![Stratasys’ booth drew crowds throughout formnext 2018 [Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/image-asset_img_5eb0a2653b1a7.jpg)

Stratasys had a lot to show at formnext 2018 as company execs answered a lot of questions — and raised even more.

A crowded press conference provided a look into announcements on both the polymer and metal sides of the latest from the 3D printing industry mainstay, with input from Andy Middleton, Executive Vice President; Andreas Langford, President, EMEA; Zehavit Reisin, Vice President and Head of Solutions and Materials Business; and Rafie Grinvald, Director of Product Marketing and Management. The next day, I caught up at the Stratasys booth with Pat Carey, Senior Vice President, Sales, to go a bit deeper.

“Stratasys sees opportunities and challenges in 3D printing,” Middleton began pragmatically, noting that the company has been seeing its 11,000 industrial customers in Europe move from prototyping toward “real manufacturing” solutions. “There’s a lot more great brainpower outside Stratasys than inside, and looking at the numbers, we can see that additive will find its place in the manufacturing world just as it has in the prototyping world.”

![Andy Middleton discusses challenges in 3D printing for manufacturing [Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/IMG_20181113_161201_img_5eb0a265d1e65.jpg)

To reach fuller adoption in the manufacturing workflow, Middleton pointed to five elements that need to be developed to a high level:

-

Applications and materials control

-

Cost competitiveness

-

High throughput and short time-to-part

-

Strict quality and control

-

24/7 service and connectivity

“If as a company Stratasys can have those, we will have a high impact on growth and adoption,” he added. “There’s resistance to change if the effort is too high.”

It was here that the event’s announcements swung to center stage. Discussing two new technologies, Middleton pointed to expansion beyond Stratasys’ trademark FDM 3D printing with LPM (Layered Powder Metallurgy, the long-promised in-house-developed metal 3D printing technology) and High Speed Sintering (HSS, in partnership with Xaar) on the plastics side.

![Stratasys’ portfolio includes FDM, LPM, and HSS 3D printing [Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/IMG_20181113_161709_img_5eb0a26657f0b.jpg)

