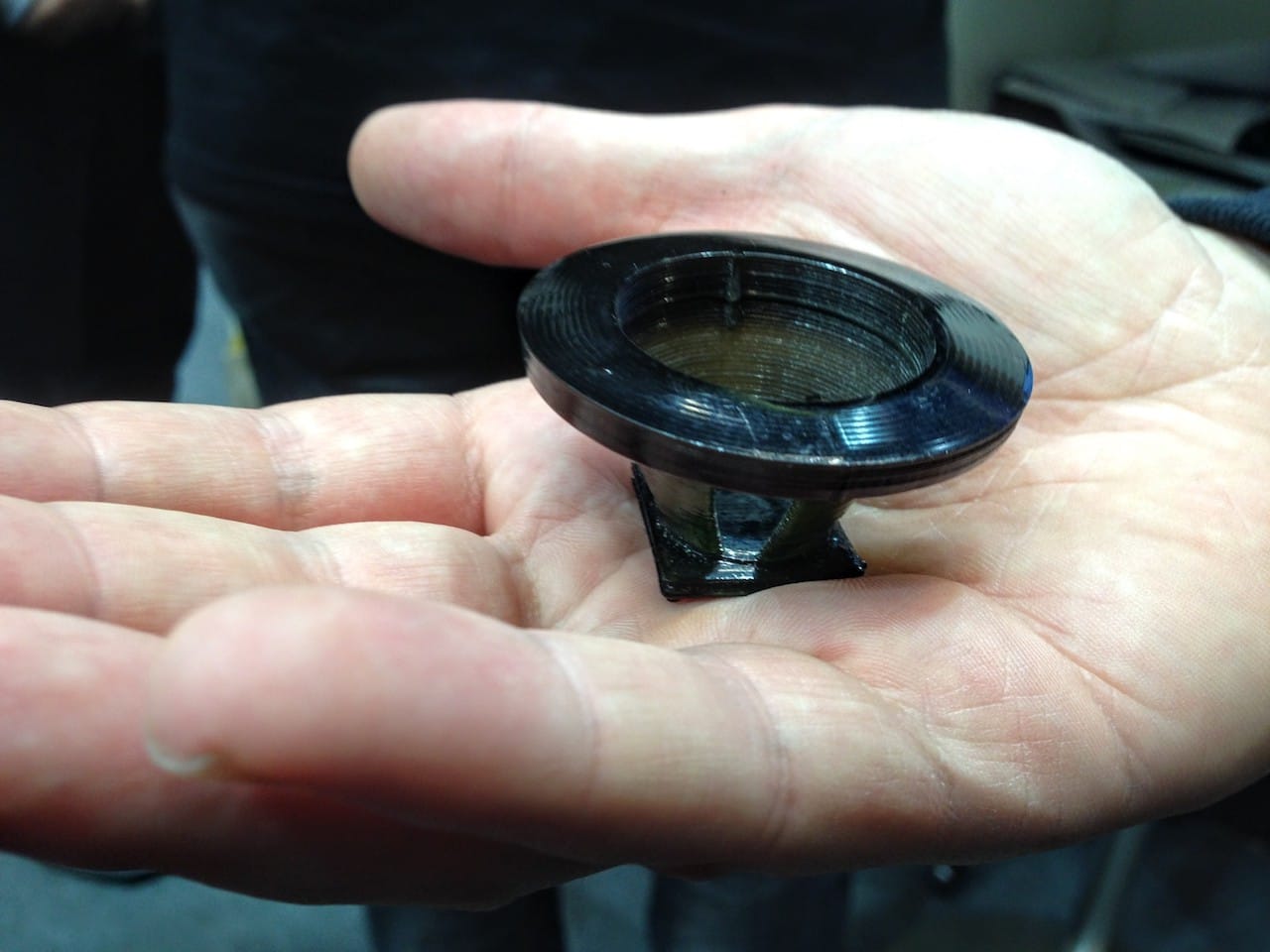

The very first 3D print ever made, decades ago

The very first 3D print ever made, decades ago

As today is Fabbaloo’s tenth anniversary I felt it wise to do a recap – of everything that’s happened in 3D printing over the past decades.

Yes, this is an ambitious project, but I feel it important to put the vast accumulation of events of the past ten years into broad themes, from which it is possible to perceive the large movements of companies and technologies. This will likely be our longest post ever. Let’s start at the very beginning.

The Conception

It all began in the early 1980’s, when two innovative engineers developed the most basic two 3D printing processes. Chuck Hull invented a method of creating objects exposing photopolymer resin to ultraviolet light. Meanwhile, engineer Scott Crump invented the process of plastic extrusion, apparently on his kitchen table using leftover parts from an inkjet printer.

These were both cases of innovators taking technology elements available at that time and combining them together in new ways to provide a fantastic new capability.

I was extremely fortunate to see – and actually handle – the world’s very first 3D printed object, a simple shape made by the resin process in the 1980’s, imaged at top. This historic object is held with great reverence by those tending to it, and those who see it. It must have been difficult to imagine back then what astonishing things would follow this object in decades to come.

