Charles R. Goulding and Preeti Sulibhavi consider the use of 3D printing to compete with Amazon’s growth in India.

To many, it is not immediately obvious why Amazon would open its largest office building in the world in Hyderabad, India. The building colossus can accommodate up to 15,000 employees, has 49 elevators, a helipad and is Amazon’s first wholly-owned building outside of the United States. But why has Amazon made India its largest operating base outside the US?

What might help answer this question is that Amazon is not the only tech giant residing in Hyderabad. Microsoft and Ikea’s first Indian stores are in fact Amazon’s neighbors. Hyderabad, a cosmopolitan, bustling metropolis, is known to many US companies as a software tech talent center.

But Amazon is not investing billions of US dollars to recruit talent alone. Amazon has observed that the country has over 600 million internet users who are becoming as savvy at shopping for household items and groceries as they are at coding software. Amazon has identified a demand for its products that can potentially grow at an astounding rate.

Articles have been written describing the behemoth nature of the building size – 1.8 million square feet – and about how Amazon has been weaving itself into the fabric of Indian life. But this gigantic Amazon office campus in Hyderabad has not come without some opposition.

Small business owners in various marketplaces throughout Hyderabad and independent vendors on other Indian e-commerce marketplaces are suffering great losses, as their customers are lured to the deep discounts and effortless shopping experience that Amazon offers. Amazon’s opposition claims that the tech giant may be profiting off certain business loopholes. The story is akin to the time when American tech giants were squeezing out small businesses here in the US, not too long ago.

The “Tech-Vantage”

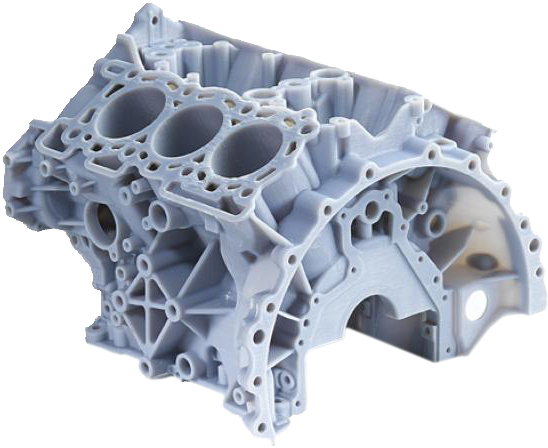

In order to solve one problem, Amazon may have to fix another. This is where 3D printing can help provide a “tech-vantage” to smaller Indian manufacturers who do find a way to compete with the Goliaths on Amazon’s selling platform. Small to mid-size Indian manufacturers can utilize 3D printing technologies to create their products at lower cost, higher speed, and more versatility.

While the initial investment in a 3D printer may be a large sum for a mom-and-pop Indian shop, it will not come without rewards. 3D printers can take design to product in a fraction of the time traditional manufacturing processes require and can produce to scale. In addition to providing smaller Indian vendors with a selling platform on its website, Amazon could provide discounts for 3D printed, Indian-made products bought and sold on its Indian site.

Examples of some 3D printing companies already establishing themselves in Hyderabad include:

Research & Development tax credits are available for the eligible US-based, 3D printing activities that Amazon engages in.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

Sometimes you have to see something to believe it. The Amazon office campus in Hyderabad is one of those things. The new, ultra-modern, cement-and-steel structure sits amidst centuries-old stone temples and marble mosques. But the Amazon Hyderabad campus is, in a way, also a symbol of belief. Amazon believes it can do well in India. Amazon can also do well for India, if it provides discounts to homegrown vendors that incorporate advanced technologies, such as 3D printing, into their production processes. If technology is leveraged, this can be a “win-win-win,” for Amazon, the Indian people and 3D printing.