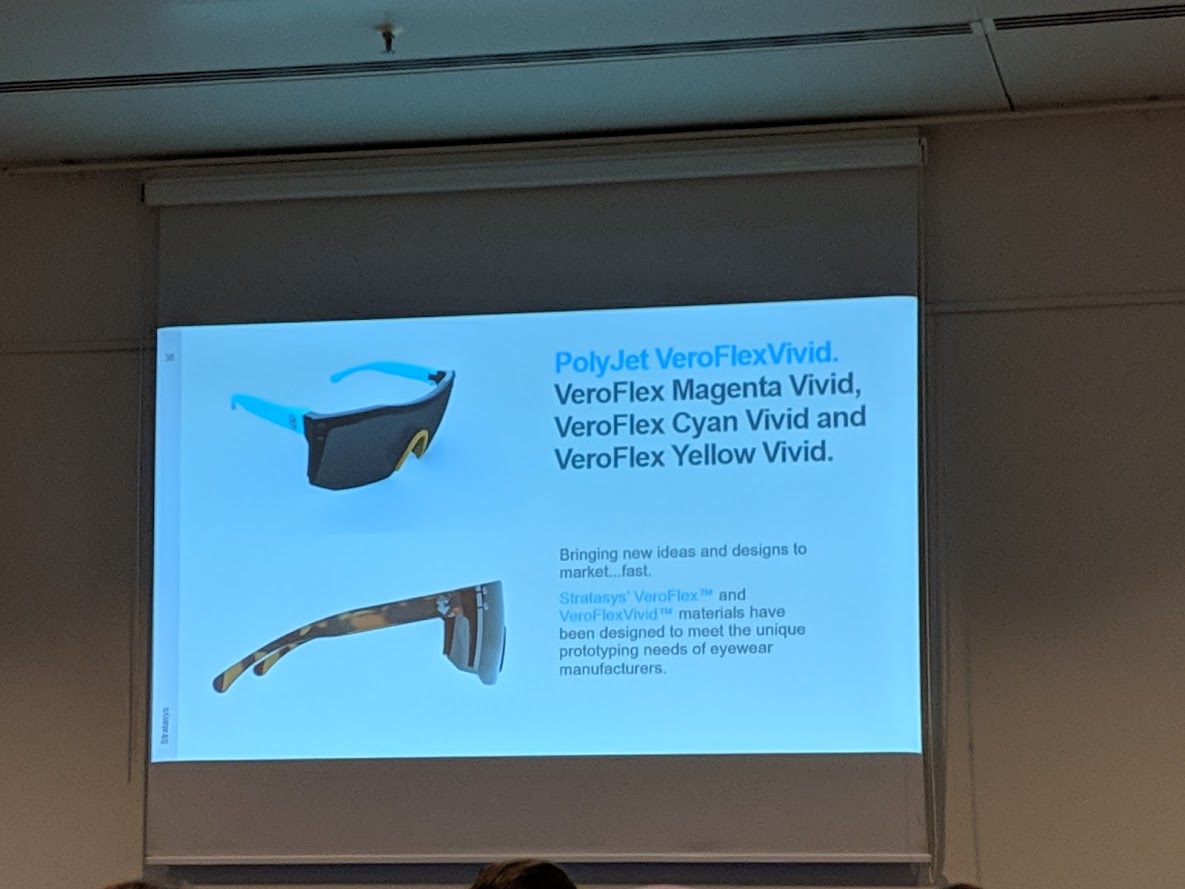

In addition to the expanding physical portfolio, Langfeld noted that, “We need to diversify our offerings beyond machines and materials,” and discussed Stratasys Consulting as a means to “get from idea to fully integrated solution.” Reisin addressed another market response, with the expansion of the company’s materials solutions including the introduction of elastomers for the F123 series, as well as new Antero for the Fortus 900 and new vivid colors for PolyJet systems.

Returning to metals, Grinvald noted that there remain notable “barriers preventing true disruption” and acknowledged that “there’s been lots of gossip the last few months” following the company’s announcement-of-an-announcement of forthcoming metal solutions.

Now introducing more details about LPM — a name that first appeared publicly at IMTS just two months ago — Grinvald explained that the technology will use standard powders, starting with aluminum (“This is going to be our sweet spot”) and will leverage 20 years of inkjet experience to enable complexity of design.

![Rafie Grinvald shares a look at aluminum 3D printing [Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/IMG_20181113_164219_img_5eb0a2687bebb.jpg)

Stratasys, which at last year’s formnext highlighted its relationship with Desktop Metal (a long-standing one), does not see LPM as competitive with this interest; “Our relationship with them will remain unchanged,” Middleton said. Grinvald picked up the thread, noting differences in the technologies: “This is not binder jet technology, you guys.” For LPM, “sintering is the secret sauce,” he continued, as shrinkage is controlled carefully so accuracy and density are well known quantities for the final part produced.

The company is currently not disclosing size (“But be assured it is for production volumes,” said Middleton) or price point for the final system, as LPM is still in development ahead of its release, with first installations with European customers (likely in the automotive industry) slated for next year.

![L-R: Andy Middleton, Rafie Grinvald, Andreas Langfeld, and Zehavit Reisin share during a Q&A [Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/IMG_20181113_164514_img_5eb0a26906b4b.jpg)

With so many conversational threads in the hour-long press conference, there was, as always, a lot to keep up with from the busy company: elastomers, metals, barriers, training, partnerships… Catching up with Carey in a quieter chat helped to clarify Stratasys’ current positioning.

Materials

![Pat Carey shows off an automotive component 3D printed in new elastomer material, with soluble supports still attached [Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/IMG_20181114_111711_img_5eb0a26975eb7.jpg)

Elastomers — with soluble supports — represent a big step for Stratasys; “for us, it’s a really big announcement,” Carey noted. Tested and tuned for 30,000 print hours, the elastomers are ready to fill a much-needed customer need on the popular F123 platform. New TPU 92A elastomer allows for stretching and compressing strong parts and, with water soluble supports, eases the process of creation.

![The poster part for the TPU 92A flexes into action [Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/IMG_20181114_111901_img_5eb0a269f3fd2.jpg)

On the PolyJet side, “the key here is to continue to extend the value.” New introductions for the J750 and J735 PolyJet systems include Agilus30 White and VeroVivid Cyan, both of which extend color capabilities significantly. With the Vivid Cyan, Carey noted, transparent blue and green prints are enabled, while the Agilus White is, as an underlying color, very important.