But many, many things did happen.

The Initial Industries

These two initial processes were patented by their respective owners, which led immediately to the formation of two 3D printing industry giants: 3D Systems and Stratasys, both of which dominate the industry to this day.

The patent locked out other competitors, but honestly, it wasn’t much of a market to start with. The technology was rather fragile and thus it was seen, correctly, as a form of prototyping. The materials available at the time were few and engineers of the day weren’t particularly impressed. I recall attending an early trade show attended by such engineers, and literally heard several proclaim that “3D printing is a fad”, as they moved on to more “serious” making machinery.

Nevertheless, both 3D Systems and Stratasys grew significantly and dominated the prototyping space.

The Consumer Explosion

Something very fascinating happened in and around 2009: the initial patents on this technology began to expire. This meant that anyone could use the same technology to produce a similar device. The first patent to expire was Stratasys’ basic thermoplastic extrusion system.

This opening led the way for academics to consider ways to perform 3D printing at a very low cost. One key project was RepRap, whose goal was to produce a machine that could 3D print itself, hence its name. They were eventually somewhat successful, at least for the plastic components. The machine could not 3D print any metal parts, nor the electronics and certainly not the high temperature components.

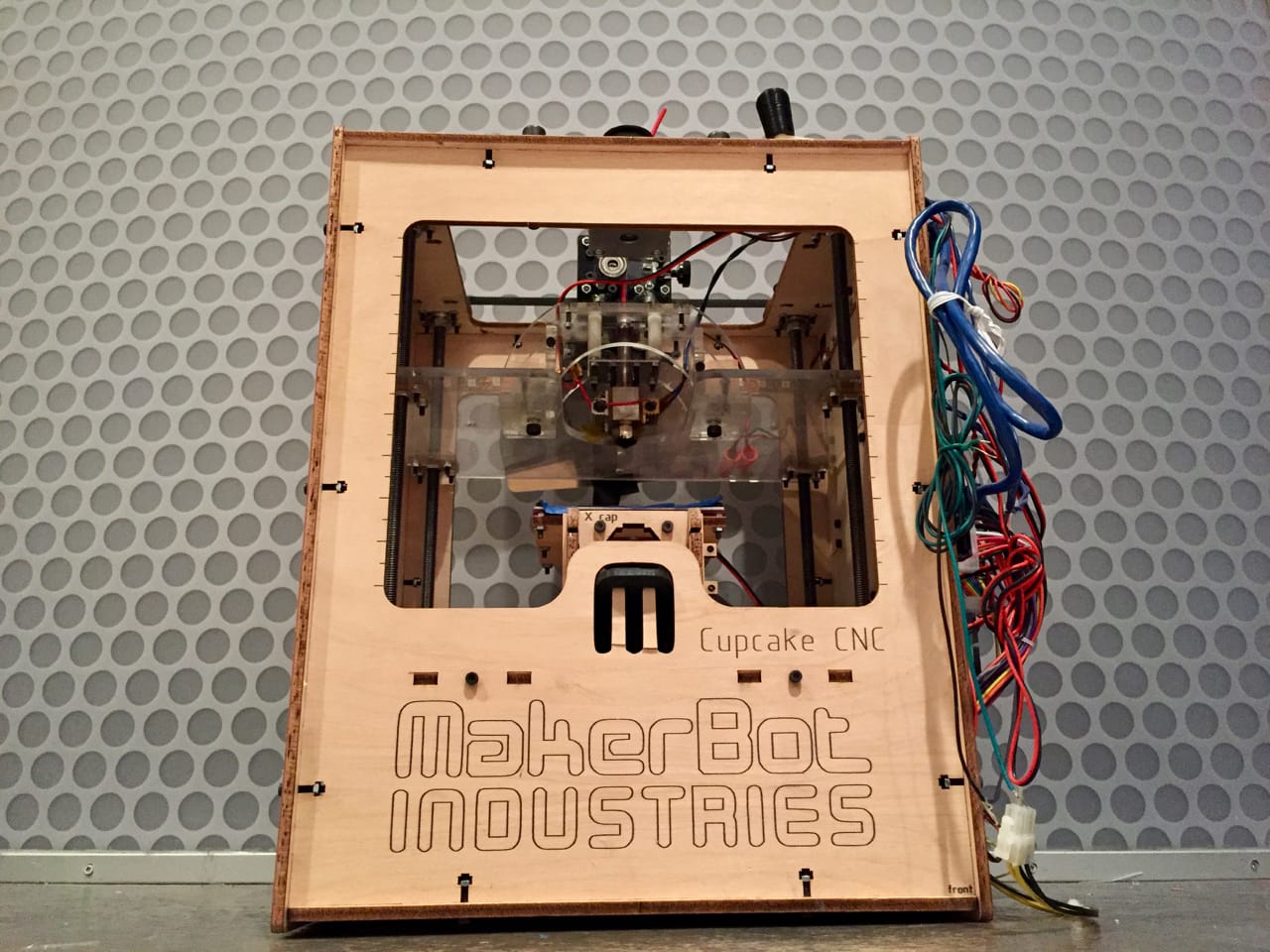

The original MakerBot CupCake desktop 3D printer, made from a kit of very small parts

The original MakerBot CupCake desktop 3D printer, made from a kit of very small parts

But RepRap’s biggest success was to inspire others to make use of their initial forays into the space. One company in particular took this up with much energy: MakerBot. The company launched in 2009 with the CupCake, a very rudimentary 3D printer kit that sorta kinda worked (we know from experience here).

