With this week’s announcement that Dremel has launched a personal 3D printer to be marketed through major retail chains, we speculated on issues they may encounter.

As you may have read, the toolmaker announced the availability of the 3D Idea Builder, a personal 3D printer capable of printing PLA with its single extruder. It’s a decent middle-of-the-road feature-wise 3D printer suited for consumers and hobbyists, priced at a reasonable USD$999.

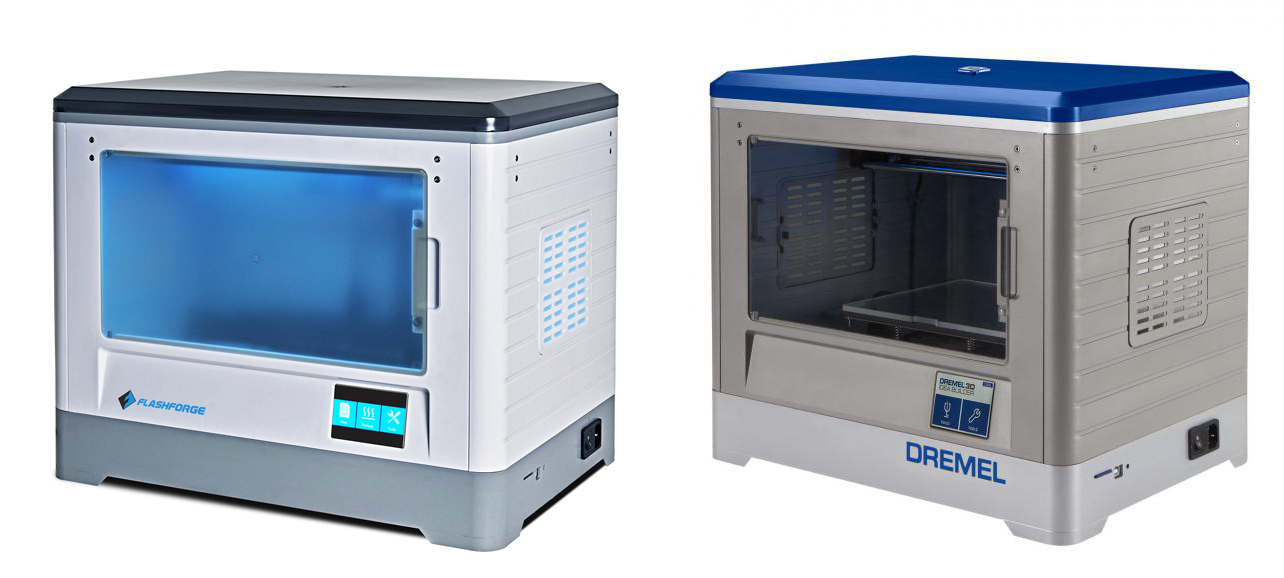

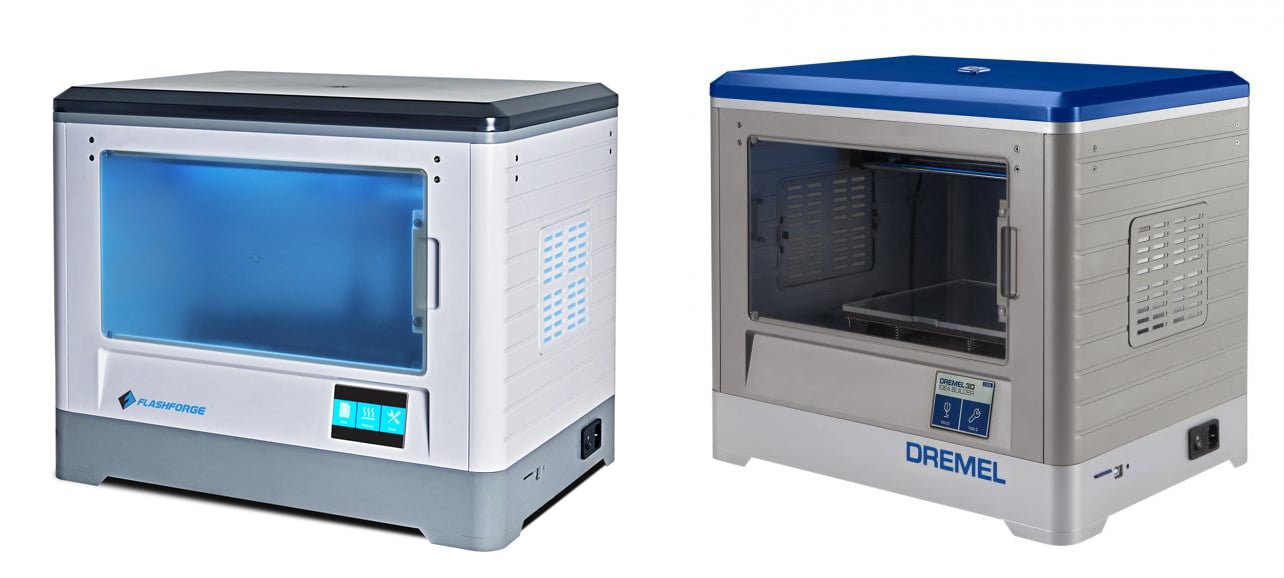

An astute commenter observed the machine is in fact rather similar to the Flashforge Dreamer machine. If you look at the comparison images above, that seems to be the case. Take a very close look at all the details and see if you can spot the difference. See it?

Yes, it’s the label.

So if we understand that a US company (Dremel) is reselling white-labeled Asian 3D printers (Flashforge), what happens? Has this happened before?

Yes. Afinia has been reselling Tiertime’s PPDP personal 3D printers for a few years now. But once that company reached “critical mass” by marketing their product through a major retail chain (Staples), Stratasys reacted by launching a four-pronged lawsuit for patent infringement against Afinia. While the lawsuit now has only three prongs, it is still underway.

It may be that Stratasys, who holds numerous still-active patents for plastic extrusion, could launch similar lawsuits against Dremel, if they see Dremel’s moves in the same way they viewed Afinia’s. That could be the major issue for Dremel. On the other hand, Dremel is a large company. Actually, “Dremel” is merely the brand name for a set of tools; the company behind the brand is Robert Bosch GmbH, the “world’s largest supplier of automotive components” based in Germany. Wait, how big are they? According to Wikipedia:

Bosch has more than 350 subsidiaries across over 60 countries and its products are sold in around 150 countries.[4] Bosch employs around 306,000 people and had revenues of approximately €52.5 billion in 2012. In 2012 it invested around €4.8 billion in research and development and applied for around 4,800 patents worldwide. In 2009 Bosch was the leader in terms of numbers of patents at the German Patent and Trade Mark Office (GPTO) with 3,213 patents.

Yes, that big. Bosch’s revenue of USD$68B is 95x larger than Stratasys’ current run rate of USD$712M. This is a far different situation than faced by Afinia, a much smaller operation. Bosch/Dremel could likely afford to pay any Stratasys licensing fees, battle them in the courts – or even purchase Stratasys outright if they felt the need to do that.

There could be some deep thinking taking place at Stratasys HQ this week.