Charles R. Goulding and Preeti Sulibhavi explore how Stanley Black & Decker and other manufacturers can leverage 3D printing to cut costs, streamline supply chains, and capitalize on R&D Tax Credits amid tariff challenges.

With the backdrop of potential import tariffs under new presidential policies, companies across industries are strategically planning to mitigate the financial impact of these changes. As seen with Steve Madden and Nike, many businesses reliant on imports, particularly from China, are exploring alternatives to reduce tariff exposure. One of the most promising avenues for this shift is 3D printing, which presents unique benefits for companies facing tariffs on imported goods. 3D printing offers solutions to mitigate tariff costs, examining key examples to highlight real-world applications.

The Case for 3D Printing as a Tariff Strategy

3D printing, or additive manufacturing, has rapidly advanced over recent years, making it a viable alternative to traditional manufacturing and an appealing strategy for tariff planning. By manufacturing products or components domestically, companies can reduce dependency on imports and eliminate the risk of high tariffs. Industries most vulnerable to tariffs, such as tools, machinery, and automotive parts, are particularly well-positioned to benefit from 3D printing.

How Tariffs and Divergence Issues Drive Demand for 3D Printing

As companies plan for potential tariff changes, they are examining both current import volumes and alternative sourcing strategies. Many businesses consider re-sourcing from countries like Mexico, Vietnam, or India; however, merely shifting production to other nations may not solve the problem. The U.S. closely monitors imports for “divergence,” where products are only nominally processed in a secondary country before being shipped to the U.S. If companies merely transfer operations to countries with limited manufacturing infrastructure, the U.S. government may still classify these imports as Chinese, subjecting them to high tariffs.

In contrast, by leveraging 3D printing for domestic production, companies can avoid divergence issues altogether. Printing products or components within U.S. borders eliminates import requirements, helping firms retain control over production, reduce lead times, and minimize tariff impact.

Stanley Black & Decker

Stanley Black & Decker’s CEO has already commented that increased China tariffs present a business challenge, which may result in higher prices for consumers.

Donald Allan, Jr., CEO of Stanley Black & Decker, said on an October 29, 2024, earnings call that his company has been planning for the possibility of higher tariffs since the spring. He stressed there are still a lot of unknowns, but his company was unlikely to move more manufacturing jobs into the United States because “it’s just not cost-effective to do.”

“What we don’t know is which scenario is going to play out and exactly how that would be. Is it going to be just China? Is it going to be every country?” Allan asked. “Those are all things that are to be determined.”

Stanley has a long-standing involvement with 3D printing and should be positioned to leverage that expertise into more US substitution for China or any overseas production.

Stanley Black & Decker has actively invested in additive manufacturing, leveraging 3D printing for rapid prototyping and to produce parts with complex geometries that would otherwise be costly or impossible to manufacture traditionally. By localizing production, Stanley Black & Decker reduces import volumes and mitigates tariff exposure, setting a model that other tool companies can follow.

Estimates show that a 60 percent China tariff rate could cost Stanley Black & Decker US$200 million per year. It would make sense for Stanley Black & Decker to invest more in 3D printing.

