CONTEXT issued a report on 3D printer sales for the second quarter of 2024, and there are some surprising results.

The company uses its connections to obtain data about company sales, both public and private companies. This is then analyzed to determine trends, which is what we’re looking at today.

CONTEXT divides up the additive manufacturing sales world into several categories. At a high level we have polymer industrial systems, metal industrial systems, midrange systems, professional systems, and entry-level systems. These categories are defined by material type and price range. Entry level, for example, is defined at any system priced below US$2500.

They saw a dramatic decline in sales of industrial polymer systems: 36% as compared to 2Q23. Most of this decline was focused on vat polymerization systems (SLA and similar), which fell almost by half. The explanation seems to be inflation, which has caused a decrease in cosmetic dental work, resulting in fewer sales for 3D Systems’ biggest client. This is very likely one of the reasons 3D Systems’ valuation has been suppressed recently in our weekly leaderboard.

Metal industrial systems were more or less flat, indicating continued use by major manufacturers. This is unsurprising given the massive effort required to certify procedures to print production metal parts. If you’re going through that process, you’re going to make the parts.

CONTEXT reports that midrange and professional systems were also slightly down over the prior quarter. However, the results would have been even worse if it hadn’t been for Formlabs’ increased sales of their Form 4 technology. Evidently many of their customers are upgrading to make use of the more effective new technology.

What’s quite surprising is the boom in entry-level systems, with sales up 65% over 2Q23, and 34% higher than 1Q24. That’s explosive growth, and is likely due to recent breakthroughs in machine ease of use, reliability and quality. More buyers are willing to use better equipment, and that should be a strong signal to entry-level 3D printer manufacturers that have not yet taken up that strategy.

CONTEXT reports on some specific entry-level manufacturers: Creality was up 64%, and Bambu Lab grew an incredible 336%, year over year.

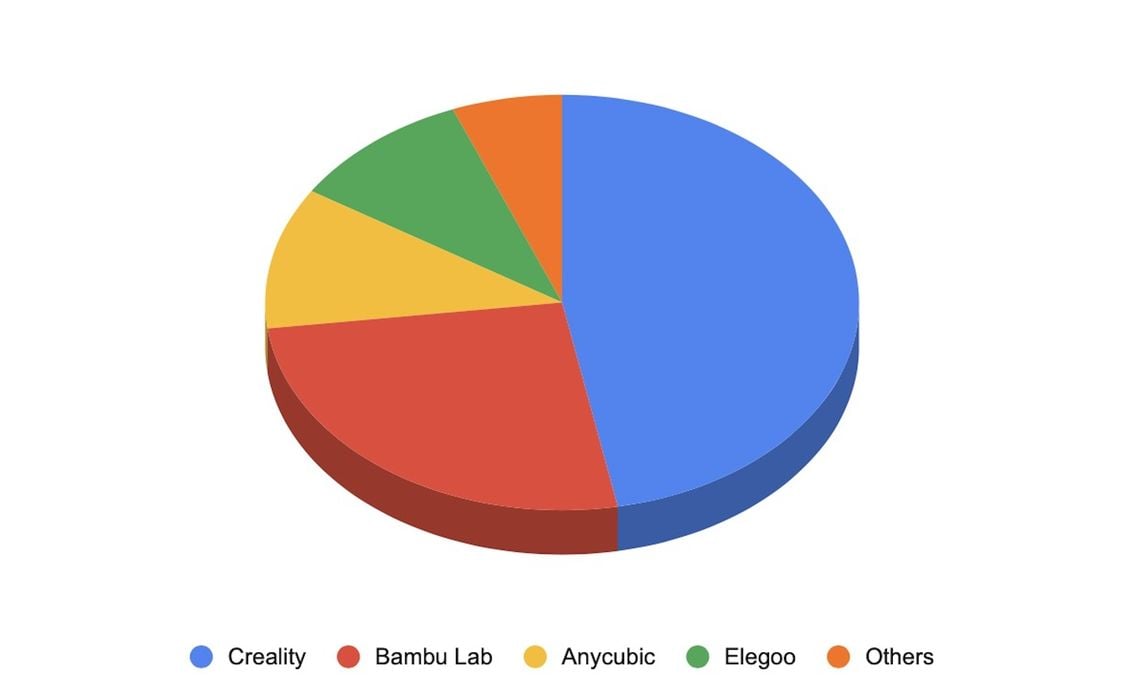

CONTEXT has calculated the market share of the entry level providers, and found the following:

- Creality: 47% revenue share of all printers in this class in 2Q24

- Bambu Lab: 26%

That’s 73% of all desktop 3D printers! Hold on, there’s more. CONTEXT wrote:

“A total of 94% of shipments in this sub-$2,500 category were from the top 4 vendors – Creality, Bambu Lab, Anycubic and Elegoo.”

This means that Elegoo and Anycubic together represent 21% of the entire market share, perhaps around ten percent each.

This also means that all of the remaining entry-level 3D printer manufacturers are squeezed into the final six percent.

That must include Prusa Research, which might be as high as four percent. That implies that Creality is now literally 10X the size of Prusa Research, and that the new Prusa MK4S may not be selling as well as believed. This may explain why Prusa Research has been increasingly focused on professional equipment, such as their XL and high temperature systems.

Via CONTEXT