Charles R. Goulding and Andressa Bonafe explore how 3D printing is reshaping the logistics industry by enabling localized production, creating new supply chain opportunities, and optimizing last-mile delivery.

As 3D printing creates more localized manufacturing processes, the logistics industry will undoubtedly face disruptions to existing supply chains. While current lanes and models may need to be reconfigured, new opportunities will arise for the distribution of materials and equipment. In this context, logistics companies must be attuned to the ongoing changes caused by more widespread adoption of 3D printing, particularly potential new partners and rising markets, such as additive manufacturing providers.

Experts see a range of potential impacts of 3D printing on logistics. In certain markets, growing demand for customized products should be accompanied by a decrease in the offshoring of mass production. Consequently, efforts that are currently geared towards long-distance shipping would be replaced by a focus on “last-mile” shipping. Possibly the most challenging aspect in logistics and supply chain management, the “last mile” refers to the final stretch of a product’s journey, “the movement of goods from a transportation hub to their final destination”. The lack of control, consistency, and scale that characterize this crucial final leg of the logistics process creates considerable hurdles. The last mile is often the least efficient one, marked by high transportation costs, traffic congestion, long delivery times, and environmental concerns.

Researchers at Cardiff University have studied the impact of additive manufacturing on city logistics, arguing that we could soon see a replacement of multi-echelon transportation hubs with integrated city logistics and 3D printing manufacturing hubs. They argue that integrated 3D printing production and transportation planning can benefit both customers and suppliers. Using the case study of healthcare product distribution, they propose an algorithm that illustrates how to maintain high 3D printer usage rates while optimizing van utilization. Combined 3D printing logistics facilities could help companies overcome the challenges of the “last mile” while taking advantage of the growing demand for customization.

Major Logistics Players’ Views on 3D Printing

Top logistics companies are turning to additive manufacturing in an effort to remain competitive. The following sections illustrate this trend with the cases of DHL, Maersk, and UPS.

DHL

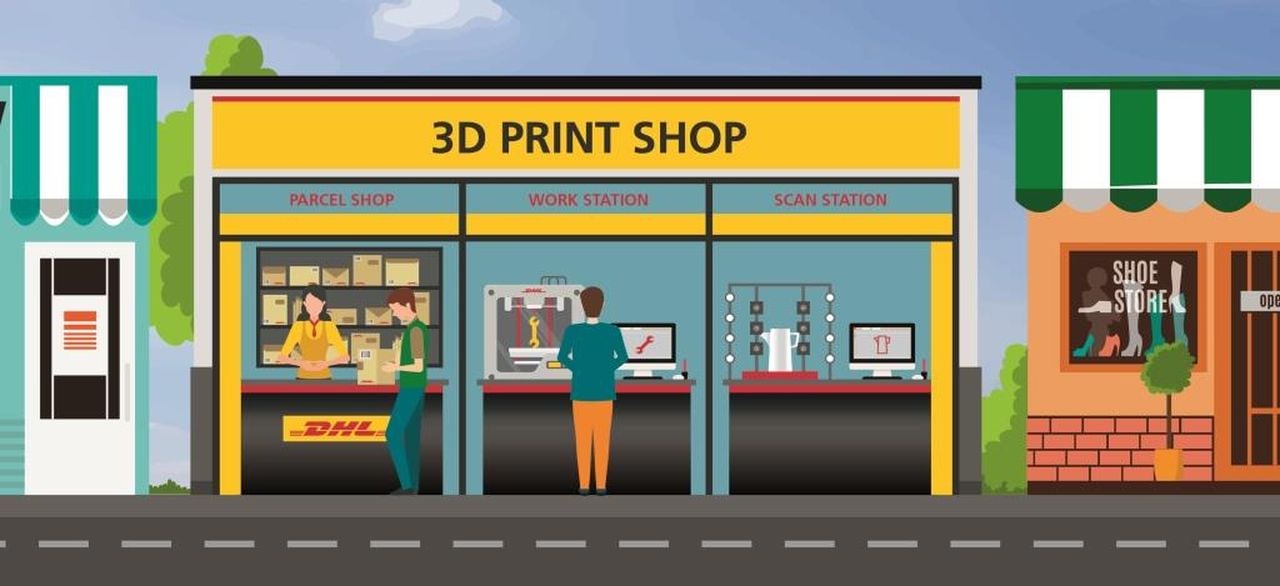

DHL’s Trend Radar points out how 3D printing has become a widely applicable technology that should continue to grow in adoption. The German logistics leader argues that this trend brings considerable opportunities, including the “growth in the scale and complexity of regional logistics networks capable of supporting print production and of business-to-business (B2B) printing services and delivery.” Referring to mass personalization and customization made possible by 3D printing, DHL reiterates the need for strong, agile, and efficient supply chain networks. The company further points out how logistics companies can take advantage of decentralized production by building servicing capabilities – “for example, partnering with local 3D printing services or producing spare parts in-house, and [using] its supply chain network to deliver parts on time.”

Maersk

In an article entitled “What to expect in 2024 – 5 trends in supply chain visibility”, Danish integrated logistics company Maersk emphasizes the importance of higher customization and discusses how 3D printing will allow conventional manufacturing systems to meet the growing demand for customized products. Additive manufacturing will be key to overcoming new challenges for organizations and their logistics, as brands strive to “produce on-demand goods, in smaller quantities, and most importantly locally”.

Active in shipping, port operation, supply chain management, and warehousing, Maersk is present in more than 130 countries and has a team of over 110,000 employees as of 2023. The company has been using 3D printing for a few years, in an effort to increase efficiency and cut costs in areas such as maintenance and procurement. In 2014, an editorial post highlighted how “3D printing could be set to revolutionize the supply chain in Maersk Tankers”. On-board additive manufacture was expected to help overcome the logistical difficulties of getting spare parts to the vessels, which are further complicated by their on-spot-trade nature and the consequent lack of predictable schedules.

More recently, the Danish shipping giant has sought to strengthen its position as a global logistics integrator by opening a 14,000-square-meter fulfillment center in Funza, Colombia, and a 3,500-square-meter facility in Panama. A greater presence in Latin America offers enhanced connectivity to customers and simplifies their supply chains. Maersk focuses on offering high-value-added solutions, including warehouse management systems and cross-docking.

UPS

Present in over 200 countries and territories, UPS began operations over 110 years ago. Faced with myriad challenges ranging from supply chain disruptions to changing consumer behaviors, the world’s largest package delivery company will cut 12,000 jobs in 2024, an effort to save nearly $1 billion. In this context, one could expect an enhanced focus on 3D printing as a value-added service offering. Throughout the country, numerous UPS locations already offer 3D printing capabilities, along with 3D CAD and 3D scanning services. Some of these locations also offer Netfabb software for 3D print file preparation and customization. For industrial customers, the company has partnered with Fast Radius, provider of comprehensive additive manufacturing solutions. Utilizing its global distribution center in Louisville, KY, the company offers automated 3D printing with direct digital manufacturing at industrial-scale volume and next-day shipping.

The Research & Development Tax Credit

The now permanent Research and Development (R&D) Tax Credit is available for companies developing new or improved products, processes and/or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Conclusion

3D printing promises to bring many changes to the logistics industry, many of which are already underway. Customization and localized production will shorten supply chains, transforming the demand for transportation. Logistics companies should implement strategies that integrate additive manufacturing as a value-added service and a means to increase efficiency in “last-mile” shipping. R&D tax credits are available to support innovative logistics players as they reinvent themselves with 3D printing.