The release of that inexpensive machine to the public sparked a new concept: could ANYONE operate a machine that manufactures stuff? Could this be done cheaply? Apparently so, or at least that’s what many people thought at the time.

MakerBot deftly marketed towards this goal, with statements such as “everyone is a maker”. They gained enormous media coverage, which was assisted by MakerBot’s NYC location near TV headquarters and by their incredibly charismatic CEO, Bre Pettis. Pettis’ singular marketing strategy put 3D printing in the minds of so many more people, captivating them with a profound vision of the future.

That vision was so incredibly popular, it became a lure for investors seeking to capitalize on this new interest. Unfortunately at the time there were only two 3D printing companies who offered publicly traded stock, the same 3D Systems and Stratasys as earlier. Their stock prices rose to ridiculous heights during this period.

While Stratasys took a conservative view and more or less observed what was going on around them, 3D Systems had a very different strategy.

In retrospect, this appears to be what happened: 3D Systems embarked on a massive campaign of corporate acquisition. During this period, the company acquired one way or another, dozens of 3D print-related operations. In fact, we did an analysis in 2015 showing they had obtained no less than 54 companies!

Many of the acquisitions made sense: GeoMagic was a well-regarded maker of 3D software, whose acquisition could bring a strong relationship to 3D Systems, for example.

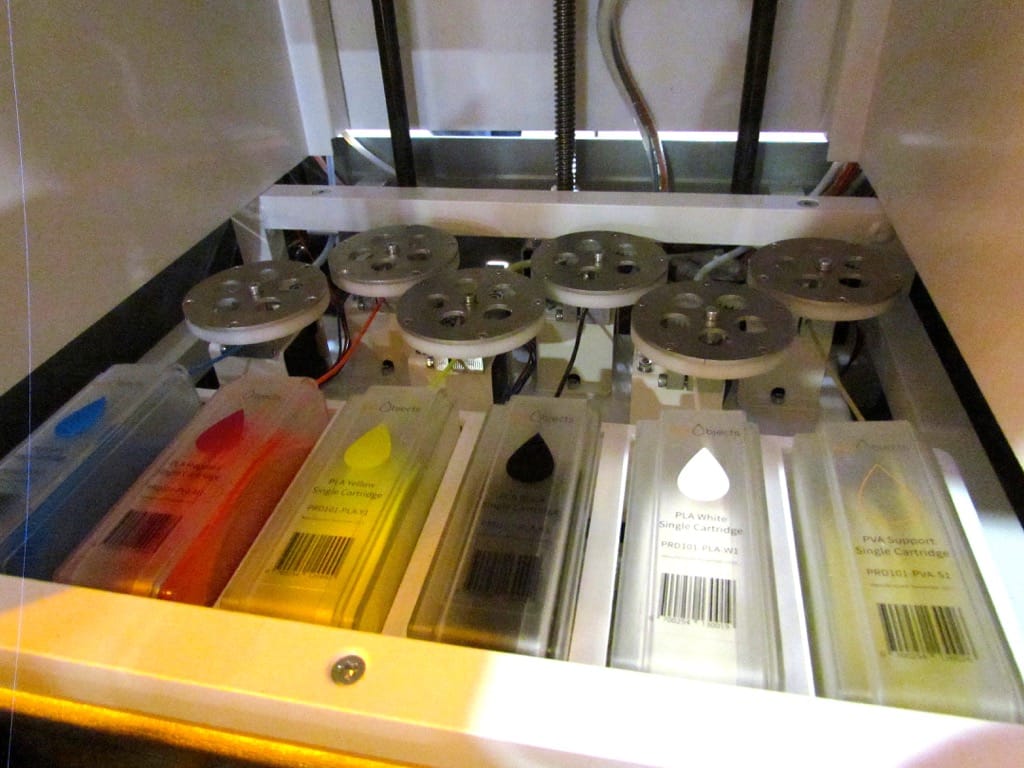

Inside the mysterious and now disappeared BotObjects color 3D printer

Inside the mysterious and now disappeared BotObjects color 3D printer

But others seemed to make little sense. Some companies appeared to be rather questionable. One in particular was disturbing: they acquired BotObjects, a company at the time touting a secret method of full color 3D printing, yet they never would show anyone a proper sample print or video of their process. It was clear to many in the industry that there were some extremely suspicious things happening there, and most of us simply avoided BotObjects. However, 3D Systems acquired them anyway.

