Charles R. Goulding and Preeti Sulibhavi consider how 3D printing might benefit from consolidation trends among marinas.

The continuing consolidation of the U.S. marina industry and new boat rental platforms are developments that should benefit 3D printing for boating. Marina consolidation, which began in 2015, continues today. Marinas participating in consolidations and/or acquisitions are large-scale portfolio holdings. Those not considering marina consolidations and/or acquisitions are smaller-scale facilities, individually-owned and operated that have decided not to entertain offers at this time or are being passed down through family generations. Either way many believe that we may be nearing the end of such marina market transactions.

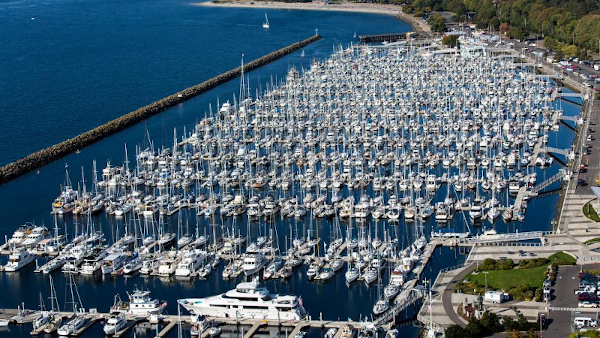

Boat owners are sophisticated customers and they desire high-quality marinas with specific amenities including well-maintained piers and slips, excellent repair facilities, good dining facilities, and overall great service. The top states for marinas are Florida, Texas, California, North Carolina, and New York. North Carolina is #4 because of coastal boating as well as inland rivers and lakes; New York at #5, not only because of its proximity to the Atlantic Ocean but also because of its more than 7,500 lakes, ponds, and reservoirs and over 50,000 miles of rivers and streams.

The New Boat Rental Platforms

Marina observers are often astonished by the large number of expensive boats that are seemingly rarely used and just sit virtually all season at marinas. Similar to the residential real estate market pre-Airbnb, these are wasted assets waiting to be enjoyed if only the right platform existed.

In June 2020, GetMyBoat, which operates like an Airbnb for watercraft, reported 350% annual growth. This increase was observed while only about half of its 9,300 locations are open for business. Additionally, Boatsetter, a rental site with locations in 600 destinations globally, has enjoyed record bookings- more this year than any since its inception in 2012, according to Jaclyn Baumgarten, CEO and co-founder.

The 3D Printing Opportunity

Boatbuilding is in large part a cottage industry and every marina is full of a wide range of boat makes and models with an ever wider range of parts and components to boot. Many of the original boat builders are no longer in business or no longer support older models. Marina facilities themselves require constant repair and renovation. The marine environment shortens the service life of all components and boats have numerous ready wear parts.

We have previously written about the types of boat components suitable for 3D printing practices. Marina consolidation allows 3D printing assets to be leveraged across a much larger volume of boatyards, boats, and marina facilities.

Innovation related to 3D printing applications for marina facilities and boats may be eligible for R&D tax credits.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Still Not Shore?

Marina consolidation and new boat rental platforms are two current trends. Combine these two trends with improved 3D printing capabilities and there should be some new business opportunities waiting, and the rest is smooth sailing.