“Our top customers, the who’s who of users, are just gaga about both of these,” he said.

![Shore samples showcase a range of hardness and vivid color capabilities [Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/IMG_20181114_112057_img_5eb0a26a7fcf5.jpg)

Hyper-realism is in focus with new introductions, as “you can create a leather armrest that looks and feels like leather; people don’t know it’s 3D printed.” Some of the display pieces at the booth did, indeed, not look 3D printed — and that worked both for and against the team. A clear blue bottle looked as though perhaps a thirsty visitor forgot a water bottle, but at closer look the cap was obviously 3D printed — and at closer look still, the transparent body had been, as well, enabling actually picture-perfect prototyping. The materials and processes used to create the bottle indeed did their job perhaps too well; Carey hopes a future display piece will be only half-finished, so visitors can see that it was 3D printed — “The minute you get rid of artifacts like layer lines, no one cares anymore — because they don’t know it’s 3D printed.”

Also joining the portfolio are PEEK-based Antero 800NA for F900 3D printers and biocompatible MED625FLX, a charmingly (?) named material for dental and orthodontic use on the Objet260 Dental and Objet260/500 Dental Selection systems.

Metal

“There have been a lot of questions about LPM,” Carey was quick to acknowledge.

Getting into a bit more about the process, he added:

“There’s no binder; it’s held together by compaction. This enables density. The agent sprays wax for the border, that this goes right off. The reason for aluminum as a start point is it’s the number one material used in aerospace and automotive; there’s not a lot of Inconel on a Ford Taurus. Our customers told us, ‘You figure this out, you’ve got it’.”

A video illustrates some of the outline of the technology:

Global Manufacturing Network

Announced the day following the press conference was an expansion of Stratasys’ Global Manufacturing Network — which in fact had never really been formally announced before.

The Global Manufacturing Network (GMN) was formed in 2003, Carey explained, and continues to expand. It is a “true network with sophisticated software” that connects members in a cloud-based system. Originally targeting software development and printer connectivity, the GMN has grown into a strong partner ecosystem that enables access to a larger network of assets, all connecting as well to Stratasys Direct Manufacturing.

Still all FDM, there’s been demand for the addition of aerospace focus, Carey continued; select members now have access as well to the Stratasys Aircraft Interiors Certification Solution.

New members of the GMN include Tecnologia & Design in Italy; Prometheus in South Korea; Tridi in Mexico; and FATHOM in the US, joining a network of members across four continents.

“Everyone else is announcing these partner networks. It’s probably time we talk about ours,” Carey said with a laugh — and an added, “Watch this space.”

Stratasys at formnext

![[Image: Fabbaloo]](https://fabbaloo.com/wp-content/uploads/2020/05/IMG_20181114_113137_img_5eb0a26c81dc5.jpg)

Overall, it was another busy — and loud — showing for Stratasys, which as ever hosted one of the larger booths on the show floor.

We’ve learned a lot in the last week about LPM, new colors and textures, and approaches to partnerships, but there’s definitely still a lot to come of all these announcements… and from those of yesteryear. Conspicuously absent this week were some of the bigger deals from last year (e.g., Continuous Build Demonstrators nowhere in sight, no discussion of software advances to keep up with new capabilities or materials). With a company as large and global as Stratasys, though, and with reach into a lot of verticals, there is of course no way to concisely gift wrap messaging on so many points.

There will of course be more to come from Stratasys, as everything continues to reshape (the last time we spoke with Middleton, for example, he was the EMEA President, a title now held by Langfeld; the company has also not yet named a new permanent CEO) and the portfolio and network reach continues to expand.

A few questions remain: Will we hear more about processes that buzzed through 2017? When will we hear more about software keeping up with the latest hardware/material capabilities? What about top leadership makeup? When will LPM become commercially available, and what will its final specs be? How exactly does metal fit into this polymer giant’s portfolio strategy?

And always: What’s next?

We’ll look forward to keeping up with the intricate series of announcements from Stratasys, looking at more actual (not marketing) “That was 3D printed??” moments, and more detail behind LPM.

Via Stratasys

The debate over use of proprietary or open materials ecosystems is becoming a big topic in 3D printing.