Other strange activities from 3D Systems during this period included the addition of a number of food printers, which would produce sugar objects or simple chocolate structures. We did not think this would ever be a big market, but food printers took on a huge presence in 3D Systems’ marketing. At the 2014 CES event the company announced so many new products we posted a story entitled “3D Systems Announces – Everything!”

3D Systems also dove deep into 3D design: the company hired a number of creative folks to produce innovative 3D designs for printing, but somehow these never made a big splash. 3D Systems even contracted popular singer Will.I.Am to be their “Chief Creative Officer” and be the front man to boost their EKOCYCLE desktop 3D printer, something else that never took off.

Will.I.Am is announced as 3D Systems Chief Creative Officer at CES

Will.I.Am is announced as 3D Systems Chief Creative Officer at CES

In retrospect what appeared to be happening was that 3D Systems was simply attempting to boost their stock price by making spectacular newsworthy announcements and acquiring companies who might otherwise result in bad news. And bad news for any 3D printing activity might reflect back on the two publicly traded companies, including 3D Systems.

If you suspect this was unsustainable, you’d be right.

The Consumer Implosion

It all fell apart in mid-2014 when the public finally realized that desktop 3D printers were actually not like a Star Trek replicator and were really a type of manufacturing machine that they would rather not operate themselves.

Yes, there were hundreds of thousands of makers who loved this stuff, but there were millions, perhaps billions, who would not. The massive market for consumer 3D printing did not exist, and the bubble popped rather abruptly.

A number of negative articles began to appear, taking the shine off the technology. In reality, nothing had changed with the technology itself, only the perception of the public had changed, and with that went the stock prices.

Crash Implications

This sudden swerve of interest was a surprise to many, although there were always pundits correctly suggesting that the notion of the general public performing 3D CAD to design and manufacture their own products was a bit of a stretch. To me the foundational problems were:

- The early desktop machines were generally unreliable, offered poor quality results and were far too complicated to operate than most consumers could possibly withstand. They were also expensive

- The lack of 3D design capability, both in skills and availability of usable software meant few could make creative use of the technology, even if it were reliable.

- The absence of a popular usage scenario implied that even if the above were resolved, there were essentially no widespread uses for consumers to benefit from the technology, although many suspected one would eventually be discovered. None has yet been found to this date, but many keep looking.

Nevertheless, a huge number of startup companies had emerged by this time, all counting on a big consumer take up of the technology. This crash put all of them in a difficult predicament.

Many operations simply folded up, but the smarter ones pivoted their activities.

Industrial 3D Printing Continued

During all this fuss, the industrial 3D printing technologies and their manufacturers were purring along, aside from the disruptive effects of huge stock price swings. Their technology continued to be developed in an evolutionary manner, and generally their customer bases grew somewhat, and some of that is likely due to the increased public awareness of 3D printing technologies.

