Today Desktop Metal announced they’ve scored another round of investment, and it’s a whopper with a lot of implications.

The company announced an investment round of USD$115M, a nine-digit number, rarely seen in the 3D printer world for a single round of investments.

This stunning amount of money raises their total investments to a massive USD$212M. There are two interesting aspects to this investment round: what it means to Desktop Metal, and who’s doing the investing.

First, what does this mean? While I am quite certain Desktop Metal has spent a bundle of cash developing and marketing their products up to this date, they have no doubt spent far less than USD$200M. This suggests they will have an enormous stash they can draw upon to undertake literally any venture they may consider.

Two ventures immediately come to mind.

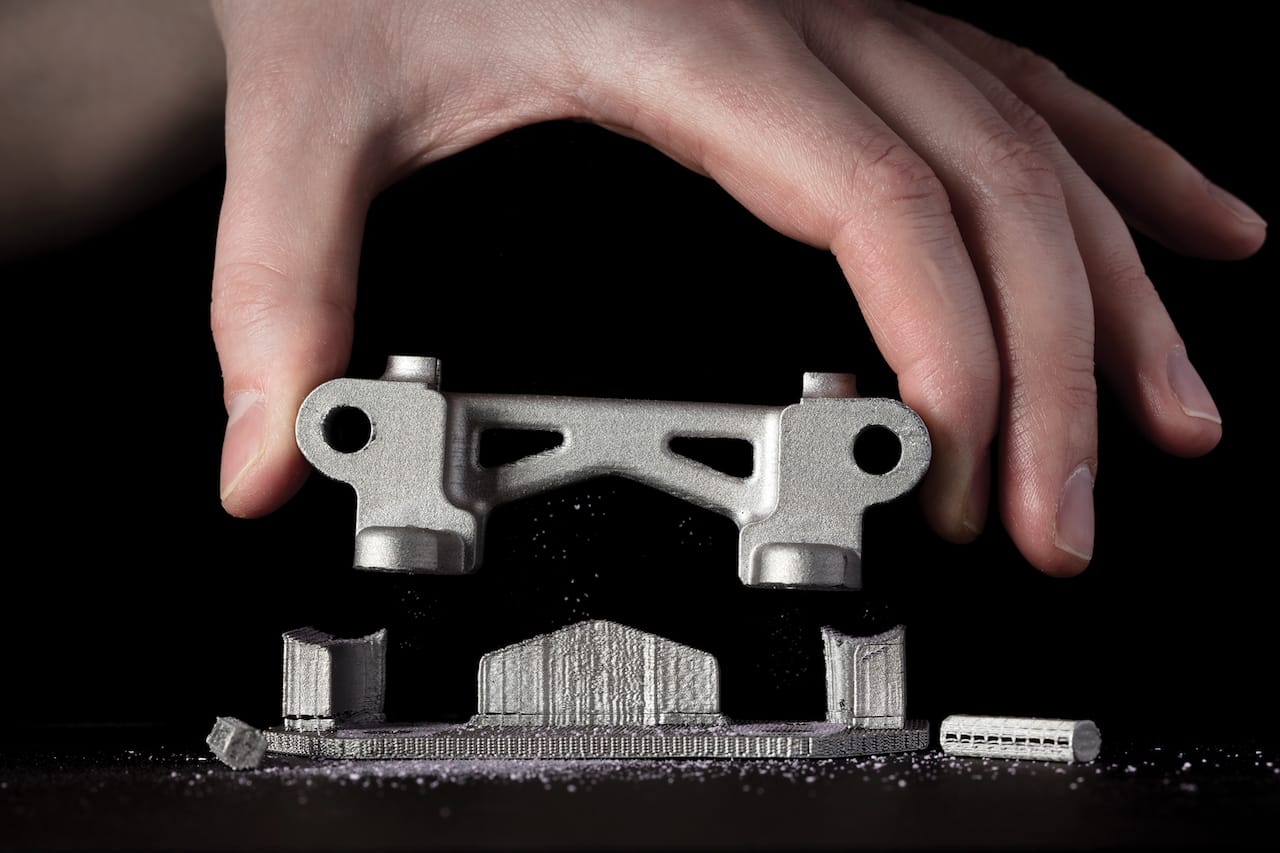

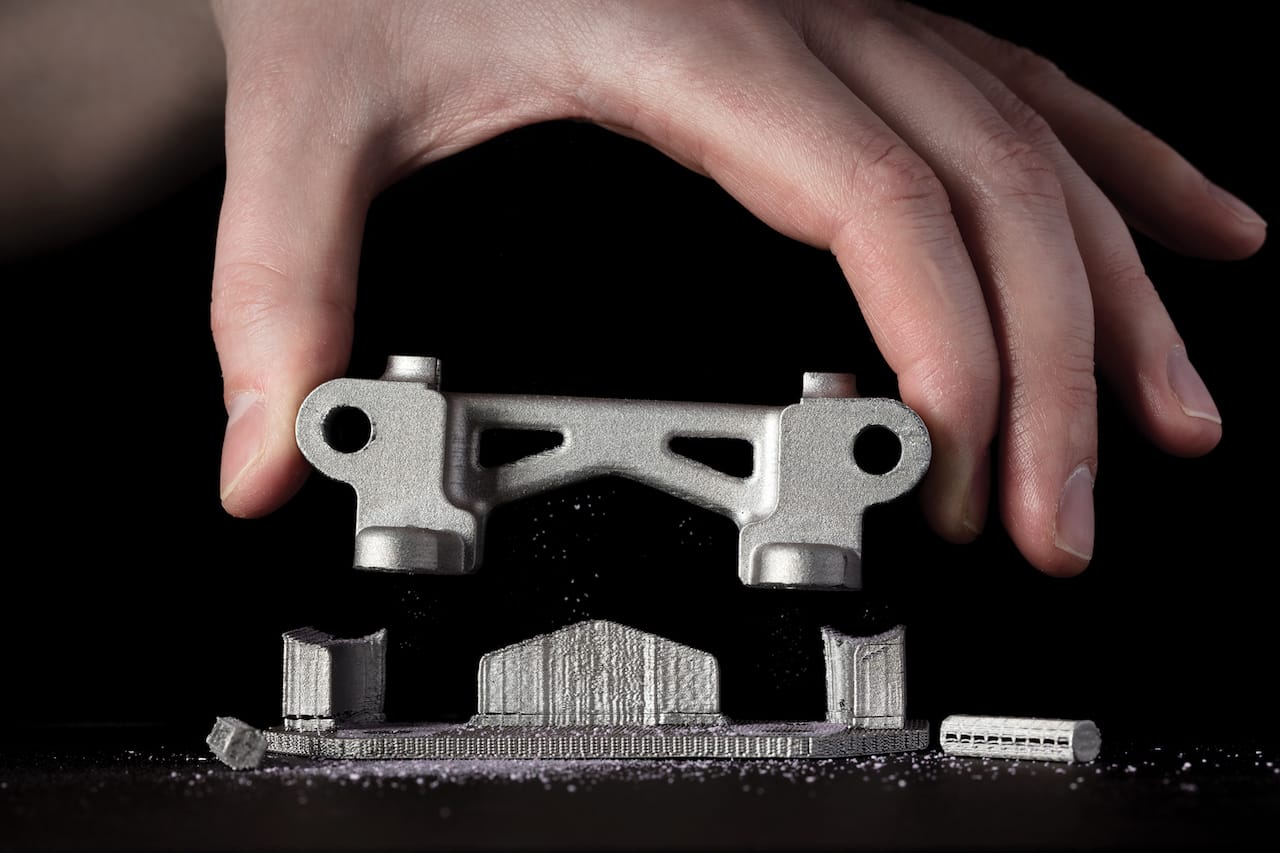

One is the development of their proposed “Production” system, which has been suspiciously absent from their displays and materials, beyond conceptual diagrams. I suspect a big chunk of the new money will be used to further the development of that very powerful system, which could be theoretically capable of extremely rapid 3D printing of production parts.

