Charles R. Goulding and Preeti Sulibhavi think that as we emerge from the global coronavirus pandemic, companies should consider emerging with a newer, cleaner balance sheet — with the help of 3D printing.

Many companies already have business losses and in most cases will be better off increasing those losses now as they prepare for the future. All physical asset removals will free-up facility space for required social distancing. Note that for tax purposes asset write-offs require physical disposal.

Here are some write-off ideas:

1. Replace standard machinery and equipment with robots and other automated technologies.

2. Dispose of all obsolete machines. Some companies keep unnecessary equipment “just in case.” However, with social distancing requirements, the increased special requirements take precedent over “just-in-case” obsolete equipment. Social distancing standards will also support “lean” initiatives.

3. Make your slow-moving parts in-house. With 3D printing, a slow-moving part can be acquired whenever needed. It is quick, easy, and results in quality replacement parts.

4. Reduce major city office leasehold assets. Many companies are shrinking their major city physical presence as their employees migrate to other areas or take to working remotely.

5. Replace old HVAC systems and equipment. Many companies are upgrading their HVAC systems, including air handling and filters to improve ventilation and filtration for COVID-19 spread prevention purposes.

6. Upgrade used kitchen equipment. With so many restaurants going out of business, superior used kitchen equipment that has often been renovated with 3D printed parts can replace existing equipment.

7. Redirect trade show display assets. If remote selling and online retail are working for your organization, then space-consuming trade show booth assets may no longer be necessary.

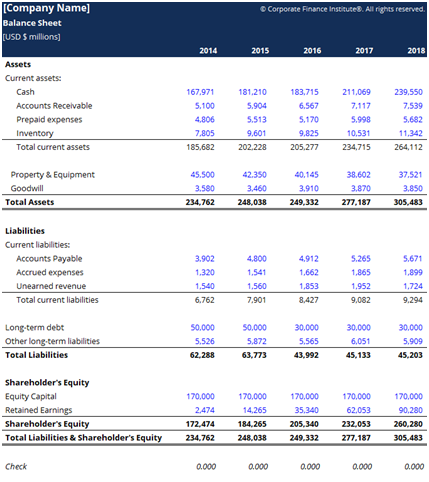

Balance sheet example template [Source: CFI]

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology and investing in similar operational process improvements strategies at any point should consider taking advantage of the Research and Development Tax Credit.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

What Hangs in the Balance…

Many businesses hold on to unnecessary and outdated assets due to inertia. Now for both financial and safety reasons, companies should take action and cleanse their balance sheets.