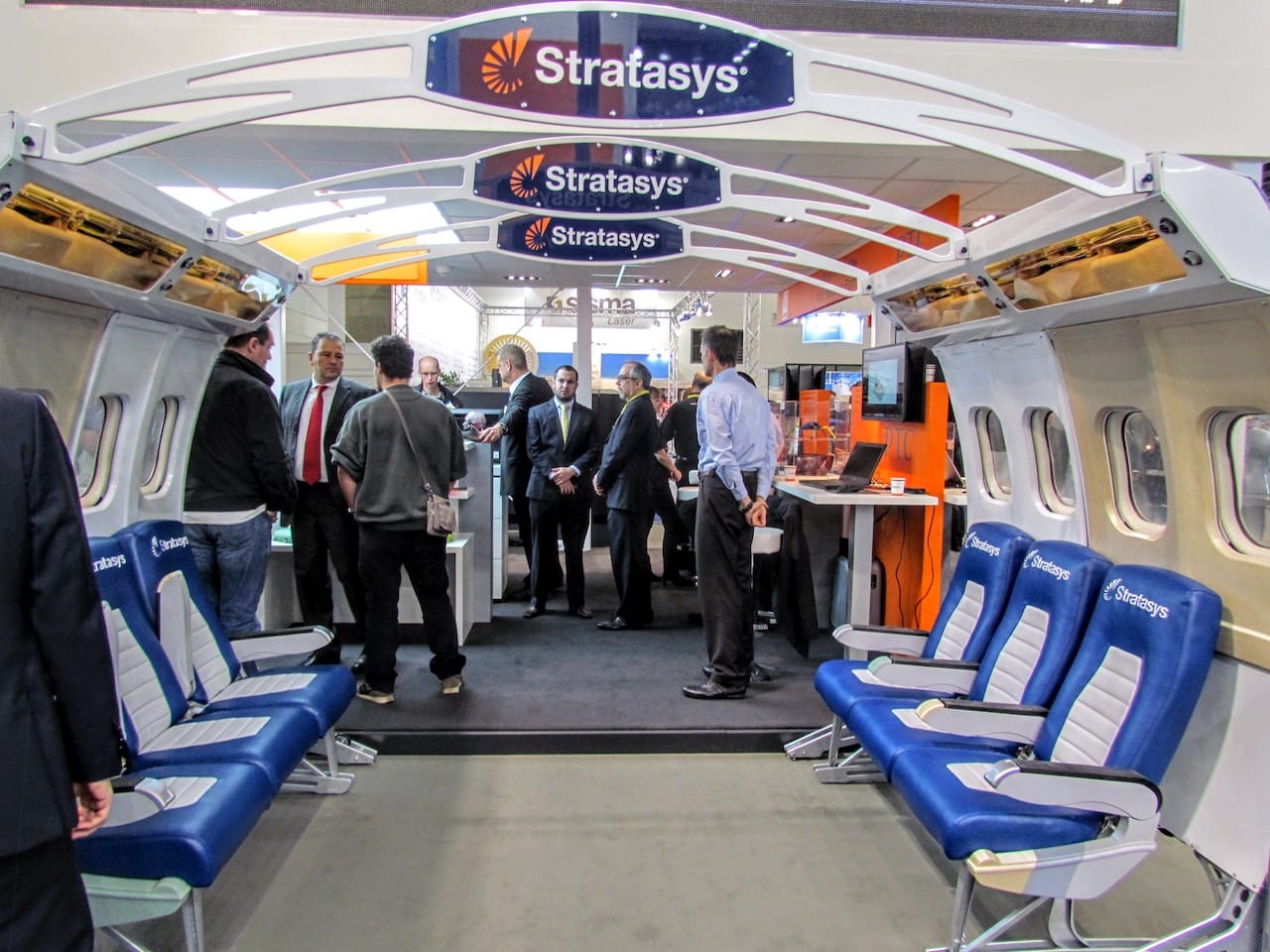

A Stratasys display at a 3D print trade show that looks suspiciously like an airliner

A Stratasys display at a 3D print trade show that looks suspiciously like an airliner

The major challenge for the industrial equipment manufacturers was, and still is, to convince manufacturers that 3D printing is a viable option for some of their activities. While they had sold many systems for prototyping, countless small and large businesses were simply unaware that they could benefit. Therefore we saw the rise of “case studies”, showing how an industry could benefit. We saw the emergence of entire company divisions dedicated to, say, “aerospace”, or “medical” applications of 3D printing technology.

These ventures indeed have moved the use of 3D printing in industry forward, but perhaps not as much as most 3D printer manufacturers may have wanted. This continues today.

The Rise of Professional 3D Printing

Meanwhile, the scramble in desktop 3D printing continued, as multiple startups whose investors expected to reap massive profits from consumer sales struggled to find a place in the new world. Two main solution strategies emerged.

One strategy, taken up early on by several desktop 3D printer manufacturers, was to align with the education market. This required only minor changes – if any – to their equipment that had been targeted at consumers. They needed only to add “educational materials”. The smart companies hired educators to help them develop course material, lesson plans, rubrics and other educational artifacts. All of these were intended to make life very easy for educators wishing to teach 3D printing, engineering, CAD, or even art to their students.

And it worked, for some. But today we find a great deal of competition in this market, simply because it is relatively easy to organize a product targeted at education.

The smarter desktop 3D printer manufacturers took a different approach. They realized there is another profitable market hidden in amongst their orders: professionals. These are people who may exist in a company (or even a department) that is unable to afford their own industrial 3D printer (or even from a print service) because of the high costs of industrial 3D printing. But they still would like to produce prototypes at their desk.

The catch was these folks need to produce prototypes in better materials than just the common ABS and especially PLA. They needed high reliability, dimensional accuracy and an ability to 3D print any given geometry without issue.

These were all problems on typical consumer-oriented desktop equipment of the day, but several manufacturers had a bit of a head start by being able to 3D print in different materials.

