Charles R. Goulding and Andressa Bonafé consider the positive economic impact of 3D printing that can carry on after the COVID-19 pandemic.

As businesses consider how to survive, and thrive, in the post-novel coronavirus world, additive manufacturing stands out as a source of optimism. In a recent Financial Times article, Wolfgang Münchau sheds light on the way forward, especially as 3D printing relates to new supply chains, robotics, and productivity.

The ongoing pandemic has made evident the vulnerability of supply chains. Efforts to increase robustness and automation have become urgent and a shift towards more local sources is already underway. Recent changes exemplify this phenomenon, including restrictions on telecomm and electrical grid equipment, semiconductors, and life-supporting drugs.

This scenario may be just what was needed to bring additive manufacturing to its full potential. According to the recently published “State of 3D Printing 2020 Report” by Sculpteo, a growing number of businesses are considering the application of 3D printing to end production rather than just prototypes. In fact, 52% of participants reported that they already do so.

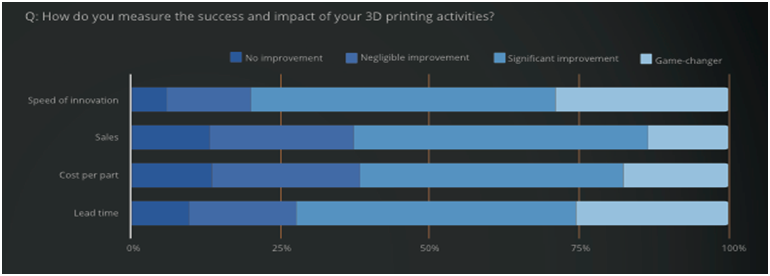

In addition to helping create a more localized production that is better prepared for crises, 3D printing brings a boost in productivity that will be crucial for post-coronavirus competitivity. Sculpteo’s survey highlights that 63% of respondents see a significant or game-changing impact of additive manufacturing on their sales and nearly 60% consider it as one of their strengths relative to their competitors. The reduction of lead time and speed of innovation were mentioned as especially important contributions of 3D printing technology.

The competitive advantage created by 3D printing can be further intensified when combined with other technologies, such as robotics. In the new world of social distancing, where workers must be separated by 6 feet, collaborative robots emerge as a productivity-enhancing alternative to crowded plant floors.

In Mr. Münchau’s words:

“Right now, many people see the lockdown as an unavoidable economic calamity. These are the dark days of the crisis. But we might find out later that the experience may have triggered a large scale technological shift (…). A positive technology shock would constitute a truly rational reason for optimism.”

The Research and Development Tax Credit

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit can be used to offset Alternative Minimum tax for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.