Charles R. Goulding and Preeti Sulibhavi reveal how CORE Industrial Partners’ broad investment strategy is shaping the future of industrial technology.

When we hear about private equity firm CORE Industrial Partners in the 3D printing space, it’s usually in the context of their investments in digital manufacturing service providers like FATHOM and UPTIVE. However, a deeper look at CORE’s portfolio reveals that they are much more than just a 3D printing-focused firm. Though additive manufacturing investments make up a significant portion of their activity, CORE has demonstrated an ability to identify value across a diverse range of industrial companies.

This strategy has proven successful, as evidenced by CORE’s recent closure of $887 million in new capital commitments, far surpassing their initial targets. The raise included US$685 million for CORE Industrial Partners Fund III to continue their core strategy of acquiring manufacturing and industrial technology companies. It also marked the launch of a new US$202 million Industrial Services Fund targeting the high-growth industrial services sector.

Below is a table of some companies in CORE’s portfolio:

| Partner Companies | Industry or Type of Product/Service |

| UPTIVE | 3D printing and/or AM |

| 3DXTECH | 3D printing and/or AM |

| Saylite | LED & traditional lighting |

| Kelvix | LED lighting |

| Cadrex Manufacturing Solutions | Production parts & assemblies for manufacturing |

| FATHOM | Digital manufacturing including CNC & Industry 4.0 |

| GEM Manufacturing | Precision metal components & assemblies |

| Incodema | Precision machining & metal cutting |

| Prototek | CNC machined & fabricated parts |

| MedLit Solutions | Pharmaceutical packaging & printing services |

| Century Box | Packaging solutions |

| Cohere Beauty | Hair & skin care manufacturer |

| J&K Ingredients | Food & beverage (baked goods) |

| Aviation Concepts | Aviation industry parts & components |

It is apparent that CORE’s diversified portfolio of companies covers a range of industries that include 3D printing but also lighting, aerospace/defense and pharmaceutical solutions where 3D printing is commonly used.

The flexibility in CORE’s investment mandate allows them to capitalize on distressed assets across components of the industrial ecosystem, not just 3D printing. While 3D printing is a prevalent technology, CORE’s portfolio shows they dig deeper to find long-term value.

Recent innovations showcase CORE’s range of 3D printing investments:

FATHOM

Under CORE’s guidance following their SPAC struggles, FATHOM brought on technology leader Ryan Martin as CEO and focused efforts on high-value production applications (Martin has since left the company). This includes innovating to 3D print novel ways to integrate electronics, as showcased with their partnership to embed heating elements in a boot dryer device.

UPTIVE

The private digital manufacturing bureau formed by CORE has expanded services through the acquisition of specialty service providers like precision CNC shop AGM Turbine Components. This allows them to offer hybrid subtractive and additive solutions tailored to client needs.

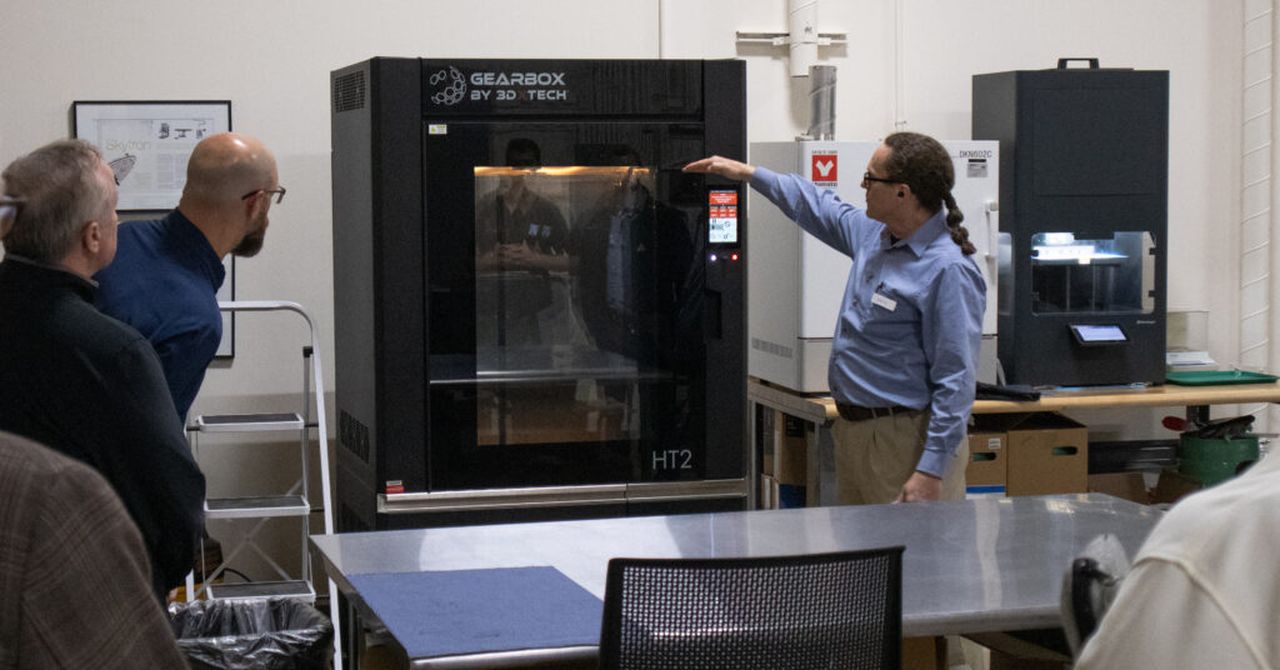

3DXTECH

In addition to digital services, CORE maintains holdings across the AM product ecosystem. Their 3D printer and materials manufacturer 3DXTECH continues enhancing systems, as shown through new partnerships to develop sintering furnaces and collaborate on novel powder-bed fusion alloys.

However, a broad look at CORE’s other recent acquisitions shows their scope extends far beyond 3D printing:

Bachman Machine Company

A specialty manufacturer of tight-tolerance parts for aerospace and defense applications using conventional subtractive methods like CNC machining and turning.

United Performance Metals

A metal service center providing custom coil processing and slitting for industrial original equipment manufacturers. Services include annealing, leveling, and edging of various metal coils.

Composite Resources

Produces highly engineered molded fiber components for major OEM manufacturers in diverse transportation markets including aerospace interiors, construction machinery, and agriculture.

The Research & Development Tax Credit

The now permanent Research & Development Tax Credit (R&D) Tax Credit is available for companies developing new or improved products, processes and/ or software.

3D printing can help boost a company’s R&D Tax Credits. Wages for technical employees creating, testing and revising 3D printed prototypes can be included as a percentage of eligible time spent for the R&D Tax Credit. Similarly, when used as a method of improving a process, time spent integrating 3D printing hardware and software counts as an eligible activity. Lastly, when used for modeling and preproduction, the costs of filaments consumed during the development process may also be recovered.

Whether it is used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit-eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits

Conclusion

These companies exemplify the diversity of CORE’s approach in targeting undervalued industrial companies. Their flexibility to respond to market dynamics and capitalize on distressed assets makes CORE an important firm to watch. While 3D printing investments feature prominently today, we may continue to see this PE group lead consolidation and evolution across tangential segments of the manufacturing ecosystem moving forward.