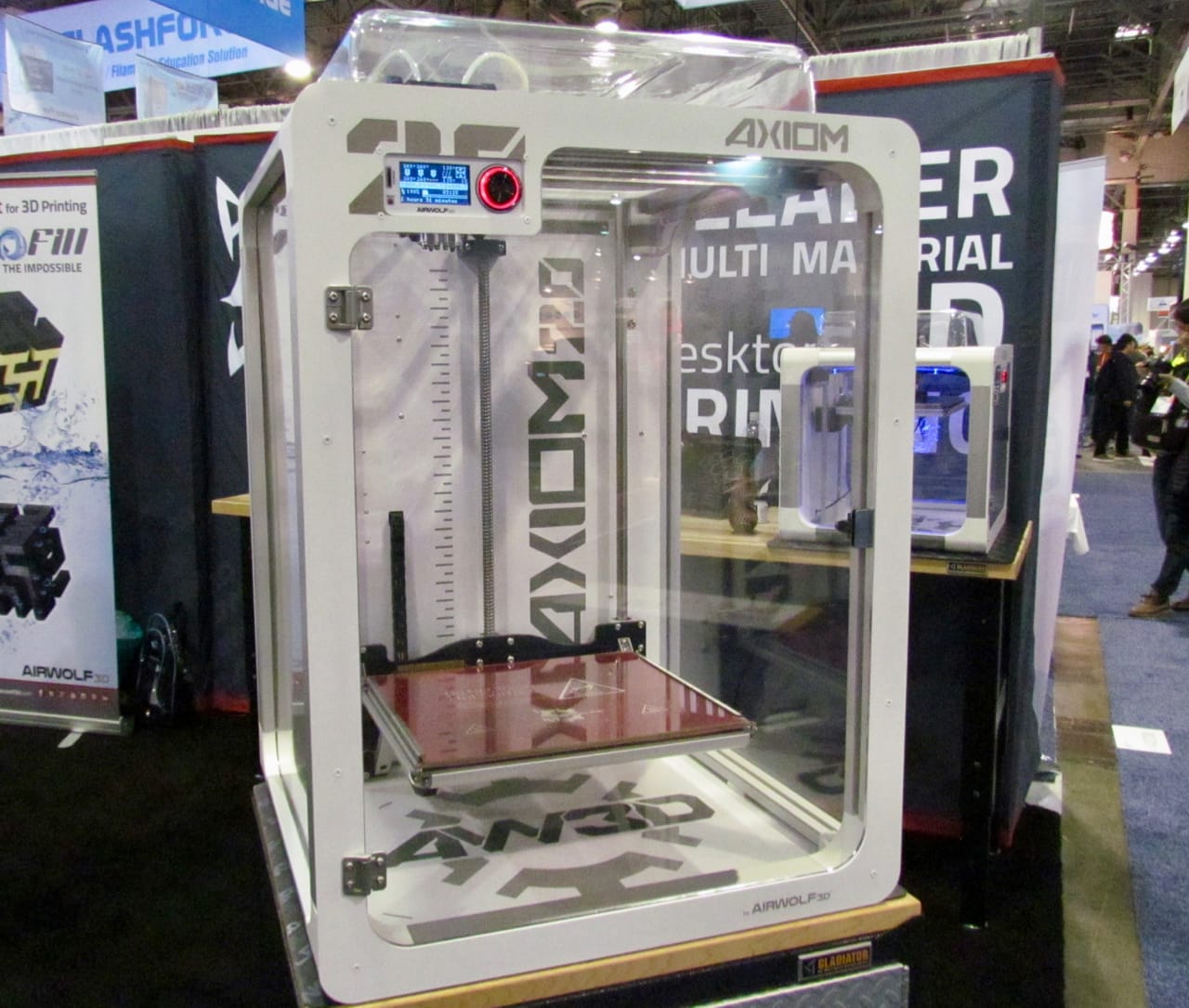

A typical professional desktop 3D printer system from AirWolf3D

A typical professional desktop 3D printer system from AirWolf3D

We then saw in the past couple of years a rush by multiple desktop 3D printer manufacturers to adapt their equipment to meet this need. We saw the introduction of:

- Automated calibration to simplify use and increase print reliability

- Networking capability to permit groups of professionals to share equipment

- Introduction of many different highly desired engineering materials, such as nylon, ASA, polypropylene and more

- The addition of a second material in machines for printing water soluble support structures, enabling easy printing of any geometry

- The emergence of high-temperature equipment, enabling the use of even more exotic materials, such as ULTEM, PEEK and others

- Large-format 3D printers capable of producing much larger objects

These all added up to a choice of many powerful desktop 3D printers suitable for engineers, whose businesses are willing to pay far more than consumers would have, at least per unit. This is where the growth is taking place for desktop 3D printers today.

The Corporate Newcomers

At this same time a number of newcomers arrived on the scene. Many were manufacturing equipment makers, such as CNC Mills or Robotic Arms. These vendors were quite familiar with equipment for workshops and generally felt they would be able to easily create a 3D printer product because “it’s just another manufacturing machine”.

A typical new 3D metal printer from an established Asian manufacturing equipment maker

A typical new 3D metal printer from an established Asian manufacturing equipment maker

And many did, and these machines can certainly operate successfully. But where these companies are challenged is not in the machinery but instead in the marketing, sales and support. The existing companies such as 3D Systems, EOS, Stratasys and others have literally decades of experience in how to tune equipment to get the very best results and achieve required certifications for certain industries, as well as having deeply embedded sales and distribution newtorks. This is something the newcomers will take years to obtain, if ever.

Asian companies also fall into this mode, where they have slowly been appearing in the West. Although many of these are very well established firms with competent equipment and support, they have huge challenges in penetrating western markets because the methods of sales and marketing are quite different. It’s quite possible that once they figure out how to work the market properly they may dominate.

One key entrant in the past few years has been HP. The company has long been interested in 3D printing, as they had even been reselling Stratasys gear way back in 2010. However, I believe that was merely a “toe in the water” for them to find out more about the space. Once they learned a sufficient amount about the technologies and markets, they went back into the labs and developed their own system.

HP’s MJF 3D printing system on display

HP’s MJF 3D printing system on display

Their process, MJF, is quite capable and is apparently based on an open source technology abandoned years ago – but with many refinements that today make it a capable 3D printing process.

