3D print service Sculpteo today released the results of their latest comprehensive annual survey of 3D printing use worldwide.

Sculpteo State of 3D Printing

The company, now part of the BASF family, has been doing these surveys each year for the past six years. This year’s survey is by far the largest in terms of respondents, as over 1,600 people provided data from worldwide locations. Sculpteo says the respondents consisted of 62% with engineering backgrounds, while 22% of respondents were CEOs. Over 60% of respondents had at least three years of experience in the field.

Formally entitled “The State of 3D Printing By Sculpteo, 2020 Edition”, the report is over 20 pages of charts and insights. I reviewed a pre-release version of the document and noted several interesting findings.

3D Printing Application Trends

In the question asking for the purpose of 3D printing, there were a couple of interesting insights. While “Prototyping” remains the number one application, as it has been for decades, “Production” is now at 48%, not too far behind. It’s possible at some point production may overtake prototyping, and that’s the first time I’ve seen evidence this may actually happen.

An ominous category also appeared on the purpose chart: “Mass Production”. This, I presume, means high unit volume 3D printing, something that many thought might never be possible only a few years ago. Now this appears on the chart with a competent total of 13%. With new 3D printing technologies on the move, expect this percentage to continue to rise and perhaps even take the top spot in several years.

It seems that most respondents tend to use external services for their 3D printing needs, with the exception of “Plastics”. Perhaps this is because the process of 3D printing other materials is often considerably challenging, in particular metal 3D printing. Or it might be because many of the respondents are Sculpteo users who by nature would use services.

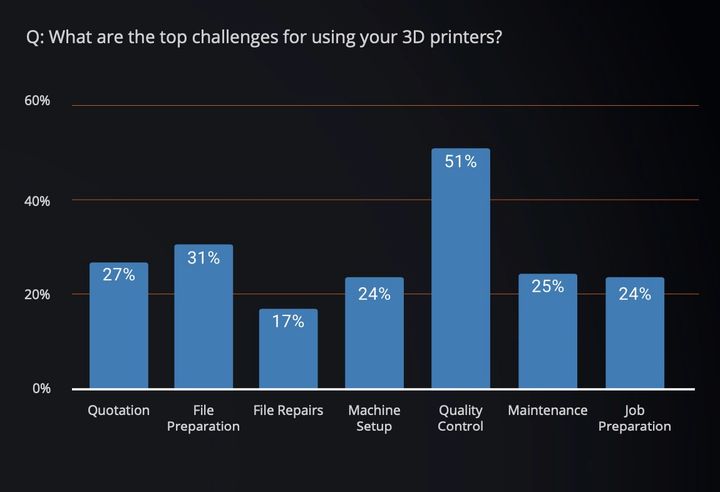

The top challenge for respondents by a wide margin is “Quality Control”, with over 50% citing this as the “main issue”. “File Preparation” was a distant second at only 31%.

This is quite an interesting finding, as it suggests 3D printer manufacturers should consider increasingly QC mechanisms on their devices, and in particular offer better-tuned software and print parameters using some new approaches.

3D Printing Post-Processing Trends

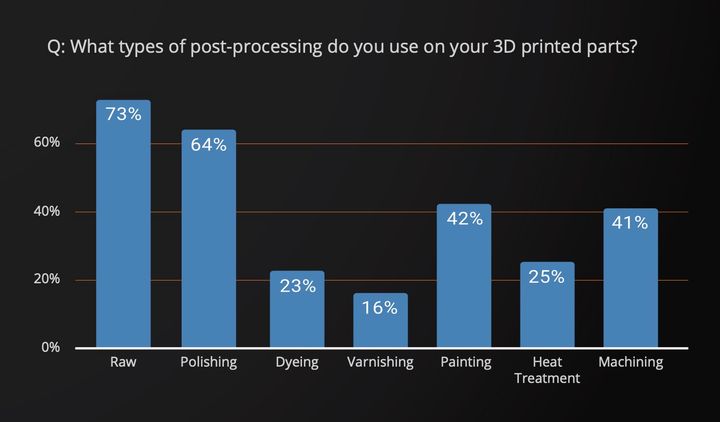

While some 73% of respondents use their 3D prints “Raw”, as in “not post-processed”, a wide variety of post-processing techniques are used, with polishing being the most frequently encountered. This makes sense, as that was the “original” finishing technique to overcome unsightly layer lines. However, painting, at 42%, seems quite a bit higher than I would have imagined.

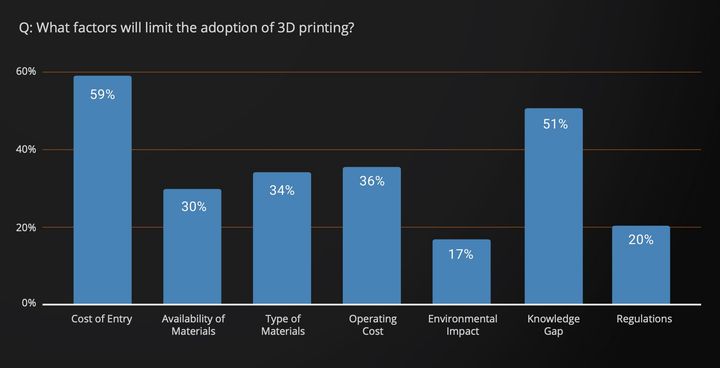

Adoption of 3D printing has always been a challenge, but here we have 59% of respondents saying it’s due to “Cost of Entry”. This is not surprising, as that is likely the “total cost”. While the cost of machines has been dropping and quality improving, the other factors, such as design, post-processing and complex job preparation are labor-intensive and must contribute to this viewpoint.

The message here to vendors and entrepreneurs is to continue to develop products and services to simplify the process of using 3D printing in an end-to-end sense, rather than just tweaking the machine print speeds.

Belief in 3D Printing

I’m pleased to see that only 4% of respondents now say 3D printing is “A Novelty”. Also, only 1% of respondents said “I think it’s a strategic mistake for us to use 3D printing”.

While these seem like outlandish statements today (and they are), I recall years ago being at trade shows where engineers would repeatedly say such things. Nevertheless, 8% of non-North America / Europe respondents DO think 3D printing is a fad.

Those days are now gone forever.

Important Factors in 3D Printing

For some reason respondents now say “Machine Capabilities” are more important than “Material Supply & Costs”. For a long time material costs were the number one complaint in surveys I’ve seen. However, this is not the case here. Could this be because users have increasingly found profitable ways to 3D print objects even with pricey materials? However, 54% say the biggest barrier to expanding 3D printing within their company is “Budget”.

A very surprising 47% of respondents wanted more “Sustainable Materials / Technologies”. This underscores something I wrote about recently where I’ve seen increasing evidence of both interest in and production of sustainable solutions. As we proceed deeper into the 21st century, this number is likely to increase strongly — another message to manufacturers.

One item seemed rather low to me: only 3% say 3D printing is used to “Improve Spare Parts Management”. This represents the concept of “Digital Inventory”, which I believe could be a massive business case for certain companies. Expect this number to increase, and for manufacturers, this could be a way to jump ahead of the competition.

I’ll stop here, but there are many more fascinating insights available in this long-anticipated report. You can obtain a copy at no charge from Sculpteo, and I encourage you to do so.