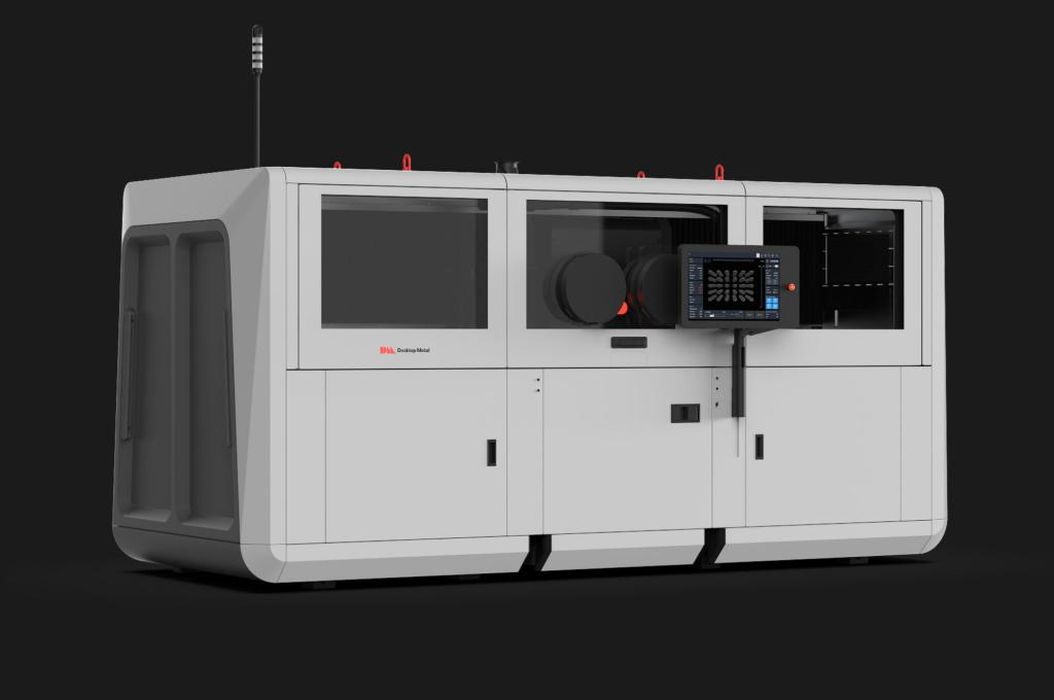

A few years ago, Stanley Black & Decker was named the first company to install Desktop Metal’s Production System P-50 metal 3D printer and its production platform applications. Among the materials to be qualified for the P-50 printer are 316L stainless steel, 420 stainless steel, nickel alloy IN625, D2 tool steel, and HH stainless steel, while aluminum 6061 is being developed in partnership with Uniformity Labs. This development is still in its early stages.

Milwaukee Tool

Milwaukee Tool is well-known in the tool industry for its innovative product line and is now exploring the benefits of 3D printing.

1. Rapid Prototyping for Product Development

Milwaukee Tool produces a wide array of tools with varying specifications, often designed in response to consumer feedback or industry trends. Traditionally, prototyping requires expensive molds and a long lead time, especially when sourced from overseas. By integrating 3D printing into its design process, Milwaukee Tool can rapidly prototype new tool designs in-house, drastically reducing both time and cost.

For example, if Milwaukee Tool is developing a new line of cordless drills, it can use 3D printing to quickly produce prototypes and make iterative adjustments based on testing results. The flexibility to modify designs on demand accelerates innovation and allows the company to respond more swiftly to market demands. Ultimately, this domestic prototyping approach minimizes dependency on Chinese suppliers, reducing import costs and tariff exposure.

2. On-Demand Production of Replacement Parts

Milwaukee Tool offers lifetime warranties on many of its products, committing to provide replacements for defective or worn parts. Sourcing replacement parts from overseas suppliers often results in delays and increases expenses, particularly with tariffs in place. With 3D printing, Milwaukee Tool can shift to an on-demand production model for replacement parts.

Imagine a common scenario where customers need replacement handles, housing cases, or internal components for drills or saws. Instead of stocking these parts in large quantities or importing them, Milwaukee Tool can print parts as needed, saving on both storage and import costs. This flexibility is beneficial for supporting long-term products with varying part requirements. Furthermore, printing replacement parts domestically strengthens customer service by enabling Milwaukee Tool to quickly respond to customer needs without long shipping delays.

The Allure of 3D Printing for Other Industries: Polaris

Outside of the tool industry, other manufacturers reliant on imported components, such as Polaris, an all-terrain vehicle manufacturer, are exploring 3D printing applications. Polaris, which spends approximately US$100 million annually on Chinese parts, could potentially print a portion of these components domestically, such as custom brackets, housings, or fixtures used in its vehicle assembly. Producing these parts in the U.S. would not only reduce tariffs but also streamline Polaris’ supply chain, cutting down on production time and shipping costs.

How Companies Can Access Import Data for Strategic Planning

Effective tariff planning involves detailed import data analysis to pinpoint the products and components most vulnerable to tariffs. Several data services provide trade/import information, which can be invaluable to 3D printing sales and marketing teams. With this data, 3D printing companies can approach large importers with targeted proposals for reducing costs through domestic additive manufacturing.

Companies could analyze their top imported components from China, identify items feasible for 3D printing, and gradually shift production of these parts to domestic facilities. This would not only align with tariff planning but also provide greater control over quality and lead times.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes are typically eligible expenses toward the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software can also be an eligible R&D expense. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion: Tariff Planning as an Opportunity for 3D Printing

As companies brace for potential tariff hikes, 3D printing presents a strategic opportunity to reduce costs, bring manufacturing in-house, and streamline supply chains. Stanley Black & Decker and Milwaukee Tool’s implementation of 3D printing for prototyping, on-demand replacement parts, and customized accessories is just one example of how additive manufacturing can transform tariff planning strategies. For companies in industries heavily reliant on imports, the shift to domestic 3D printing is an investment not only in tariff mitigation but also in resilience against global supply chain disruptions.

With technology advancing rapidly, now is the time for companies to assess 3D printing as a viable solution for tariff challenges.