The significance of HP is that they are massively larger financially than any other competitor. They understand the Western markets and have a distribution system far greater than any other existing 3D printer manufacturer. They’ve been moving slowly (since 2010) but now are a force to be considered by others. However, they are still subject to the challenging market conditions of Stratasys resellers, who are restricted to sell only Stratasys equipment. This has effectively blocked HP (and others) from accessing the best resellers with the most buying contacts in industry. Why drop lucrative Stratasys equipment, maintenance and materials contracts to switch to as-yet unproven HP gear? This may change suddenly if HP grows large enough.

The Metal Explosion

A “hot” laser process performing layer-by-layer 3D printing in fine metal powder

A “hot” laser process performing layer-by-layer 3D printing in fine metal powder

While 3D metal printers have been available for years using a “hot” process involving lasers or electron beams, they hadn’t caught on with most manufacturers until relatively recently. Part of the issue was the extreme costs of 3D metal printing, in which you might pay as much as USD$500 PER KILOGRAM of metal powder, in addition to the very substantial equipment and labor costs.

This extreme cost of 3D metal printing essentially locked out many industries from even contemplating 3D metal printing. Only industries where the parts already cost huge amounts would be relevant, and so the use of 3D metal printing in aerospace, automotive and medical areas began to grow. It took years, but from small ventures, word of mouth at conferences eventually won over these industries who now operate – or should be operating – fleets of 3D metal printers.

The utility of 3D printing in these industries, particularly aerospace, is of such magnitude that it attracted GE itself to purchase not one, but TWO 3D metal printer manufacturers. And they even sought a third company as well. Evidently their strategy is to curb the market on 3D metal printing and they seem to be doing a pretty good job of it so far.

Pressure on the Old Guard

Both the emergence of professional desktop 3D printing and 3D metal printing have begun to affect the long time major 3D printer manufacturers. Remember their original use case and still prime revenue generator was for prototyping.

But now we increasingly see professional desktop 3D printers being able to produce very high quality prototypes in many different materials, precisely what 3D Systems and Stratasys have depended upon for years. And they tend to be a lot less expensive, too.

This has forced strategic changes at both companies, who likely see their main market eroding over time. What is their new strategy? I believe it is to move into full production, rather than simply prototyping. It makes some sense, as the manufacturing market is far larger than simply prototyping.