Another venture they will most assuredly embark upon is a massive sales, marketing and distribution campaign. They will strive to lock up quality resellers in each geographic region, perhaps leveraging the investment cash to sweeten deals where necessary. They will probably expand their marketing campaigns dramatically in size and geography. In fact, in their press release CEO Ricin’s Fulop explained:

The funding will help fuel the company’s speed to market, expand its sales programs, as well as progress the development of advanced R&D. The company is also exploring international expansion as early as 2018.

But really it means they now have almost no financially constraints whatsoever. They could even afford to make a very large mistake and still recover. THat’s a very nice place to be if you’re in business.

But the second interesting aspect was the nature of the investors. Take a look at the list of the 29 entities that made up the investment round:

- AEG

- DCVC Opportunity

- Dirt Devil

- Future Fund

- GE Ventures

- GV

- Hoover

- Kleiner Perkins Caufield & Byers

- Lowe’s Ventures

- Lux Capital

- Milwaukee Tool

- Moonrise Venture Partners

- New Enterprise Associates

- Oreck

- Ryobi

- Saudi Aramco

- Shenzhen Capital Group

- Techtronic Industries

- Tyche

- VAX

- Vertex Ventures

There are some participants whose presence you’d find not particularly surprising, such as Kleiner, New Enterprise Associates and several Capital investment groups. There’s even GE Ventures, who is investing in all manner of 3D metal printing technologies, too. Lowe’s Ventures has previously invested in 3D printing technology in various ways.

