supplier of building systems. These moves are not just about increasing market share but also about driving innovation and efficiency in the construction industry.

The adoption of 3D printing, in particular, has the potential to revolutionize the way plumbing and HVAC systems are designed and installed. With the ability to produce custom components on demand, Ferguson is leading the charge in bringing this cutting-edge technology to the forefront of the industry. As the company continues to integrate its acquisitions and explore new technologies, it is well-positioned to remain a dominant force in the construction and home improvement markets for years to come.