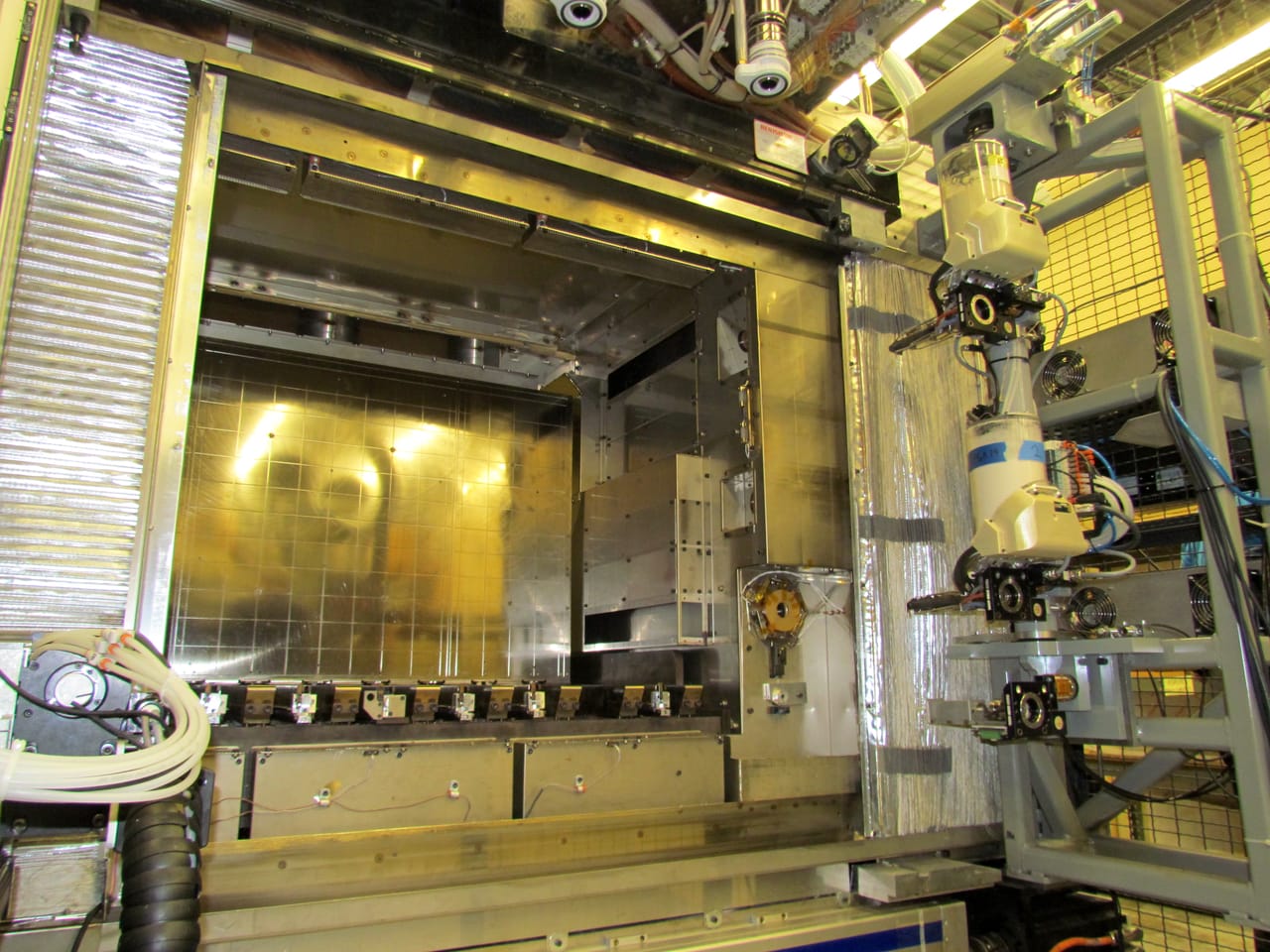

Inside the build chamber of Stratasys’s incredible “infinite build demonstrator”

Inside the build chamber of Stratasys’s incredible “infinite build demonstrator”

Stratasys has released a number of “demonstrator units” that portend a move towards production environments. They’ve also cut deals with Siemens, a provider of manufacturing systems, to assist in the development, which eventually may become a transition. Similarly, 3D Systems released their “Figure 4” unit, which is a modular robotic automation of their equipment, which again leads us towards a production environment.

While 3D Systems and Stratasys move towards big-time production, low volume manufacturing has taken hold. It now seems that the price of manufacturing low volume quantities of items is actually best served through 3D printing, rather than assuming the typically large cost of setting up a full manufacturing line. 3D Systems and Stratasys both offer such capabilities in their numerous 3D print service operations, and there are other startups, like Voodoo Manufacturing, who have implemented their own form of low volume manufacturing using robotic assists for common desktop 3D printers.

The Second Metal Explosion

While several vendors continue to pursue the high-end 3D metal printing market, there’s another one developing at a lower end.

The extreme cost of traditional 3D metal printing makes it practical only for a few industries to take part, but what about the rest? We now have an answer: several new market entrants have developed “cold processes” for 3D metal printing that are far less expensive, but may not yet produce parts of the extreme quality required for, say, medical or aerospace certification.

But there are TONS of applications for metal objects that do not require such certification, perhaps a larger market itself.

A 3D printed metal part by Markforged, using a “cold” process

A 3D printed metal part by Markforged, using a “cold” process

Thus we now see the beginnings of a second explosion of 3D metal printing to new industries with new processes from new companies like Markforged, Desktop Metal and others. This should result in a huge growth of 3D metal printing usage by smaller industries.

This second metal explosion is so significant that Stratasys organized a deal with their exclusive resellers to permit them to sell Desktop Metal equipment to ensure they’re not left behind by a future bulge in 3D metal printer sales.

The Current State and The Future

That’s what happened up to now, as far as I can see. So we could extrapolate these trends into predictions that might take place over the next ten years:

Professional equipment: A huge growth area, where every design, architectural or engineering firm should have many such devices. I expect dramatic feature improvements to continue and result in very powerful equipment that rivals and exceeds today’s industrial gear. We may see this type of equipment on many professionals’ desks.

Metal equipment: The two processes, “hot” and “cold” will grow rapidly within each of their respective markets. The “cold” group will need to do significant marketing to “turn on” the small and medium businesses to the concept of 3D metal printing, just as the plastic manufacturers had to do previously. The “hot” group will grow rapidly within their target industries and drag along powder manufacturers, 3D metal printing specialists and others.

Industrial equipment: I see a slow transition to full production systems that will directly integrate within today’s highly controlled manufacturing lines, as current prototyping options will eventually be largely overtaken by professional desktop options. These true production machines will not be designed as standalone devices, but rather become part of a manufacturing process. If any of the current major industrial 3D printer manufacturers can pull this off, they will be well rewarded within that huge manufacturing market.

Consumer equipment: Will continue to languish until someone solves the “3D content” problem. This may take a player like Amazon, for example, to produce a platform where consumers can truly download many useful and appropriate parts that can be printed at home. In other words, someone has to make it useful for consumers before they will adopt the technology. Those 3D printer manufacturers that did not transition to professional mode will fight it out in a race to the bottom.

And after that, what’s next? I cannot say, but I would not be surprised if yet another astonishing making process emerges from the labs or academic institutions that puts all of the above out of business. Molecular assembly, anyone?

That’s the risk of being in the 3D printing business in the 21st century. But, as Captain Kirk once wisely said:

The potential for knowledge and advancement is equally great!

Risk – Risk is our business.

That’s what this starship is all about. That’s why we’re aboard her.