But what about these: Dirt Devil? Hoover? VAX? Ryobi?

Those are brands of vacuum cleaners. Yes, vacuum cleaners.

Those brands are all owned by Techtronic Industries of Hong Kong, a very large investment holding company producing consumer products, such as the vacuum cleaners. And Techtronic Industries itself appears on the list of investors.

Why would a manufacturer of vacuum cleaners invest huge money in a 3D metal printer company?

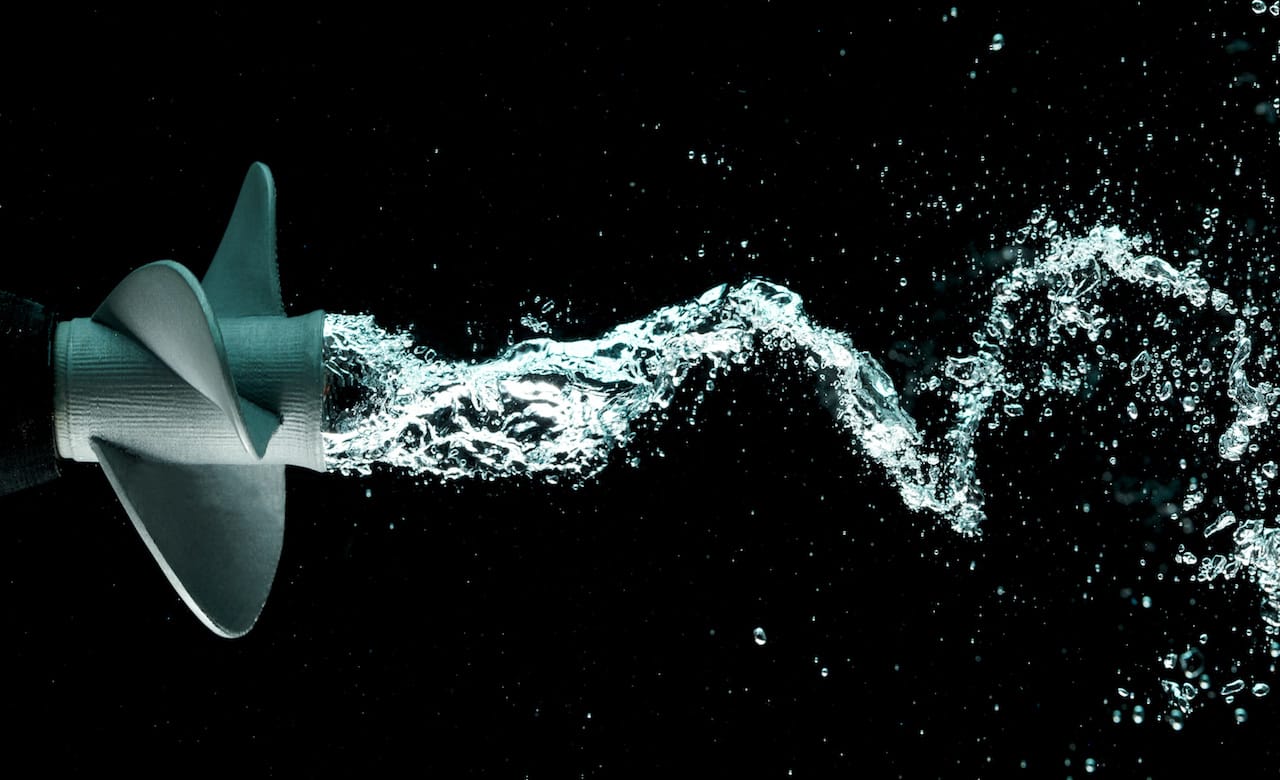

They must have specific interest in the technology for use in their business, and I suspect this means they will intend on using the technology to develop some type of rather unusual vacuum design that hasn’t previously been available.

It makes no sense to personalize a vacuum, so it must be that a proposed vacuum’s parts can only be produced with 3D printing techniques. I have no idea what this could be, but I could speculate and suggest it may have something to do with complex airflows, or perhaps some kind of non-clogging dust trap that requires no filters.

Whatever they’re doing, I’m certain Desktop Metal would be pleased to sell them as many 3D metal printers as they would like.

Via Desktop Metal