Charles R. Goulding and Preeti Sulibhavi examine the coming together of 3D printing and wind power.

The wind power industry has remained remarkably resilient during the pandemic. Some of the factors supporting this continued growth are:

- The ability to continue construction projects

- Institutional purchasers such as governments and large corporations committed to sustainability

- Wind industry consolidation

- Competitive end-user pricing compared to fossil fuel costs

- Recognition that with the sudden reduced fossil fuel consumption the air is much cleaner

Ørsted, the Danish leader in energy, is shifting from oil and gas to developing wind farms. In 2017, it divested its oil and gas assets and changed its name to Ørsted (after Hans Christian Ørsted, one of Denmark’s most renowned scientific innovators) from its previous name of Dansk Olie og Naturgas (DONG), meaning Danish Oil and Natural Gas. In fact, it is quickly becoming the largest developer of wind farms and is partway through a $30 billion investment plan to move away from fossil fuels to become one of the few future renewables major. About 50.1% of the company is owned by the Danish state.

The Danish Technological Institute is collaborating with the DTU Mechanical Engineering to create digital tools to help control the production of 3D printed metal parts, focusing on selective laser melting (SLM).

These 3D printed metal parts are first digitally visualized, computer-simulated, then printed on a metal substrate for a non-thermal variable, more homogenous metal part. This is where DTU Mechanical Engineering, the Danish Technological Institute, and Ørsted can come together to advance wind energy technology.

3D printing has taken notice of this to some extent. Vestas has made a 3D printed wind turbine clamp, printed by Avid Product Development using BASF TPU and HP Multi Jet Fusion technology.

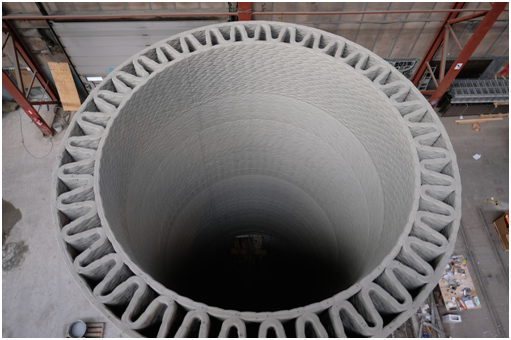

In fact, 3D printing companies are considering factors that many might overlook, such as designing and producing the turbine bases to be functional as well as transportable. It makes sense. You can’t utilize a great wind turbine base unless you can transport it to the desired location first. Designing the wind turbine parts for the unique needs and resources of a particular location is also another factor that is being considered.

Henrik Lund-Nielsen, Founder of COBOD International, strongly believes that “with our groundbreaking 3D printing technology combined with the competence and resources of our partners, we are convinced that this disruptive move within the wind turbines industry will help drive lower costs and faster execution times, to benefit customers and lower the carbon footprint from the production of energy.”

US-based activities associated with 3D printed wind turbine parts are eligible for US Federal Research and Development tax benefits.

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

It is a good sign that the wind industry had held its own during the pandemic. This bodes well for the long-term viability of the wind industry and the expanding 3D printing contribution. Let’s hope that the 3D printing community can come together with the wind-powered energy industry while we enter this new era of renewable energy.