Charles R. Goulding and Adam Friedman examine where 3D printing might fit into a new acquisition.

2020 has been a record year for semiconductor merger transactions. We have recently covered NVIDIA’s purchase of Arm Holdings for $40 Billion and Analog Device’s purchase of Maxim Integrated for $20.9 Billion and both transactions’ impacts on 3D printing in particular.

As of October 2020, Advanced Micro Devices (AMD) CEO Lisa Su made the acquisition announcement and stated: “Our acquisition of Xilinx marks the next leg in our journey to establish AMD as the industry’s high-performance computing leader and partner of choice for the largest and most important technology companies in the world“.

These three acquisitions created three United States powerhouse semiconductor manufacturers that will help secure America’s leading global position in semiconductors.

Advanced Micro Devices has entered the 3D printing market on what can be considered a beta scale, meaning that the development of 3D printing technologies is nascent and has a high potential for greater usage and coverage. A recent market 3D printing project example by AMD was giving gamers and PC builders guide documentation on how to 3D print the casing for the R9 Fury X graphics card. The official webpage is located here. This plays well for the AMD-Xilinx merger because Xilinx is a company that provides extensive coverage of do-it-yourself (DIY) computer building and PC networking 3D printing.

The real promise for AMD in the 3D printing space is not as practical or as expected. As written and highlighted by the design firm BRPH, AMD could contribute to 3D printing by making 3D printed models that could then be used for such designs as digital projection mapping. 3D modeled and 3D printed parts can be utilized by AMD’s technologies and create visuals that would be unable to be rendered without a high level of processing for 3D printing. For firms like BRPH, AMD’s design and modeling make all the difference for creating custom displays that are virtualized and projected from augmented reality (AR).

Xilinx is buttressing their new AMD merged company as a research and development powerhouse.

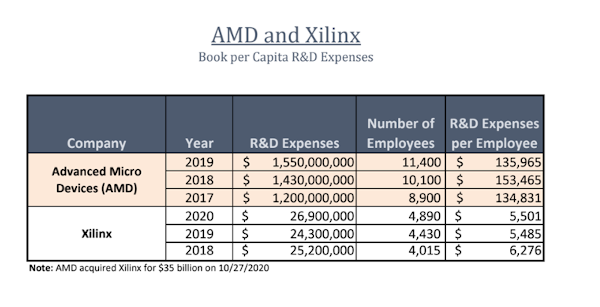

Xilinx prides itself on being the company responsible for the invention of the field-programmable gate array (FPGA). Given the long time development of FPGAs and its centralization in most, if not all, prototyping of computer chips, it’s a winner-take-all move with this merger. AMD continuously creates faster and faster computer chips, adhering to Moore’s Law and any corollaries of Moore’s Law in the chip market. Xilinx will also be merging with a company in Advanced Micro Devices that has a high R&D expense per employee. This will not increase the total R&D expenses for Xilinx but will also have them incorporate more research and development to employee workflow. Below is a table that represents the R&D expenditures by both firms in recent years:

The Research and Development Tax Credit

Whether it’s used for creating and testing prototypes or for final production, 3D printing is a great indicator that R&D Credit eligible activities are taking place. Companies implementing this technology at any point should consider taking advantage of R&D Tax Credits.

Enacted in 1981, the now permanent Federal Research and Development (R&D) Tax Credit allows a credit that typically ranges from 4%-7% of eligible spending for new and improved products and processes. Qualified research must meet the following four criteria:

- Must be technological in nature

- Must be a component of the taxpayer’s business

- Must represent R&D in the experimental sense and generally includes all such costs related to the development or improvement of a product or process

- Must eliminate uncertainty through a process of experimentation that considers one or more alternatives

Eligible costs include US employee wages, cost of supplies consumed in the R&D process, cost of pre-production testing, US contract research expenses, and certain costs associated with developing a patent.

On December 18, 2015, President Obama signed the PATH Act, making the R&D Tax Credit permanent. Beginning in 2016, the R&D credit has been used to offset Alternative Minimum Tax (AMT) for companies with revenue below $50MM and, startup businesses can obtain up to $250,000 per year in payroll tax cash rebates.

Conclusion

The merger between AMD and Xilinx is a powerhouse move that scales up the technologies both AMD and Xilinx manufacture. 3D printing will be strengthened by this merger and a prediction is that designing chips for next-generation modeling and design will influence both existing and new AMD-Xilinx technology.